- United Kingdom

- /

- Oil and Gas

- /

- LSE:GENL

Some Confidence Is Lacking In Genel Energy plc (LON:GENL) As Shares Slide 25%

Genel Energy plc (LON:GENL) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 46% share price drop.

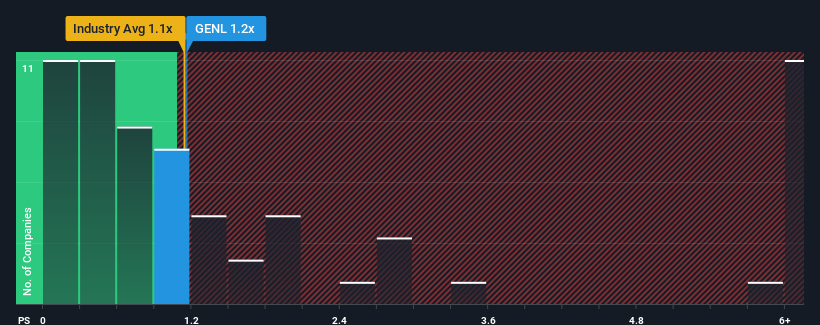

Although its price has dipped substantially, it's still not a stretch to say that Genel Energy's price-to-sales (or "P/S") ratio of 1.2x right now seems quite "middle-of-the-road" compared to the Oil and Gas industry in the United Kingdom, where the median P/S ratio is around 1.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Genel Energy

How Has Genel Energy Performed Recently?

While the industry has experienced revenue growth lately, Genel Energy's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Genel Energy will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

Genel Energy's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 44%. As a result, revenue from three years ago have also fallen 12% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to plummet, contracting by 16% per year during the coming three years according to the three analysts following the company. With the rest of the industry predicted to shrink by 1.5% per year, it's a sub-optimal result.

In light of this, it's somewhat peculiar that Genel Energy's P/S sits in line with the majority of other companies. With revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. Maintaining these prices will be difficult to achieve as the weak outlook is likely to weigh down the shares eventually.

The Key Takeaway

With its share price dropping off a cliff, the P/S for Genel Energy looks to be in line with the rest of the Oil and Gas industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Genel Energy currently trades on a higher P/S than expected based on revenue decline, even more so since its revenue forecast is even worse than the struggling industry. Even though the company's P/S is on par with the rest of the industry, the fact that it's revenue outlook is poorer than an already struggling industry suggests that the P/S isn't justified. We're also cautious about the company's ability to resist even greater pain to its business from the broader industry turmoil. This presents a risk to investors if the P/S were to decline to a level that more accurately reflects the company's revenue prospects.

You always need to take note of risks, for example - Genel Energy has 1 warning sign we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:GENL

Genel Energy

Operates as an independent oil and gas exploration and production company.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives