- United Kingdom

- /

- Oil and Gas

- /

- LSE:ITH

Why We're Not Concerned About Ithaca Energy plc's (LON:ITH) Share Price

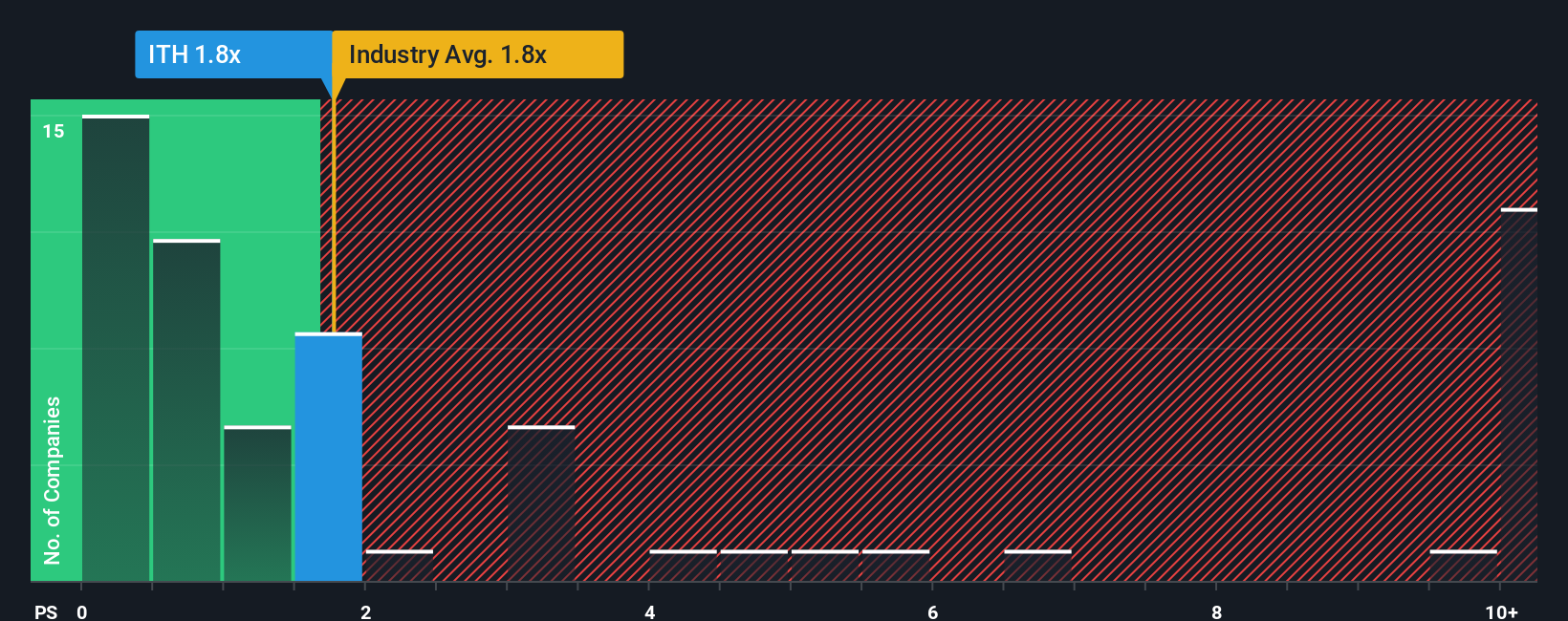

With a median price-to-sales (or "P/S") ratio of close to 1.8x in the Oil and Gas industry in the United Kingdom, you could be forgiven for feeling indifferent about Ithaca Energy plc's (LON:ITH) P/S ratio, which comes in at about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Ithaca Energy

What Does Ithaca Energy's Recent Performance Look Like?

Recent times have been pleasing for Ithaca Energy as its revenue has risen in spite of the industry's average revenue going into reverse. It might be that many expect the strong revenue performance to deteriorate like the rest, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ithaca Energy.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Ithaca Energy's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 36% last year. Revenue has also lifted 21% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Turning to the outlook, the next three years should generate growth of 3.7% each year as estimated by the four analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 5.5% per annum, which is not materially different.

With this information, we can see why Ithaca Energy is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On Ithaca Energy's P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've seen that Ithaca Energy maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Ithaca Energy that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:ITH

Ithaca Energy

Engages in the development and production of oil and gas in the North Sea.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives