- United Kingdom

- /

- Oil and Gas

- /

- AIM:ZPHR

What You Can Learn From Zephyr Energy plc's (LON:ZPHR) P/S After Its 26% Share Price Crash

Zephyr Energy plc (LON:ZPHR) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. The last month has meant the stock is now only up 6.3% during the last year.

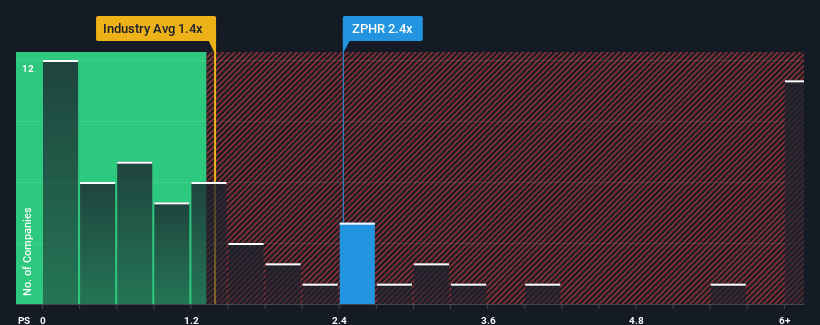

In spite of the heavy fall in price, you could still be forgiven for thinking Zephyr Energy is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.4x, considering almost half the companies in the United Kingdom's Oil and Gas industry have P/S ratios below 1.4x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Zephyr Energy

How Has Zephyr Energy Performed Recently?

Zephyr Energy has been doing a reasonable job lately as its revenue hasn't declined as much as most other companies. It seems that many are expecting the comparatively superior revenue performance to persist, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price, especially if revenue continues to dissolve.

Want the full picture on analyst estimates for the company? Then our free report on Zephyr Energy will help you uncover what's on the horizon.How Is Zephyr Energy's Revenue Growth Trending?

In order to justify its P/S ratio, Zephyr Energy would need to produce impressive growth in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 10%. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue growth will be highly resilient over the next year growing by 56%. Meanwhile, the broader industry is forecast to contract by 2.2%, which would indicate the company is doing very well.

In light of this, it's understandable that Zephyr Energy's P/S sits above the majority of other companies. Right now, investors are willing to pay more for a stock that is shaping up to buck the trend of the broader industry going backwards.

The Final Word

Zephyr Energy's P/S remain high even after its stock plunged. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Zephyr Energy's analyst forecasts revealed that its superior revenue outlook against a shaky industry is contributing to its high P/S. Outperforming the industry in this manner looks to have provided investors with a bit of confidence that the future will be bright, bolstering the P/S. We still remain cautious about the company's ability to keep swimming against the current of the broader industry turmoil. Otherwise, it's hard to see the share price falling strongly in the near future under the current growth expectations.

It is also worth noting that we have found 6 warning signs for Zephyr Energy (1 is a bit concerning!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Zephyr Energy, explore our interactive list of high quality stocks to get an idea of what else is out there.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zephyr Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:ZPHR

Zephyr Energy

Engages in the exploration and production of oil and gas resources in the United States.

High growth potential and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion