- United Kingdom

- /

- Oil and Gas

- /

- AIM:ZPHR

Institutional investors have a lot riding on Zephyr Energy plc (LON:ZPHR) with 54% ownership

Key Insights

- Institutions' substantial holdings in Zephyr Energy implies that they have significant influence over the company's share price

- A total of 7 investors have a majority stake in the company with 51% ownership

- Ownership research, combined with past performance data can help provide a good understanding of opportunities in a stock

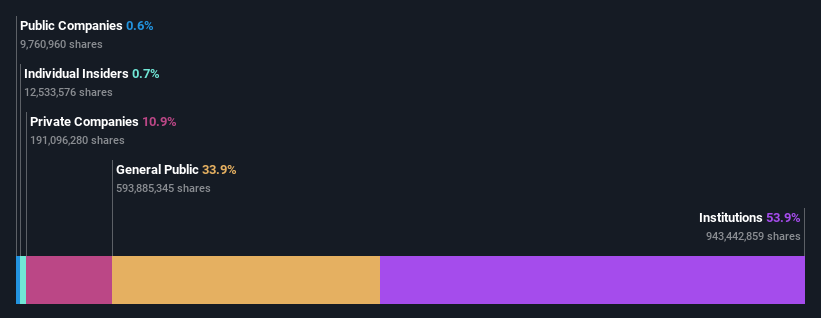

To get a sense of who is truly in control of Zephyr Energy plc (LON:ZPHR), it is important to understand the ownership structure of the business. The group holding the most number of shares in the company, around 54% to be precise, is institutions. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

Last week’s 13% gain means that institutional investors were on the positive end of the spectrum even as the company has shown strong longer-term trends. The gains from last week would have further boosted the one-year return to shareholders which currently stand at 64%.

Let's delve deeper into each type of owner of Zephyr Energy, beginning with the chart below.

View our latest analysis for Zephyr Energy

What Does The Institutional Ownership Tell Us About Zephyr Energy?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

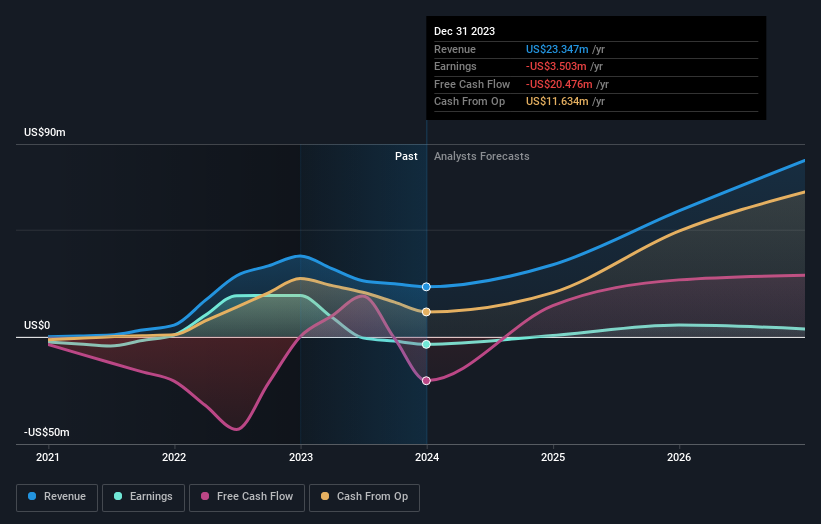

Zephyr Energy already has institutions on the share registry. Indeed, they own a respectable stake in the company. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Zephyr Energy's earnings history below. Of course, the future is what really matters.

Since institutional investors own more than half the issued stock, the board will likely have to pay attention to their preferences. Hedge funds don't have many shares in Zephyr Energy. The company's largest shareholder is Jarvis Securities plc, Asset Management Arm, with ownership of 15%. In comparison, the second and third largest shareholders hold about 11% and 9.1% of the stock.

We did some more digging and found that 7 of the top shareholders account for roughly 51% of the register, implying that along with larger shareholders, there are a few smaller shareholders, thereby balancing out each others interests somewhat.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. There is some analyst coverage of the stock, but it could still become more well known, with time.

Insider Ownership Of Zephyr Energy

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our data suggests that insiders own under 1% of Zephyr Energy plc in their own names. However, it's possible that insiders might have an indirect interest through a more complex structure. It has a market capitalization of just UK£95m, and the board has only UK£677k worth of shares in their own names. We generally like to see a board more invested. However it might be worth checking if those insiders have been buying.

General Public Ownership

The general public-- including retail investors -- own 34% stake in the company, and hence can't easily be ignored. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Private Company Ownership

It seems that Private Companies own 11%, of the Zephyr Energy stock. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 2 warning signs we've spotted with Zephyr Energy .

But ultimately it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Valuation is complex, but we're here to simplify it.

Discover if Zephyr Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ZPHR

Zephyr Energy

Engages in the exploration and production of oil and gas resources in the United States.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives