- United Kingdom

- /

- Oil and Gas

- /

- LSE:HBR

Harbour Energy plc (LON:HBR) Investors Are Less Pessimistic Than Expected

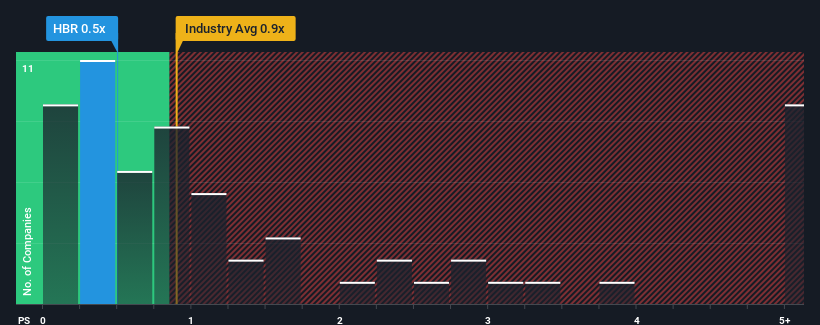

There wouldn't be many who think Harbour Energy plc's (LON:HBR) price-to-sales (or "P/S") ratio of 0.5x is worth a mention when the median P/S for the Oil and Gas industry in the United Kingdom is similar at about 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Harbour Energy

What Does Harbour Energy's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Harbour Energy's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Harbour Energy's future stacks up against the industry? In that case, our free report is a great place to start.How Is Harbour Energy's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Harbour Energy's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 2.8%. Still, the latest three year period has seen an excellent 88% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should bring plunging returns, with revenue decreasing 9.4% per year as estimated by the nine analysts watching the company. The industry is also set to see revenue decline 1.1% each year but the stock is shaping up to perform materially worse.

With this in mind, we find it intriguing that Harbour Energy's P/S is similar to its industry peers. With revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

What Does Harbour Energy's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Harbour Energy currently trades on a higher P/S than expected based on revenue decline, even more so since its revenue forecast is even worse than the struggling industry. It's not unusual in cases where revenue growth is poor, that the share price declines, sending the moderate P/S lower relative to the industry. In addition, we would be concerned whether the company can even maintain this level of performance under these tough industry conditions. This presents a risk to investors if the P/S were to decline to a level that more accurately reflects the company's revenue prospects.

Before you settle on your opinion, we've discovered 1 warning sign for Harbour Energy that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Harbour Energy, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Harbour Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:HBR

Harbour Energy

Engages in the acquisition, exploration, development, and production of oil and gas reserves in Norway, the United Kingdom, Germany, Mexico, Argentina, North Africa, and Southeast Asia.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives