- United Kingdom

- /

- Oil and Gas

- /

- LSE:ITH

Getting In Cheap On Ithaca Energy plc (LON:ITH) Might Be Difficult

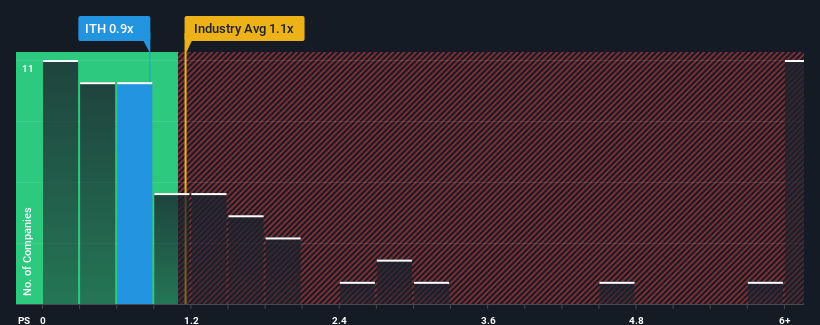

With a median price-to-sales (or "P/S") ratio of close to 1.1x in the Oil and Gas industry in the United Kingdom, you could be forgiven for feeling indifferent about Ithaca Energy plc's (LON:ITH) P/S ratio of 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Ithaca Energy

What Does Ithaca Energy's Recent Performance Look Like?

Recent times haven't been great for Ithaca Energy as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ithaca Energy.How Is Ithaca Energy's Revenue Growth Trending?

In order to justify its P/S ratio, Ithaca Energy would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 17%. Pleasingly, revenue has also lifted 151% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the seven analysts covering the company are not great, suggesting revenue should decline by 3.7% each year over the next three years. Although, this is simply shaping up to be in line with the broader industry, which is also set to decline 1.8% per annum.

With this in consideration, it's clear to see why Ithaca Energy's P/S stacks up closely with its industry peers. Nonetheless, with revenue going in reverse, it's not guaranteed that the P/S has found a floor yet. There is still potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our findings align with our suspicions - a closer look at Ithaca Energy's analyst forecasts shows that the company's similarly unstable outlook compared to the industry is keeping its price-to-sales ratio in line with the industry's average. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to justify a high or low P/S ratio. Although, we are somewhat concerned whether the company can maintain this level of performance under these tough industry conditions. For now though, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Before you settle on your opinion, we've discovered 1 warning sign for Ithaca Energy that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:ITH

Ithaca Energy

Engages in the development and production of oil and gas in the North Sea.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives