- United Kingdom

- /

- Oil and Gas

- /

- LSE:GKP

Why Investors Shouldn't Be Surprised By Gulf Keystone Petroleum Limited's (LON:GKP) 27% Share Price Surge

Despite an already strong run, Gulf Keystone Petroleum Limited (LON:GKP) shares have been powering on, with a gain of 27% in the last thirty days. Notwithstanding the latest gain, the annual share price return of 7.8% isn't as impressive.

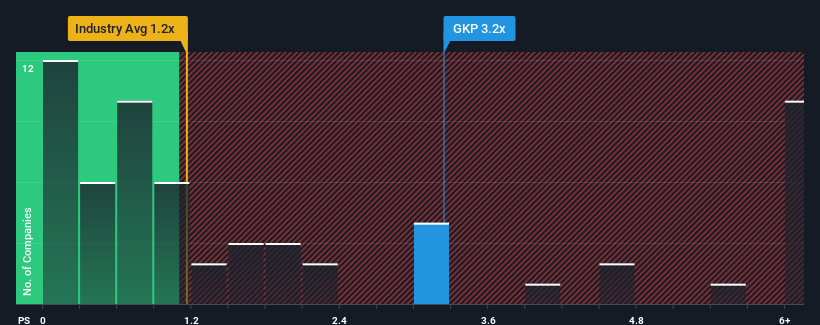

After such a large jump in price, you could be forgiven for thinking Gulf Keystone Petroleum is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 3.2x, considering almost half the companies in the United Kingdom's Oil and Gas industry have P/S ratios below 1.2x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Gulf Keystone Petroleum

How Gulf Keystone Petroleum Has Been Performing

Gulf Keystone Petroleum has been struggling lately as its revenue has declined faster than most other companies. One possibility is that the P/S ratio is high because investors think the company will turn things around completely and accelerate past most others in the industry. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Gulf Keystone Petroleum will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Gulf Keystone Petroleum?

In order to justify its P/S ratio, Gulf Keystone Petroleum would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 73% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 14% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 32% per annum during the coming three years according to the four analysts following the company. That would be an excellent outcome when the industry is expected to decline by 0.2% per year.

With this in consideration, we understand why Gulf Keystone Petroleum's P/S is a cut above its industry peers. Right now, investors are willing to pay more for a stock that is shaping up to buck the trend of the broader industry going backwards.

What Does Gulf Keystone Petroleum's P/S Mean For Investors?

Shares in Gulf Keystone Petroleum have seen a strong upwards swing lately, which has really helped boost its P/S figure. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Gulf Keystone Petroleum's analyst forecasts revealed that its superior revenue outlook against a shaky industry is contributing to its high P/S. Outperforming the industry in this manner looks to have provided investors with a bit of confidence that the future will be bright, bolstering the P/S. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. Although, if the company's prospects don't change they will continue to provide strong support to the share price.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Gulf Keystone Petroleum that you should be aware of.

If you're unsure about the strength of Gulf Keystone Petroleum's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:GKP

Gulf Keystone Petroleum

Engages in the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives