- United Kingdom

- /

- Oil and Gas

- /

- LSE:SEPL

Undiscovered Gems in the United Kingdom to Watch This August 2024

Reviewed by Simply Wall St

The market in the United Kingdom has been flat over the last week but is up 11% over the past year, with earnings forecast to grow by 14% annually. In this environment, identifying stocks with strong growth potential and solid fundamentals can be particularly rewarding for investors.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| London Security | 0.31% | 9.47% | 7.41% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| FW Thorpe | 3.34% | 11.37% | 9.41% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 6.58% | 9.90% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Yellow Cake (AIM:YCA)

Simply Wall St Value Rating: ★★★★★★

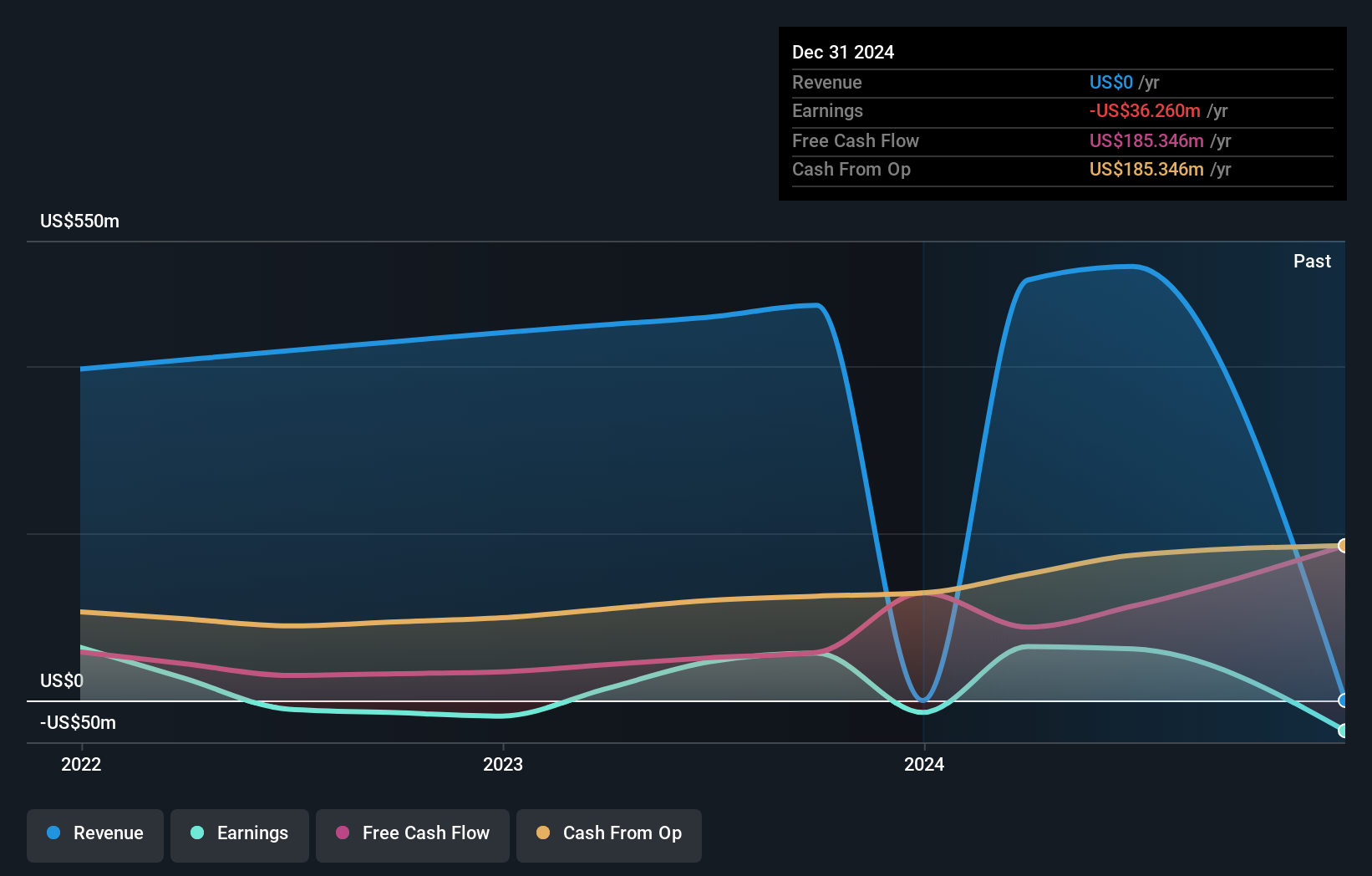

Overview: Yellow Cake plc operates in the uranium sector with a market cap of £1.14 billion.

Operations: Yellow Cake plc generates revenue primarily from holding U3O8 for long-term capital appreciation, amounting to $735.02 million.

Yellow Cake plc, a small cap in the UK market, has recently turned profitable with net income hitting US$727.01 million for the year ending March 31, 2024. This contrasts sharply with a net loss of US$102.94 million the previous year. The company reported revenues of US$735.02 million and boasts a low price-to-earnings ratio of 2.1x compared to the UK market's 17x average. With no debt over the past five years and high levels of non-cash earnings, Yellow Cake seems well-positioned despite forecasted earnings declines averaging 91% annually over the next three years.

- Get an in-depth perspective on Yellow Cake's performance by reading our health report here.

Examine Yellow Cake's past performance report to understand how it has performed in the past.

Ocean Wilsons Holdings (LSE:OCN)

Simply Wall St Value Rating: ★★★★★★

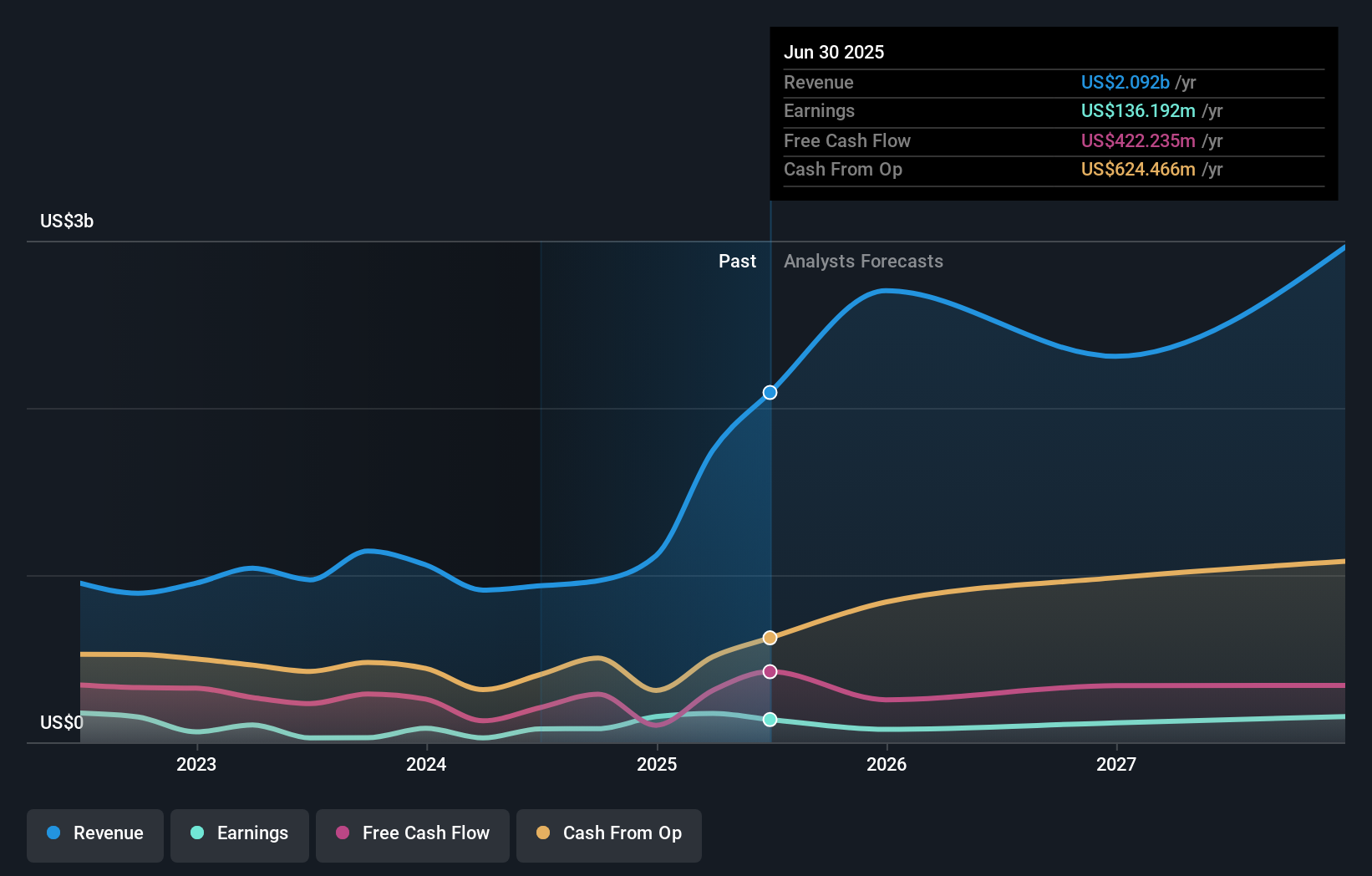

Overview: Ocean Wilsons Holdings Limited, with a market cap of £510.99 million, is an investment holding company that provides maritime and logistics services in Brazil.

Operations: Revenue from maritime services in Brazil stands at $519.35 million.

Ocean Wilsons Holdings has been making waves with a 32.7% earnings growth over the past year, outpacing the Infrastructure industry’s 16.1%. Its debt to equity ratio improved from 42.7% to 38% in five years, showcasing financial prudence. The company also boasts a price-to-earnings ratio of 10.9x, significantly lower than the UK market average of 17x. Additionally, recent M&A discussions about selling its subsidiary Wilson Sons could further enhance its strategic positioning and value proposition for investors.

Seplat Energy (LSE:SEPL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Seplat Energy Plc is involved in oil and gas exploration, production, and gas processing activities across Nigeria, the Bahamas, Italy, Switzerland, Barbados, and England with a market cap of £1.09 billion.

Operations: Seplat Energy generates revenue primarily from oil ($815.03 million) and gas ($120.87 million). The company's market cap stands at £1.09 billion, reflecting its significant presence in the energy sector across multiple countries.

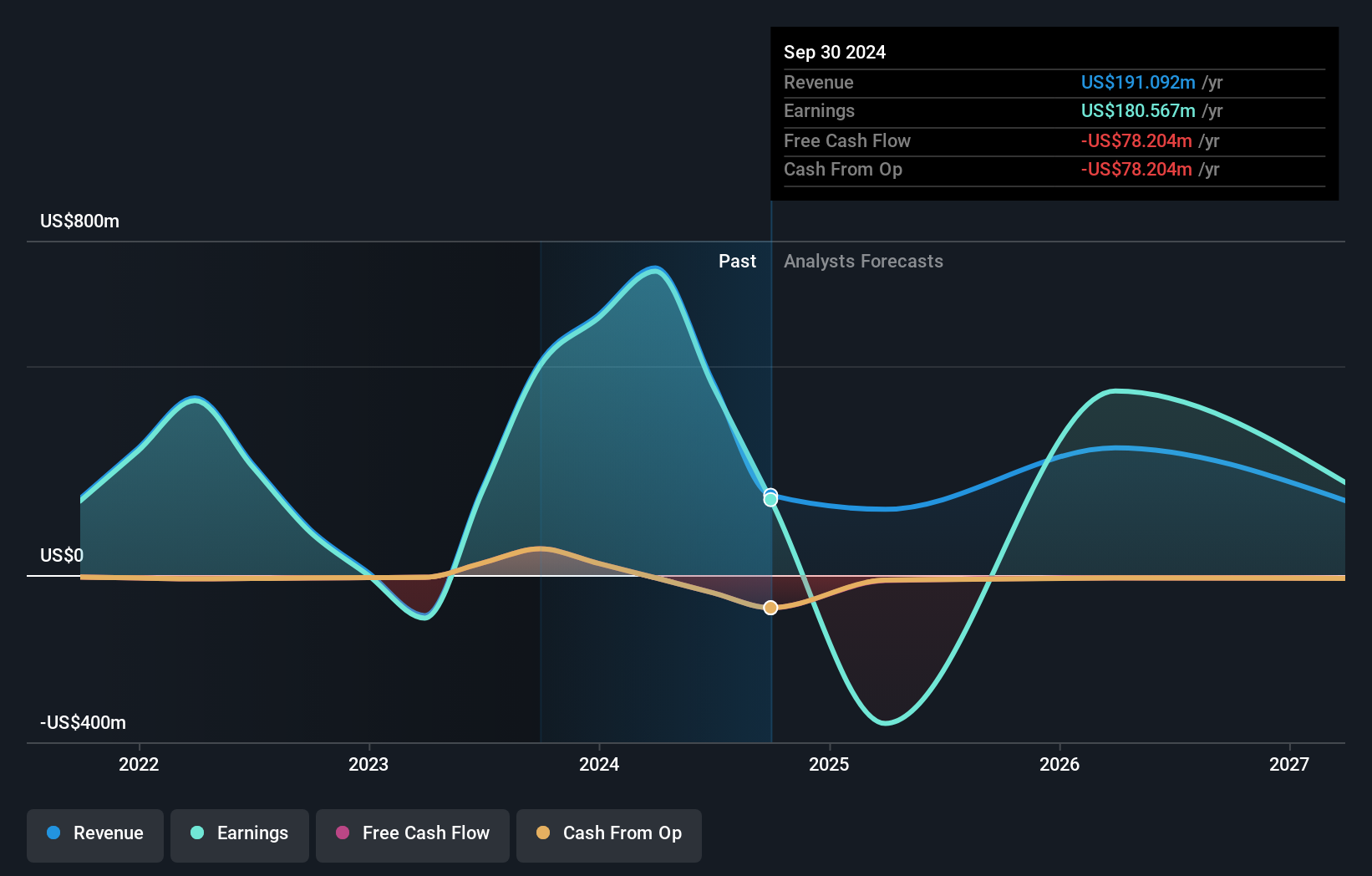

Seplat Energy has experienced notable growth, with earnings surging 207.6% over the past year, outpacing the Oil and Gas industry's -56%. The company's net debt to equity ratio stands at a satisfactory 20.6%, while interest payments are well covered by EBIT at 5.8x. Despite a volatile share price in recent months, Seplat remains profitable with positive free cash flow and forecasts earnings growth of 13.59% annually.

- Delve into the full analysis health report here for a deeper understanding of Seplat Energy.

Understand Seplat Energy's track record by examining our Past report.

Where To Now?

- Unlock more gems! Our UK Undiscovered Gems With Strong Fundamentals screener has unearthed 76 more companies for you to explore.Click here to unveil our expertly curated list of 79 UK Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SEPL

Seplat Energy

Engages in the oil and gas exploration and production, and gas processing activities in Nigeria, the Bahamas, Italy, Switzerland, Barbados, and England.

Established dividend payer with proven track record.