Stock Analysis

- United Kingdom

- /

- Oil and Gas

- /

- LSE:ENOG

3 UK Growth Companies With High Insider Ownership And At Least 15% Earnings Growth

Reviewed by Simply Wall St

Amidst a backdrop of cautious market sentiment in the UK, with the FTSE 100 showing mixed signals as investors navigate through political uncertainties and upcoming elections, it's crucial to focus on fundamental strengths when selecting stocks. Companies with high insider ownership and robust earnings growth are often well-positioned to weather such uncertainties, reflecting a commitment from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Plant Health Care (AIM:PHC) | 26.4% | 121.3% |

| Getech Group (AIM:GTC) | 17.3% | 108.7% |

| Petrofac (LSE:PFC) | 16.6% | 124.5% |

| Gulf Keystone Petroleum (LSE:GKP) | 10.8% | 47.6% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 25.5% |

| LSL Property Services (LSE:LSL) | 10.8% | 33.3% |

| Velocity Composites (AIM:VEL) | 28.5% | 143.4% |

| TEAM (AIM:TEAM) | 25.8% | 58.6% |

| Afentra (AIM:AET) | 38.3% | 64.4% |

| Mothercare (AIM:MTC) | 15.1% | 41.2% |

Let's explore several standout options from the results in the screener.

Energean (LSE:ENOG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Energean plc is an oil and gas company focused on exploration, development, and production, with a market capitalization of approximately £1.91 billion.

Operations: The company generates its revenue primarily from the exploration and production of oil and gas, totaling approximately $1.42 billion.

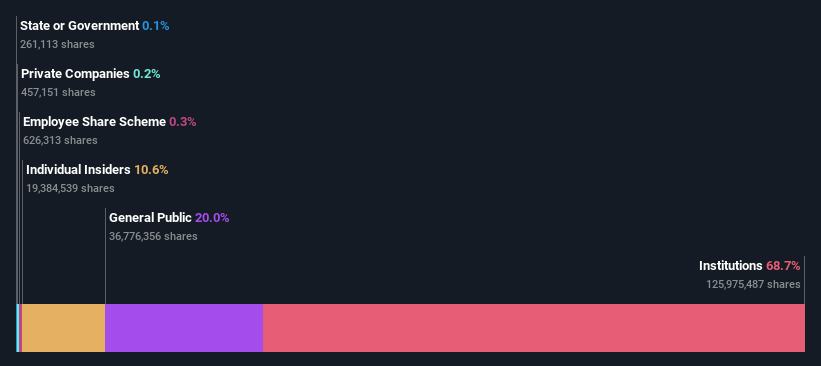

Insider Ownership: 10.7%

Earnings Growth Forecast: 18.3% p.a.

Energean, a UK-based energy company, has demonstrated robust growth with its first quarter 2024 production up by 49% year-over-year. While trading at 40.7% below its estimated fair value and expected to see revenue growth outpace the UK market at 12.2% annually, concerns persist due to high debt levels and a dividend that is not well covered by earnings or cash flows. Insider ownership remains substantial, yet recent activities do not indicate significant insider buying or selling over the past three months.

- Click to explore a detailed breakdown of our findings in Energean's earnings growth report.

- Our valuation report here indicates Energean may be undervalued.

Foresight Group Holdings (LSE:FSG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating across the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market capitalization of approximately £576.47 million.

Operations: The company generates revenue through three primary segments: Infrastructure (£85.68 million), Private Equity (£39.28 million), and Foresight Capital Management (£11.33 million).

Insider Ownership: 31.7%

Earnings Growth Forecast: 30.9% p.a.

Foresight Group Holdings, while trading 32.8% below its estimated fair value, shows promise with expected earnings growth of 30.9% per year, outpacing the UK market forecast of 12.5%. However, profit margins have declined to 15.4% from last year's 25.5%, and the dividend coverage is weak at a rate of 4.46%. Revenue growth projections are moderate at 10% annually but still above the UK average of 3.5%, with very high forecasted Return on Equity at 41.5%.

- Delve into the full analysis future growth report here for a deeper understanding of Foresight Group Holdings.

- The valuation report we've compiled suggests that Foresight Group Holdings' current price could be inflated.

TBC Bank Group (LSE:TBCG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TBC Bank Group PLC operates primarily in Georgia, Azerbaijan, and Uzbekistan, offering a range of financial services including banking, leasing, insurance, brokerage, and card processing with a market capitalization of approximately £1.38 billion.

Operations: The company generates its revenue from banking, leasing, insurance, brokerage, and card processing services across Georgia, Azerbaijan, and Uzbekistan.

Insider Ownership: 18%

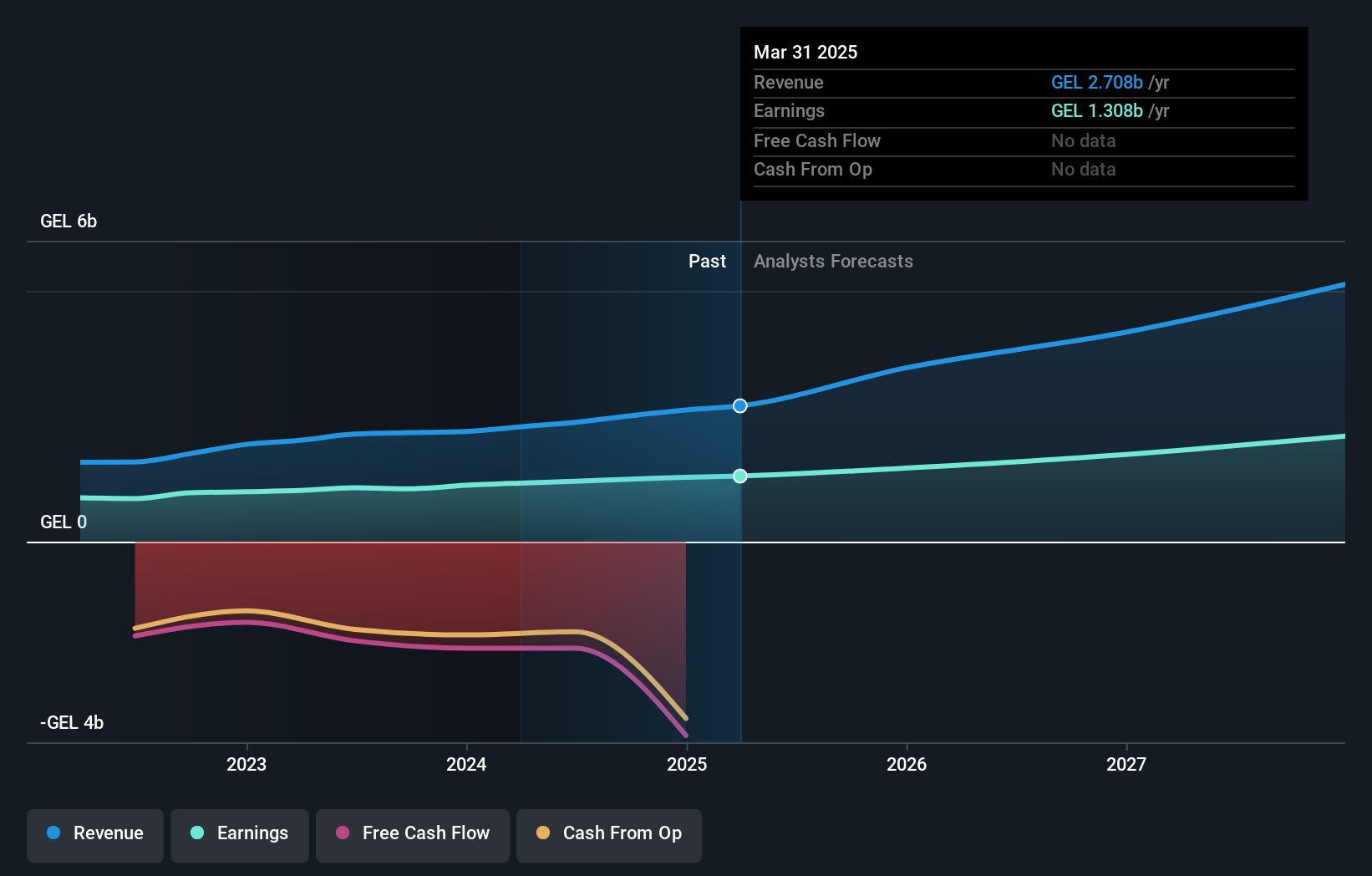

Earnings Growth Forecast: 15.2% p.a.

TBC Bank Group demonstrates a robust growth trajectory with earnings and revenue forecasted to expand by 15.22% and 18.3% per year respectively, outpacing the UK market averages. Despite trading at 47.7% below its estimated fair value, concerns linger over its unstable dividend track record and high bad loans ratio at 2.1%. Recently, the bank announced a significant share buyback program worth GEL 75 million, aiming to reduce share capital and support shareholder value.

- Click here to discover the nuances of TBC Bank Group with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential undervaluation of TBC Bank Group shares in the market.

Turning Ideas Into Actions

- Take a closer look at our Fast Growing UK Companies With High Insider Ownership list of 67 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Energean is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ENOG

Energean

Engages in the exploration, production, and development of oil and gas.

Solid track record and good value.