- United Kingdom

- /

- Oil and Gas

- /

- LSE:ENOG

3 Top UK Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

As the FTSE 100 and FTSE 250 indices experience downward pressure due to weak trade data from China, investors in the UK are closely monitoring how global economic challenges impact domestic markets. In such an environment, growth companies with high insider ownership can be particularly appealing as they often demonstrate strong alignment between management and shareholder interests, potentially offering resilience amidst broader market volatility.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Taylor Maritime (LSE:TMI) | 21% | 65% |

| SRT Marine Systems (AIM:SRT) | 24.3% | 91.4% |

| Manolete Partners (AIM:MANO) | 38.1% | 29.5% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.9% | 20.8% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 85.7% |

| Faron Pharmaceuticals Oy (AIM:FARN) | 24.6% | 62% |

| ENGAGE XR Holdings (AIM:EXR) | 15.3% | 84.5% |

| Energean (LSE:ENOG) | 19% | 38.9% |

| B90 Holdings (AIM:B90) | 22.1% | 157.2% |

| ActiveOps (AIM:AOM) | 19.5% | 43.3% |

We'll examine a selection from our screener results.

Energean (LSE:ENOG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Energean plc is involved in the exploration, production, and development of oil and gas, with a market cap of £1.50 billion.

Operations: The company's revenue is primarily derived from its oil and gas exploration and production segment, which generated $1.25 billion.

