Stock Analysis

- United Kingdom

- /

- Personal Products

- /

- AIM:W7L

Exploring Undiscovered UK Stocks With Potential In July 2024

Reviewed by Simply Wall St

The United Kingdom's stock market has recently experienced a downturn, influenced by disappointing trade data from China which has notably impacted the FTSE 100 and FTSE 250 indices. Amid these broader market challenges, identifying stocks with potential requires a focus on companies that demonstrate resilience and strategic adaptability to global economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| London Security | 0.31% | 9.47% | 7.41% | ★★★★★★ |

| Georgia Capital | NA | -27.80% | 18.94% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Fix Price Group | 43.59% | 12.53% | 23.49% | ★★★★★☆ |

| Ros Agro | 57.18% | 17.80% | 18.35% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 6.58% | 9.90% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Warpaint London (AIM:W7L)

Simply Wall St Value Rating: ★★★★★★

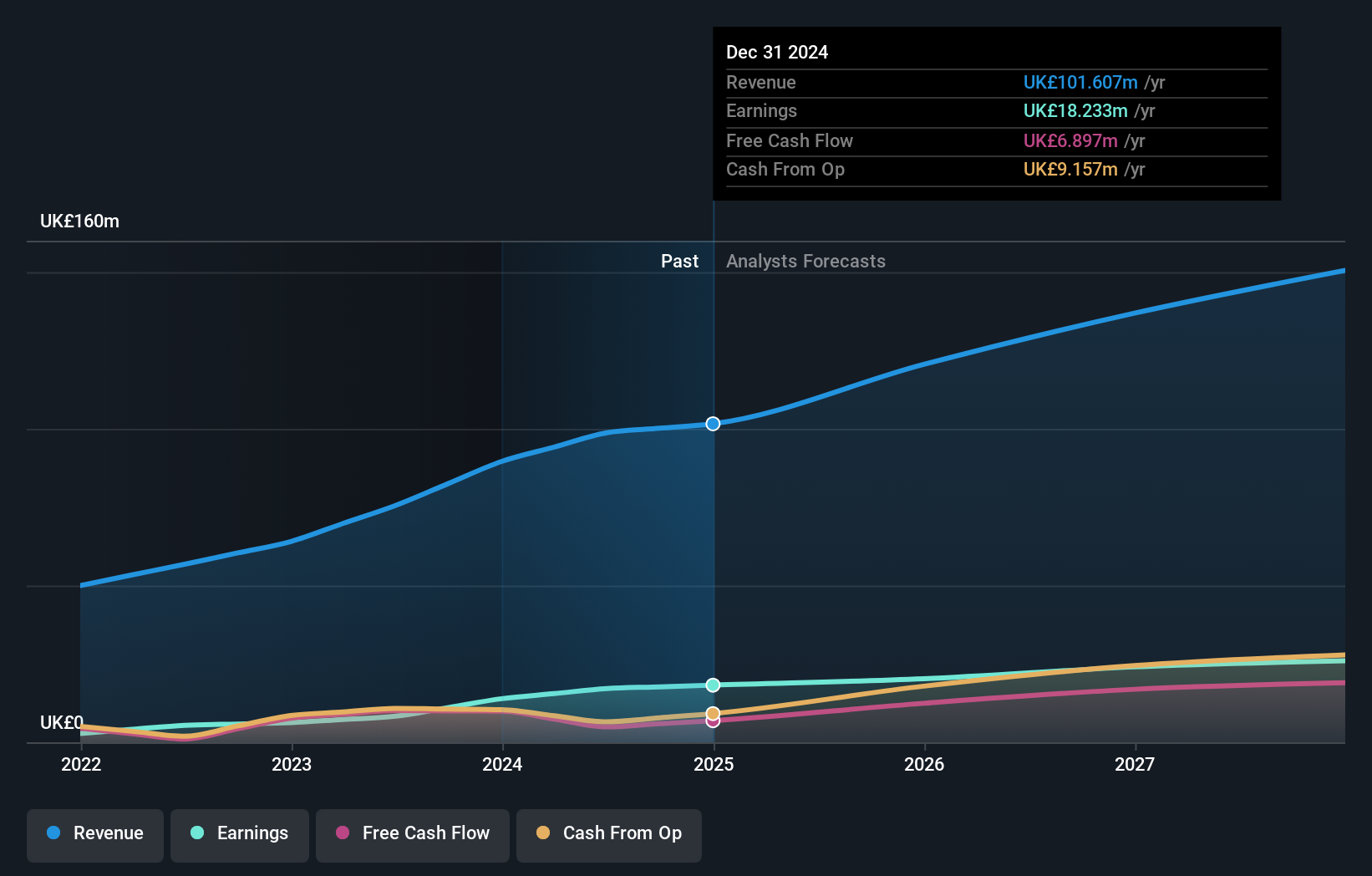

Overview: Warpaint London PLC, together with its subsidiaries, produces and sells cosmetics and operates with a market capitalization of £490.64 million.

Operations: The company generates the majority of its revenue from its own brand products, totaling £87.07 million, complemented by a smaller close-out segment that contributed £2.52 million. Its business model has shown a consistent increase in gross profit margin over recent years, reaching 39.87% as of the latest data point, reflecting improved operational efficiency and product mix optimization.

Warpaint London PLC, a lesser-known player in the personal products sector, showcases robust financial health and growth potential. With no debt and earnings that surged by 122% last year, the company outperformed its industry's growth of 17%. Recent activities include a £31.5 million equity offering and a dividend increase to 6 pence per share, signaling confidence in sustained profitability. Forecasted annual earnings growth stands at 15%, underscoring Warpaint's upward trajectory amid dynamic market conditions.

- Unlock comprehensive insights into our analysis of Warpaint London stock in this health report.

Gain insights into Warpaint London's past trends and performance with our Past report.

Alpha Group International (LSE:ALPH)

Simply Wall St Value Rating: ★★★★★★

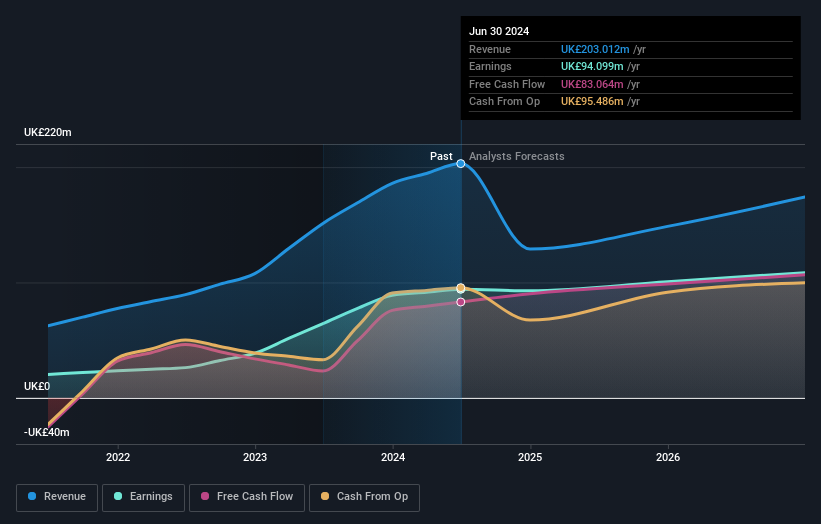

Overview: Alpha Group International plc specializes in foreign exchange risk management and alternative banking solutions, serving clients in the UK, Europe, Canada, and globally with a market cap of £1.06 billion.

Operations: Alpha Group International generates revenue through a diversified portfolio, including payment solutions (Alpha Pay), institutional services, and corporate operations across multiple global cities. The company has shown significant growth in gross profit, reaching £159.30 million by the end of 2023 with a gross profit margin of 85.66%, reflecting efficient cost management and robust operational performance.

Alpha Group International, a standout in the UK market, has demonstrated robust financial health with a 130% earnings growth over the past year and is forecast to grow at 8.25% annually. Trading below the industry average with a P/E ratio of 11.9x compared to the UK market's 16.7x, Alpha offers compelling value. Recently added to multiple FTSE indices and initiating share repurchases, Alpha's strategic moves underline its potential as an undiscovered gem poised for further visibility and growth.

Wilmington (LSE:WIL)

Simply Wall St Value Rating: ★★★★★★

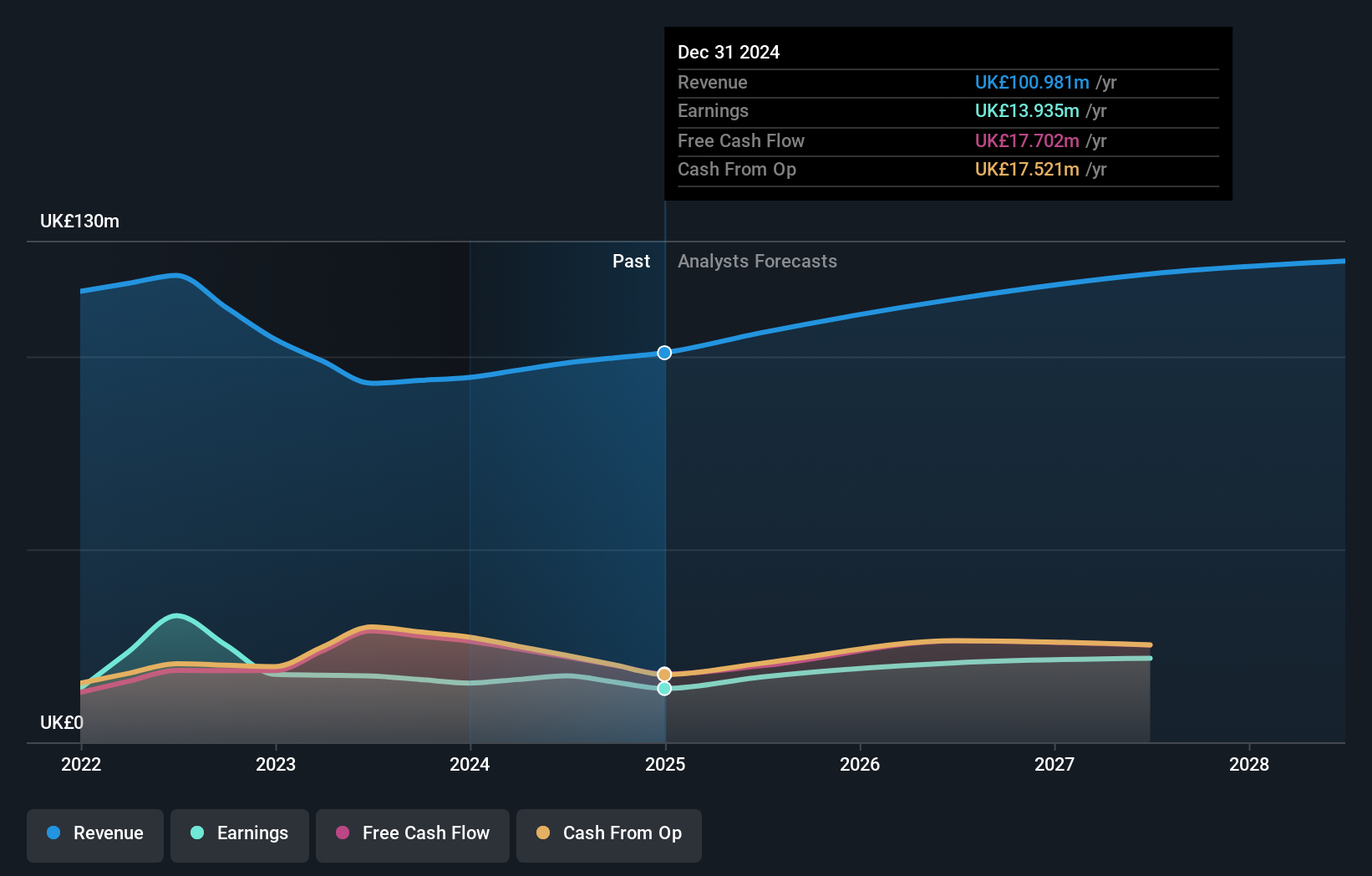

Overview: Wilmington plc operates globally, offering information, data, training, and education solutions to professional markets primarily in the UK, Europe, and North America with a market capitalization of £356.87 million.

Operations: Wilmington generates its revenue primarily through two segments: Intelligence and Training & Education, with respective earnings of £57.86 million and £67.13 million. The company's operational model involves managing costs related to goods sold and operating expenses while deriving income from both operational activities and non-operational financial activities.

Wilmington stands out as an intriguing prospect, currently trading at 28.6% below its estimated fair value, highlighting potential for appreciation. This debt-free entity has shown a robust performance with a 4.4% earnings growth last year, surpassing the Professional Services industry's growth of 1%. Despite forecasts suggesting a potential average earnings decline of 6.6% annually over the next three years, Wilmington’s historical ability to reduce debt—from a ratio of 139% five years ago to zero—underscores its financial prudence and operational efficiency.

Taking Advantage

- Unlock more gems! Our UK Undiscovered Gems With Strong Fundamentals screener has unearthed 74 more companies for you to explore.Click here to unveil our expertly curated list of 77 UK Undiscovered Gems With Strong Fundamentals.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Warpaint London might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:W7L

Outstanding track record with flawless balance sheet.