- United Kingdom

- /

- Banks

- /

- LSE:TBCG

3 UK Growth Stocks With High Insider Ownership Growing Earnings Up To 26%

Reviewed by Simply Wall St

In the last week, the United Kingdom market has been flat, but over the past 12 months, it has risen by 11%, with earnings forecast to grow by 14% annually. In this context, identifying growth companies with high insider ownership can be particularly advantageous as these stocks often align management interests with shareholder value and demonstrate confidence in future performance.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Filtronic (AIM:FTC) | 28.6% | 33.5% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 73.8% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 23.7% |

| Helios Underwriting (AIM:HUW) | 23.9% | 14.7% |

| Foresight Group Holdings (LSE:FSG) | 31.9% | 27.9% |

| LSL Property Services (LSE:LSL) | 10.8% | 33.3% |

| Belluscura (AIM:BELL) | 36.1% | 113.4% |

| B90 Holdings (AIM:B90) | 24.4% | 142.7% |

| Velocity Composites (AIM:VEL) | 27.6% | 188.7% |

| Judges Scientific (AIM:JDG) | 11.9% | 27.5% |

Let's dive into some prime choices out of the screener.

Energean (LSE:ENOG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Energean plc is involved in the exploration, production, and development of oil and gas, with a market cap of £1.82 billion.

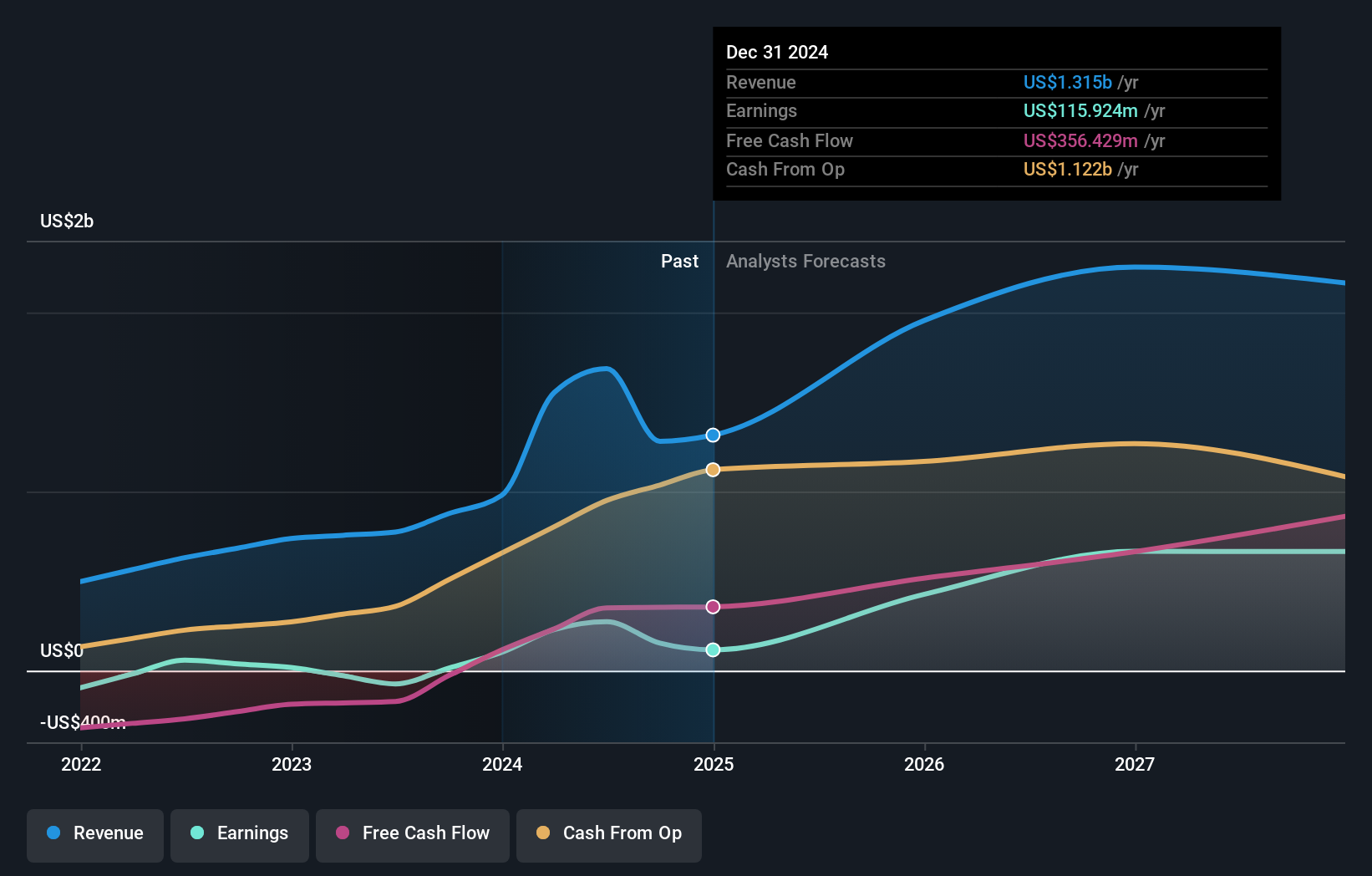

Operations: Energean's revenue primarily comes from its oil and gas exploration and production segment, generating $1.42 billion.

Insider Ownership: 10.6%

Earnings Growth Forecast: 14.6% p.a.

Energean plc, a growth company with high insider ownership, recently confirmed the successful start-up of the Cassiopea field and took Final Investment Decision for the Katlan development project. Analysts forecast Energean's earnings to grow 14.56% annually, outpacing the UK market. Despite high debt levels and a dividend not well-covered by earnings, its stock is trading at 52.4% below estimated fair value with substantial insider buying in recent months.

- Dive into the specifics of Energean here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Energean's share price might be too pessimistic.

PPHE Hotel Group (LSE:PPH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PPHE Hotel Group Limited owns, co-owns, develops, leases, operates, and franchises upscale hotels across several European countries including the Netherlands and the United Kingdom with a market cap of £566.70 million.

Operations: The company's revenue segments are comprised of Owned Hotel Operations in the United Kingdom (£235.31 million), Croatia (£78.38 million), the Netherlands (£63.30 million), Germany, Hungary, and Serbia (£22.76 million), as well as Management and Central Services (£48.27 million).

Insider Ownership: 14.8%

Earnings Growth Forecast: 26% p.a.

PPHE Hotel Group, with significant insider ownership, has seen its earnings grow by 120.6% over the past year and is forecasted to grow at 26.03% annually, outpacing the UK market. However, interest payments are not well covered by earnings and its dividend yield of 2.96% is not supported by free cash flows. Despite these concerns, it trades at a substantial discount to its estimated fair value and recently announced a share repurchase program and an interim dividend increase.

- Click here and access our complete growth analysis report to understand the dynamics of PPHE Hotel Group.

- In light of our recent valuation report, it seems possible that PPHE Hotel Group is trading behind its estimated value.

TBC Bank Group (LSE:TBCG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TBC Bank Group PLC, with a market cap of £1.74 billion, offers banking, leasing, insurance, brokerage, and card processing services to corporate and individual customers in Georgia, Azerbaijan, and Uzbekistan through its subsidiaries.

Operations: The company's revenue segments include Segment Adjustment at GEL 2.13 billion and Uzbekistan Operations at GEL 236.42 million.

