- United Kingdom

- /

- Energy Services

- /

- AIM:TGP

Slammed 26% Tekmar Group plc (LON:TGP) Screens Well Here But There Might Be A Catch

Tekmar Group plc (LON:TGP) shares have had a horrible month, losing 26% after a relatively good period beforehand. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 52% loss during that time.

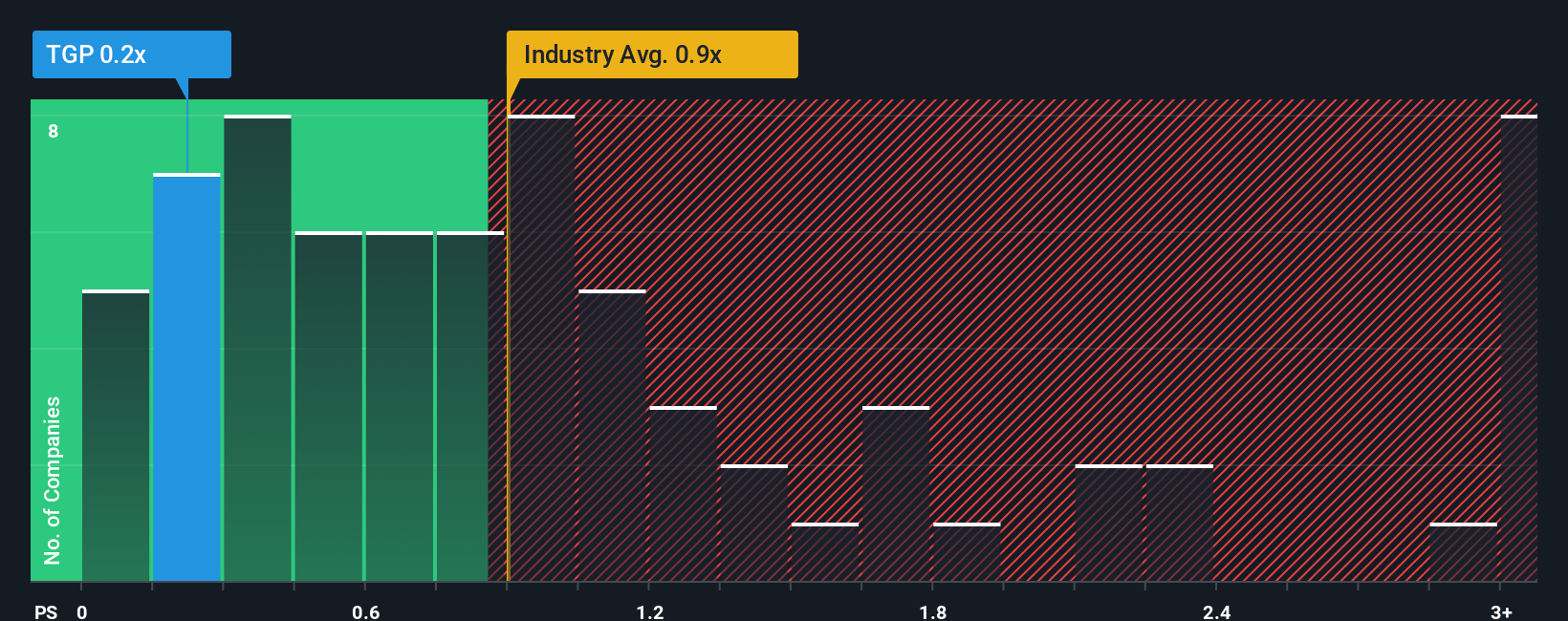

Since its price has dipped substantially, it would be understandable if you think Tekmar Group is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.2x, considering almost half the companies in the United Kingdom's Energy Services industry have P/S ratios above 0.8x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Tekmar Group

What Does Tekmar Group's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Tekmar Group's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Tekmar Group.Is There Any Revenue Growth Forecasted For Tekmar Group?

The only time you'd be truly comfortable seeing a P/S as low as Tekmar Group's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 19% decrease to the company's top line. As a result, revenue from three years ago have also fallen 5.1% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 18% over the next year. That's shaping up to be materially higher than the 2.9% growth forecast for the broader industry.

In light of this, it's peculiar that Tekmar Group's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Tekmar Group's P/S

Tekmar Group's P/S has taken a dip along with its share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Tekmar Group's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

You always need to take note of risks, for example - Tekmar Group has 1 warning sign we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Tekmar Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:TGP

Tekmar Group

Designs, manufactures, and supplies subsea stability and protection technology to offshore energy markets.

Undervalued with high growth potential.

Market Insights

Community Narratives