- United Kingdom

- /

- Diversified Financial

- /

- AIM:MAB1

October 2024 Growth Companies With High Insider Ownership On UK Exchange

Reviewed by Simply Wall St

In the last week, the United Kingdom market has stayed flat, but over the past 12 months, it has risen by 9.8%, with earnings forecast to grow by 14% annually. In this environment, identifying growth companies with high insider ownership can be beneficial as they often signal strong confidence from those closest to the business and may align well with anticipated earnings growth.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| LSL Property Services (LSE:LSL) | 10.8% | 28.2% |

| Foresight Group Holdings (LSE:FSG) | 31.8% | 27.9% |

| Judges Scientific (AIM:JDG) | 11% | 23% |

| Enteq Technologies (AIM:NTQ) | 20% | 53.8% |

| Facilities by ADF (AIM:ADF) | 22.7% | 144.7% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| Beeks Financial Cloud Group (AIM:BKS) | 32.7% | 57.9% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 29.6% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 80.6% |

Let's review some notable picks from our screened stocks.

Judges Scientific (AIM:JDG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Judges Scientific plc designs, manufactures, and sells scientific instruments with a market cap of £658.82 million.

Operations: The company generates revenue from two main segments: Vacuum instruments (£65.40 million) and Materials Sciences instruments (£70.20 million).

Insider Ownership: 11%

Earnings Growth Forecast: 23% p.a.

Judges Scientific has shown strong earnings growth, with a recent increase in net income from £1 million to £4.2 million for the half year ended June 30, 2024. Despite some insider selling and share price volatility, the company is forecasted to achieve significant earnings growth of 23% per year, surpassing UK market averages. The appointment of Dr. Ian Wilcock as Group Commercial Director is expected to bolster its strategic direction and innovation capabilities amidst high debt levels and large one-off items impacting results.

- Take a closer look at Judges Scientific's potential here in our earnings growth report.

- Our valuation report here indicates Judges Scientific may be overvalued.

Mortgage Advice Bureau (Holdings) (AIM:MAB1)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mortgage Advice Bureau (Holdings) plc, along with its subsidiaries, offers mortgage advice services in the United Kingdom and has a market cap of £394.11 million.

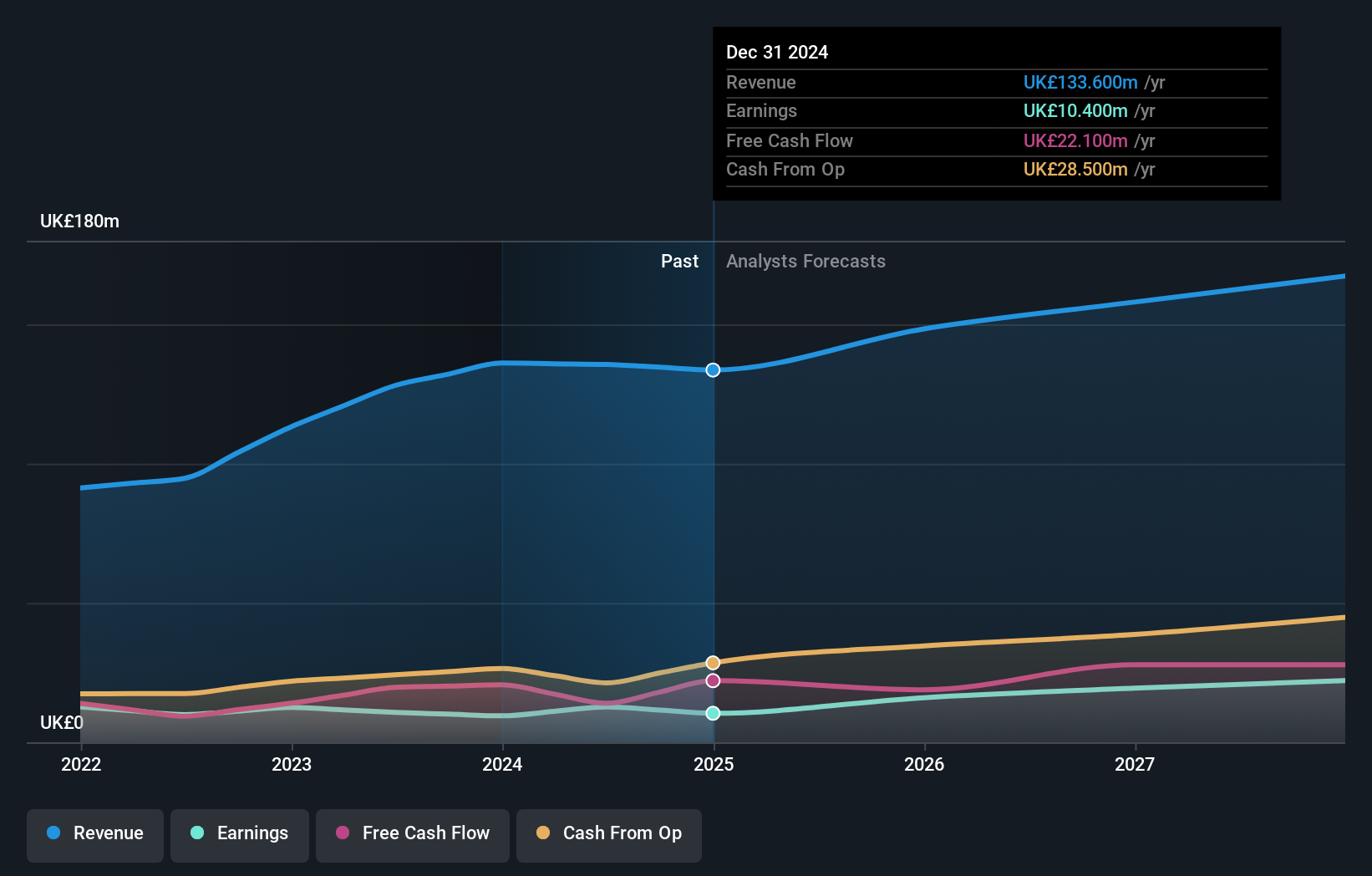

Operations: The company generates revenue primarily from the provision of financial services, amounting to £243.31 million.

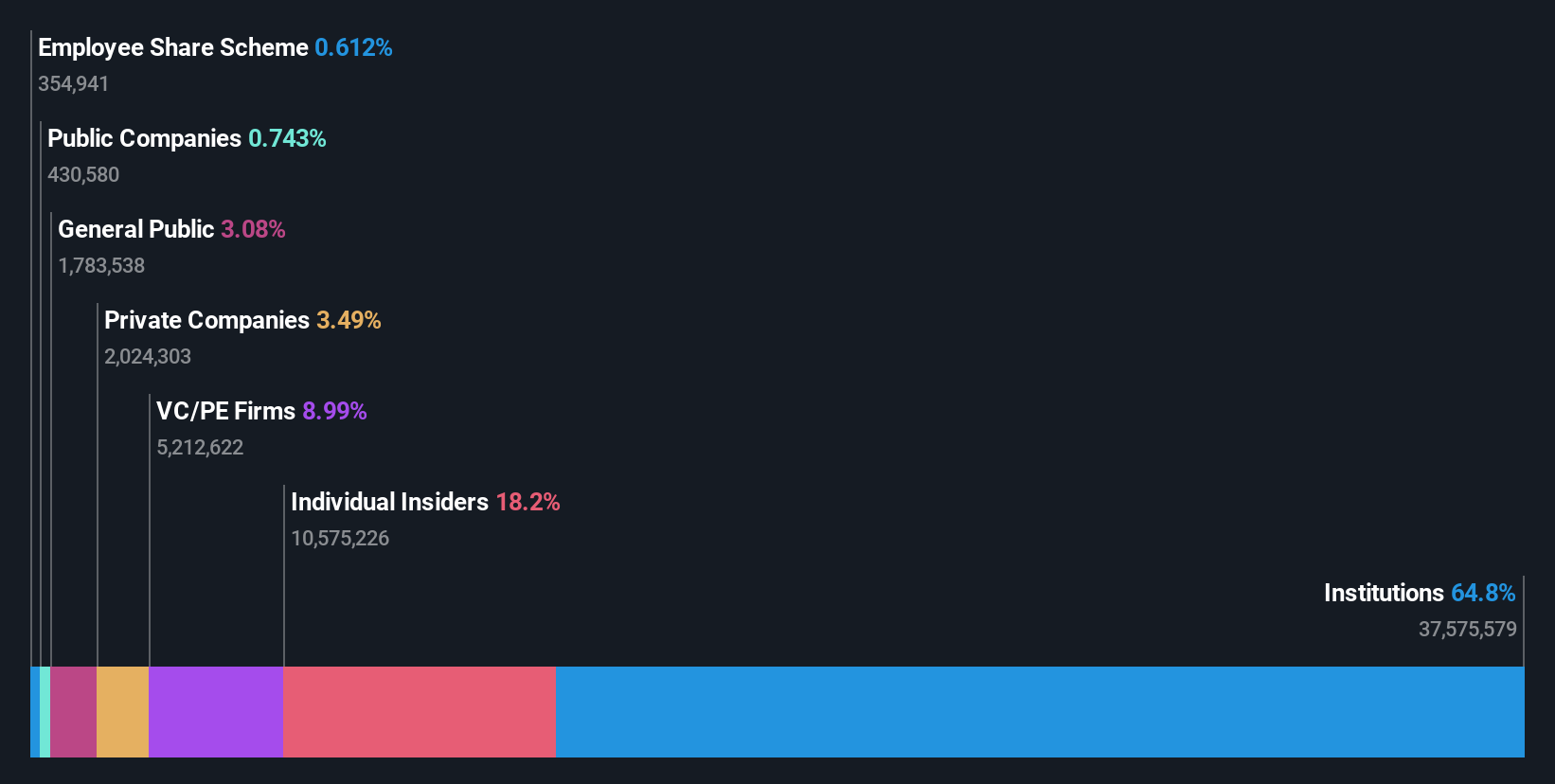

Insider Ownership: 19.8%

Earnings Growth Forecast: 29.6% p.a.

Mortgage Advice Bureau (Holdings) shows potential with high insider ownership and no substantial selling in the last three months. While earnings are forecast to grow significantly at 29.57% annually, surpassing UK market averages, recent results show a decline in net income from £6.42 million to £3.7 million for the half year ended June 30, 2024. The company's dividend yield of 4.13% is not well covered by earnings, and share price volatility remains a concern.

- Get an in-depth perspective on Mortgage Advice Bureau (Holdings)'s performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Mortgage Advice Bureau (Holdings)'s share price might be on the expensive side.

Gulf Keystone Petroleum (LSE:GKP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Gulf Keystone Petroleum Limited is involved in the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq, with a market cap of £259.61 million.

Operations: The company's revenue is primarily derived from the exploration and production of oil and gas, amounting to $115.15 million.

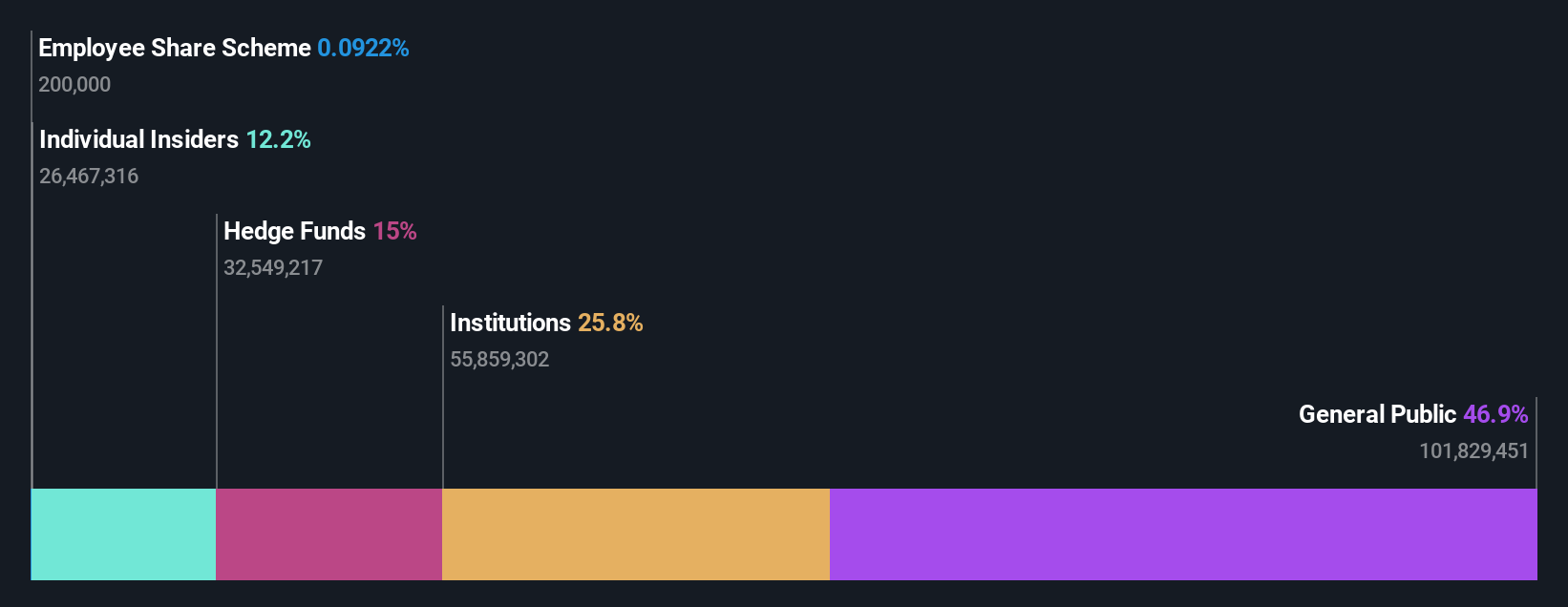

Insider Ownership: 12.2%

Earnings Growth Forecast: 80.6% p.a.

Gulf Keystone Petroleum demonstrates strong insider confidence with substantial insider buying and no sales in the past three months. Trading at 42.6% below estimated fair value, it is poised for significant growth, with earnings expected to increase by 80.57% annually and revenue projected to grow 42.8% per year, surpassing UK market averages. Recent board changes include appointing two experienced Non-Executive Directors, enhancing strategic oversight following the passing of Chair Martin Angle.

- Navigate through the intricacies of Gulf Keystone Petroleum with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Gulf Keystone Petroleum's shares may be trading at a premium.

Key Takeaways

- Delve into our full catalog of 65 Fast Growing UK Companies With High Insider Ownership here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MAB1

Mortgage Advice Bureau (Holdings)

Provides mortgage advice services in the United Kingdom.

High growth potential with mediocre balance sheet.