- United Kingdom

- /

- Oil and Gas

- /

- AIM:UJO

Union Jack Oil plc (LON:UJO) May Have Run Too Fast Too Soon With Recent 26% Price Plummet

The Union Jack Oil plc (LON:UJO) share price has fared very poorly over the last month, falling by a substantial 26%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 44% in that time.

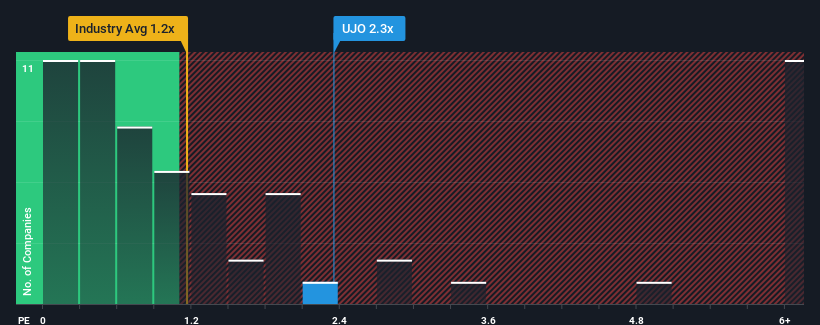

Even after such a large drop in price, when almost half of the companies in the United Kingdom's Oil and Gas industry have price-to-sales ratios (or "P/S") below 1.2x, you may still consider Union Jack Oil as a stock probably not worth researching with its 2.3x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Union Jack Oil

How Has Union Jack Oil Performed Recently?

Recent times have been advantageous for Union Jack Oil as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Union Jack Oil.Is There Enough Revenue Growth Forecasted For Union Jack Oil?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Union Jack Oil's to be considered reasonable.

Retrospectively, the last year delivered an explosive gain to the company's top line. Spectacularly, three year revenue growth has also set the world alight, thanks to the last 12 months of incredible growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should bring plunging returns, with revenue decreasing 18% as estimated by the dual analysts watching the company. The industry is also set to see revenue decline 3.3% but the stock is shaping up to perform materially worse.

In light of this, it's odd that Union Jack Oil's P/S sits above the majority of other companies. With revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. There's strong potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

The Final Word

Union Jack Oil's P/S remain high even after its stock plunged. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Union Jack Oil currently trades on a much higher than expected P/S since its revenue forecast is even worse than the struggling industry. When we see a weak revenue outlook, we suspect the share price is at risk of declining, sending the high P/S lower. In addition, we would be concerned whether the company's revenue prospects could slide further under these tough industry conditions. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It is also worth noting that we have found 2 warning signs for Union Jack Oil that you need to take into consideration.

If you're unsure about the strength of Union Jack Oil's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:UJO

Union Jack Oil

Operates as an onshore oil and gas company in the United Kingdom and the United States.

High growth potential and good value.

Market Insights

Community Narratives