Insider Ownership: 19%

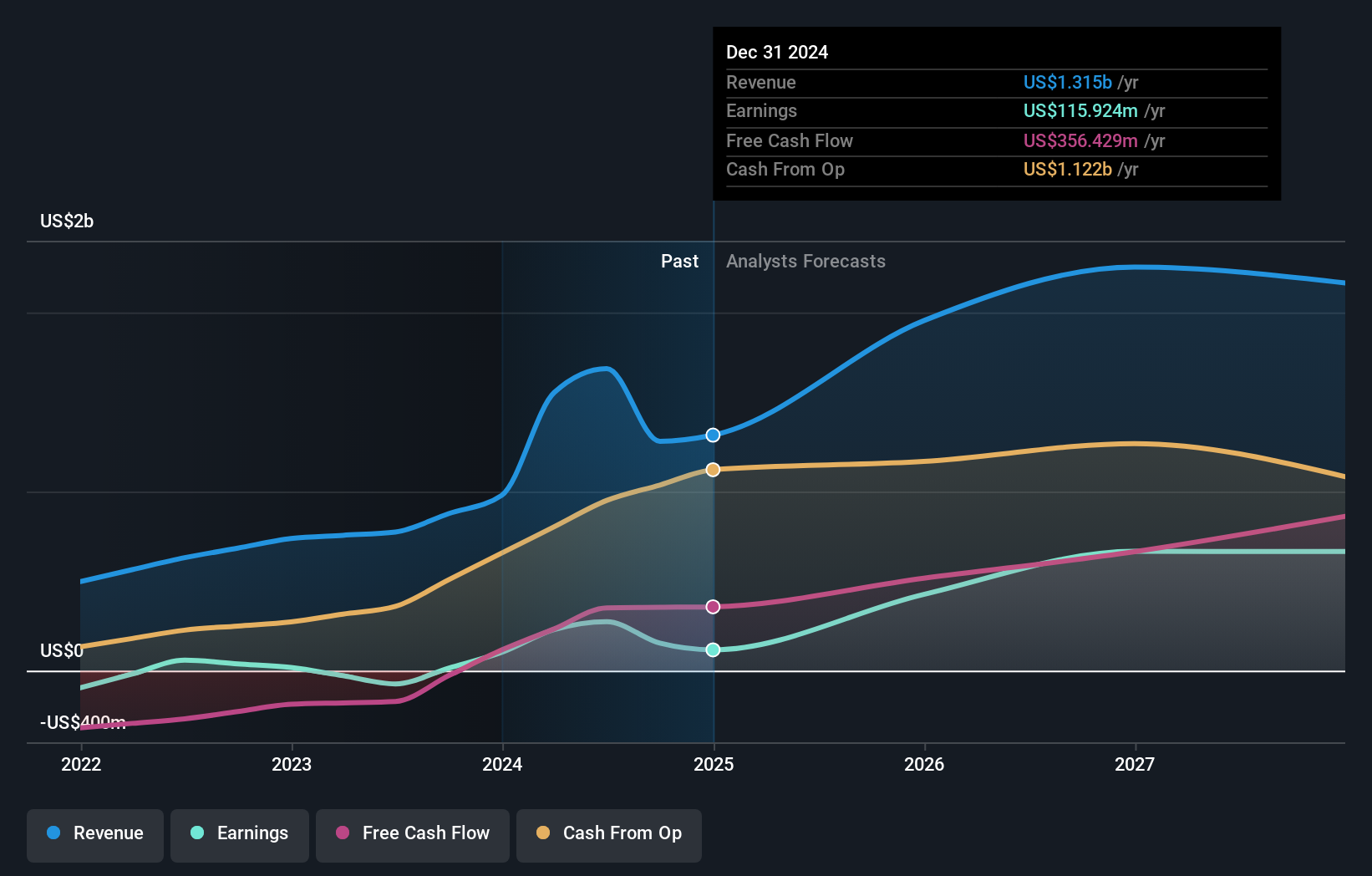

Energean's earnings are forecast to grow significantly at 38.9% annually, outpacing the UK market. Despite trading below estimated fair value and analyst price targets, interest payments aren't well covered by earnings, and the dividend remains unsustainable. Recent insider activity shows more buying than selling over three months. Production guidance was lowered due to operational delays in Israel, impacting output expectations for 2025. Earnings rose with net income reaching $110.48 million for H1 2025 despite sales decline.

- Delve into the full analysis future growth report here for a deeper understanding of Energean.

- Our valuation report unveils the possibility Energean's shares may be trading at a discount.

Gulf Keystone Petroleum (LSE:GKP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Gulf Keystone Petroleum Limited is involved in the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq with a market cap of £452.25 million.

Operations: The company's revenue is derived entirely from its activities in the exploration and production of oil and gas, amounting to $163.17 million.

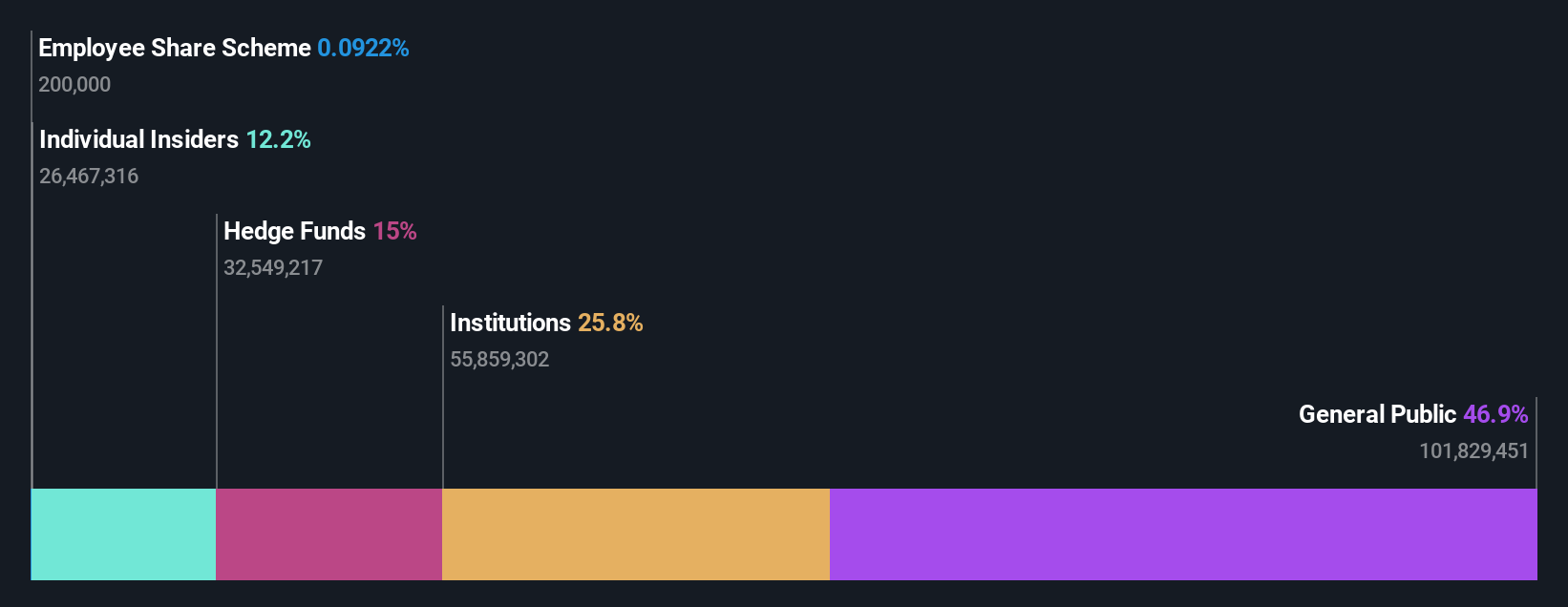

Insider Ownership: 12.2%

Gulf Keystone Petroleum's revenue is forecast to grow 23% annually, surpassing the UK market growth of 4.1%. Despite expected profitability within three years, recent earnings showed a net loss of US$7.21 million for H1 2025, with volatile share prices and an unsustainable dividend yield of 8.29%. Recent disruptions led to reduced production guidance between 40,000–42,000 bopd. A US$25 million interim dividend was announced for September despite financial challenges.

- Navigate through the intricacies of Gulf Keystone Petroleum with our comprehensive analyst estimates report here.

- Our valuation report here indicates Gulf Keystone Petroleum may be overvalued.

International Workplace Group (LSE:IWG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: International Workplace Group plc, along with its subsidiaries, offers workspace solutions across the Americas, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of £2.10 billion.

Operations: The company's revenue segments include Digital and Professional Services, which generated $373 million.

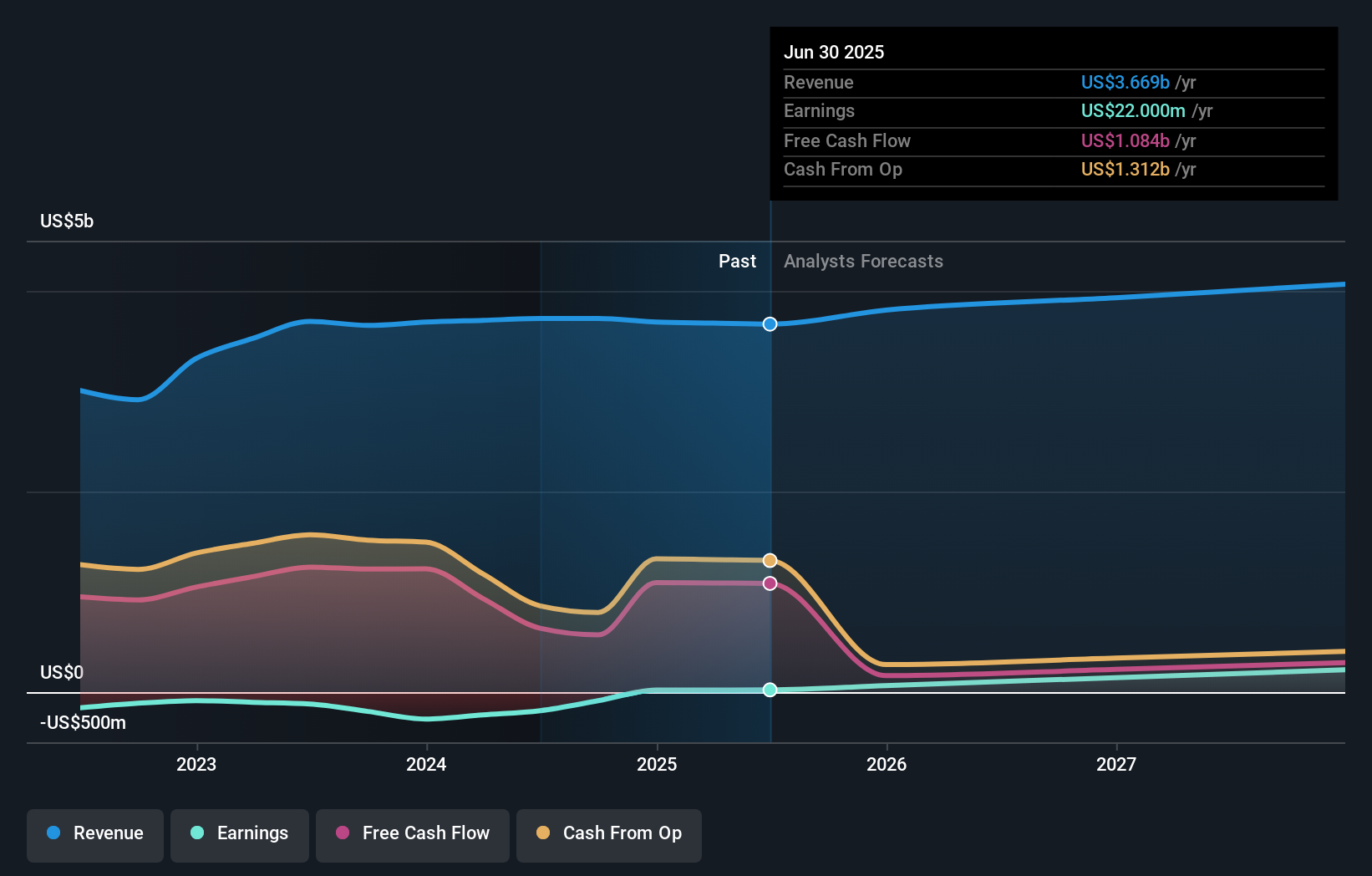

Insider Ownership: 25.5%

International Workplace Group's recent earnings reveal a net income of $11 million for H1 2025, up from $9 million the previous year. Despite trading below analyst price targets, significant insider ownership aligns with expectations of substantial annual profit growth at 70.5%, outpacing UK market averages. However, revenue growth is slower than the market at 3.6% annually. The company completed a $50 million share buyback and declared an interim dividend, though interest payments remain inadequately covered by earnings.

- Click here and access our complete growth analysis report to understand the dynamics of International Workplace Group.

- The valuation report we've compiled suggests that International Workplace Group's current price could be inflated.

Seize The Opportunity

- Delve into our full catalog of 64 Fast Growing UK Companies With High Insider Ownership here.

- Seeking Other Investments? These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Energean might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ENOG

Energean

Engages in the exploration, production, and development of oil and gas.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success