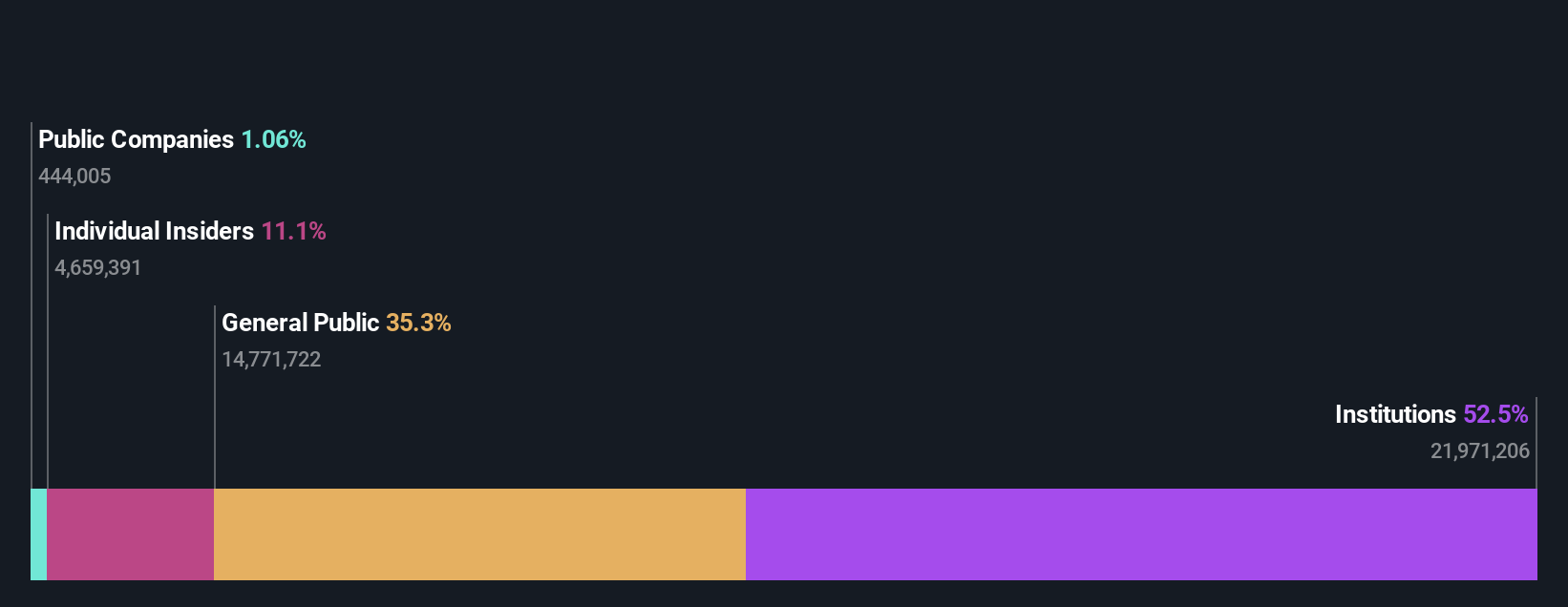

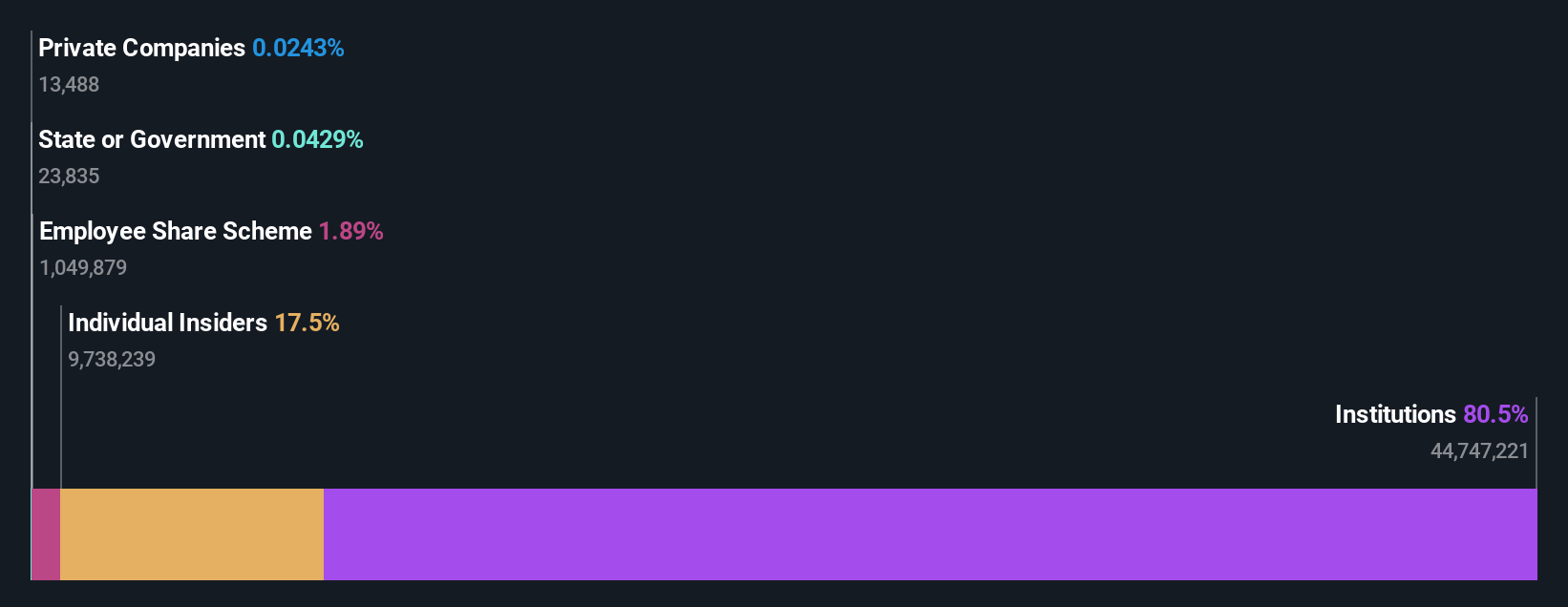

Insider Ownership: 17.6%

Earnings Growth Forecast: 15.3% p.a.

TBC Bank Group, with significant insider ownership, reported a net income of GEL 617.4 million for the half year ended June 30, 2024, up from GEL 537.46 million a year ago. Earnings per share also increased to GEL 11.33 from GEL 9.9. Despite past shareholder dilution and an unstable dividend track record, TBC trades at a substantial discount to its estimated fair value and is forecasted to grow earnings by 15.3% annually over the next three years.

- Click here to discover the nuances of TBC Bank Group with our detailed analytical future growth report.

- According our valuation report, there's an indication that TBC Bank Group's share price might be on the cheaper side.

Next Steps

- Take a closer look at our Fast Growing UK Companies With High Insider Ownership list of 68 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if TBC Bank Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:TBCG

TBC Bank Group

Through its subsidiaries, provides banking, leasing, insurance, brokerage, and card processing services to corporate and individual customers in Georgia, Azerbaijan, and Uzbekistan.

Undervalued with excellent balance sheet and pays a dividend.