Stock Analysis

- United Kingdom

- /

- Real Estate

- /

- LSE:LSL

Three UK Growth Companies With High Insider Ownership And 11% Revenue Growth

Reviewed by Simply Wall St

The United Kingdom market has shown resilience with a 4.2% increase over the past year, accompanied by an optimistic forecast of annual earnings growth at 13%. In such an environment, stocks like those of growth companies with high insider ownership and robust revenue expansion can be particularly compelling.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Plant Health Care (AIM:PHC) | 34.2% | 121.3% |

| Petrofac (LSE:PFC) | 16.6% | 124% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 74.6% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 23.5% |

| Foresight Group Holdings (LSE:FSG) | 31.9% | 27.9% |

| Helios Underwriting (AIM:HUW) | 23.1% | 14.7% |

| Belluscura (AIM:BELL) | 39.5% | 117.8% |

| Velocity Composites (AIM:VEL) | 27.6% | 173.3% |

| B90 Holdings (AIM:B90) | 24.4% | 142.7% |

| Judges Scientific (AIM:JDG) | 11.5% | 25.3% |

Let's take a closer look at a couple of our picks from the screened companies.

Franchise Brands (AIM:FRAN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Franchise Brands plc operates a franchising business with activities spanning across the United Kingdom, North America, and Europe, and has a market capitalization of approximately £329.66 million.

Operations: The company's revenue is generated from several segments, including Azura (£0.75 million), Pirtek (£41.95 million), B2C Division (£6.11 million), Water & Waste (£48.88 million), and Filta International (£27.12 million).

Insider Ownership: 29.8%

Revenue Growth Forecast: 11.5% p.a.

Franchise Brands, a notable UK growth company with high insider ownership, has recently experienced significant executive changes and reported substantial financial results. In 2023, revenue surged to £121.27 million from £69.84 million the previous year; however, net income declined to £3.04 million from £8.13 million, reflecting challenges in profit margins which dropped significantly from the prior year's levels. Despite these hurdles, analysts predict a robust annual earnings growth of 40.65% over the next three years and anticipate a potential stock price increase of 88.5%.

- Click here and access our complete growth analysis report to understand the dynamics of Franchise Brands.

- In light of our recent valuation report, it seems possible that Franchise Brands is trading behind its estimated value.

Energean (LSE:ENOG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Energean plc is a company focused on the exploration, production, and development of oil and gas, with a market capitalization of approximately £1.94 billion.

Operations: The company generates revenue primarily from its oil and gas exploration and production activities, totaling approximately $1.42 billion.

Insider Ownership: 10.6%

Revenue Growth Forecast: 11.6% p.a.

Energean, a UK-based growth company with high insider ownership, has demonstrated substantial revenue and earnings growth. Over the past year, earnings soared by a very large margin and are forecast to continue expanding at 12.98% annually. Despite trading 44.7% below estimated fair value and analysts expecting a 29.3% price increase, concerns include high debt levels and shareholder dilution over the past year. Recently, Energean committed to the Katlan development in Israel, aiming for first gas by H1 2027 which could bolster future revenues without affecting existing agreements.

- Click to explore a detailed breakdown of our findings in Energean's earnings growth report.

- According our valuation report, there's an indication that Energean's share price might be on the cheaper side.

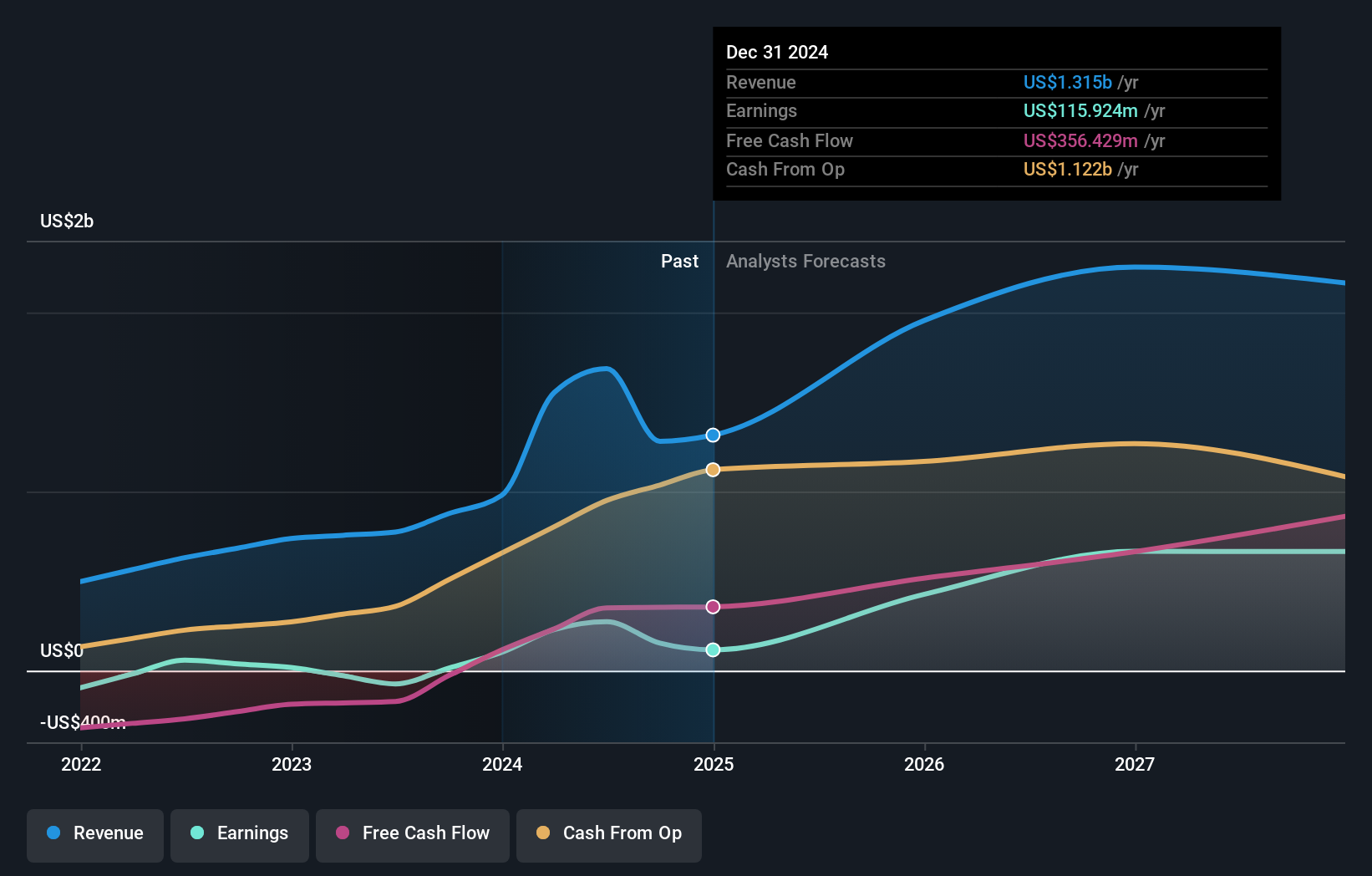

LSL Property Services (LSE:LSL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LSL Property Services plc operates in the UK, offering services to mortgage intermediaries and estate agency franchisees, as well as valuation services to lenders, with a market cap of approximately £343.98 million.

Operations: The company generates revenue through three primary segments: Financial Services (£51.69 million), Surveying and Valuation (£67.83 million), and Estate Agency, excluding Financial Services (£24.89 million).

Insider Ownership: 10.8%

Revenue Growth Forecast: 11% p.a.

LSL Property Services, a UK growth company with high insider ownership, has seen recent strategic board enhancements and dividend affirmations. The company declared a consistent dividend amidst leadership changes, including appointing experienced directors like Michael Stoop and Adrian Collins. Despite a challenging financial year with significant losses, LSL is navigating towards recovery with projected annual earnings growth of 33.3%, outpacing the UK market forecast. However, its revenue growth forecast remains modest at 11% per year, and dividends are not well-covered by earnings or cash flows.

- Delve into the full analysis future growth report here for a deeper understanding of LSL Property Services.

- Upon reviewing our latest valuation report, LSL Property Services' share price might be too optimistic.

Next Steps

- Click here to access our complete index of 63 Fast Growing UK Companies With High Insider Ownership.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:LSL

LSL Property Services

Engages in the provision of business-to-business services to mortgage intermediaries and estate agency franchisees, and valuation services to lenders in the United Kingdom.

High growth potential with excellent balance sheet.