- United Kingdom

- /

- Oil and Gas

- /

- AIM:WEN

Wentworth Resources' (LON:WEN) Dividend Will Be Increased To UK£0.0052

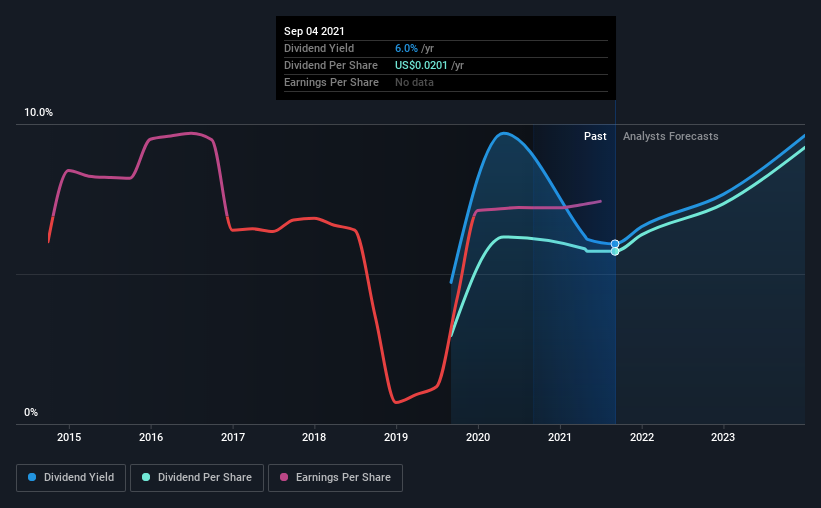

Wentworth Resources plc (LON:WEN) has announced that it will be increasing its dividend on the 8th of October to UK£0.0052. This makes the dividend yield 6.3%, which is above the industry average.

View our latest analysis for Wentworth Resources

Wentworth Resources Doesn't Earn Enough To Cover Its Payments

A big dividend yield for a few years doesn't mean much if it can't be sustained. Based on the last payment, Wentworth Resources was quite comfortably earning enough to cover the dividend. This means that a large portion of its earnings are being retained to grow the business.

EPS is set to fall by 53.4% over the next 12 months. If the dividend continues along recent trends, we estimate the payout ratio could reach 101%, which could put the dividend in jeopardy if the company's earnings don't improve.

Wentworth Resources Is Still Building Its Track Record

Looking back, the dividend has been stable, but the company hasn't been paying a dividend for very long so we can't be confident that the dividend will remain stable through all economic environments. Since 2019, the dividend has gone from US$0.01 to US$0.02. This means that it has been growing its distributions at 40% per annum over that time. It is always nice to see strong dividend growth, but with such a short payment history we wouldn't be inclined to rely on it until a longer track record can be developed.

The Dividend Has Limited Growth Potential

The company's investors will be pleased to have been receiving dividend income for some time. Let's not jump to conclusions as things might not be as good as they appear on the surface. Over the past five years, it looks as though Wentworth Resources' EPS has declined at around 29% a year. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future.

Our Thoughts On Wentworth Resources' Dividend

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Taking the debate a bit further, we've identified 2 warning signs for Wentworth Resources that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you decide to trade Wentworth Resources, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Wentworth Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:WEN

Wentworth Resources

Wentworth Resources plc engages in the exploration, development, and production of natural gas and other hydrocarbons.

Flawless balance sheet and overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026