- United Kingdom

- /

- Oil and Gas

- /

- LSE:DEC

Revenues Working Against Diversified Energy Company PLC's (LON:DEC) Share Price Following 25% Dive

To the annoyance of some shareholders, Diversified Energy Company PLC (LON:DEC) shares are down a considerable 25% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 58% share price decline.

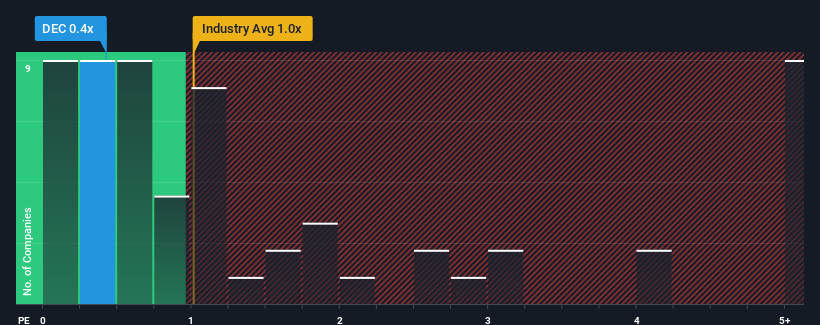

Following the heavy fall in price, considering around half the companies operating in the United Kingdom's Oil and Gas industry have price-to-sales ratios (or "P/S") above 1x, you may consider Diversified Energy as an solid investment opportunity with its 0.4x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Diversified Energy

What Does Diversified Energy's Recent Performance Look Like?

Diversified Energy hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Diversified Energy's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Diversified Energy?

Diversified Energy's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 10%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 257% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should bring plunging returns, with revenue decreasing 31% as estimated by the six analysts watching the company. With the rest of the industry predicted to shrink by 0.8%, it's a sub-optimal result.

With this in consideration, it's clear to us why Diversified Energy's P/S isn't quite up to scratch with its industry peers. However, when revenue shrink rapidly the P/S often shrinks too, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as the weak outlook is already weighing down the shares heavily.

What We Can Learn From Diversified Energy's P/S?

Diversified Energy's P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Diversified Energy's P/S is about what we expect, seeing as the P/S and revenue growth forecasts are lower than that of an already struggling industry. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. However, we're still cautious about the company's ability to resist even greater pain to its business from the broader industry turmoil. For now though, it's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 11 warning signs for Diversified Energy (4 make us uncomfortable!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:DEC

Diversified Energy

An independent energy company, focuses on the production, transportation, and marketing of natural gas and liquids primarily in the Appalachian and Central regions of the United States.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.