- United Kingdom

- /

- Energy Services

- /

- AIM:POS

It's Probably Less Likely That Plexus Holdings plc's (LON:POS) CEO Will See A Huge Pay Rise This Year

In the past three years, the share price of Plexus Holdings plc (LON:POS) has struggled to grow and now shareholders are sitting on a loss. Despite positive EPS growth in the past few years, the share price hasn't tracked the fundamental performance of the company. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 20 December 2021. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. Here's our take on why we think shareholders may want to be cautious of approving a raise for the CEO at the moment.

See our latest analysis for Plexus Holdings

Comparing Plexus Holdings plc's CEO Compensation With the industry

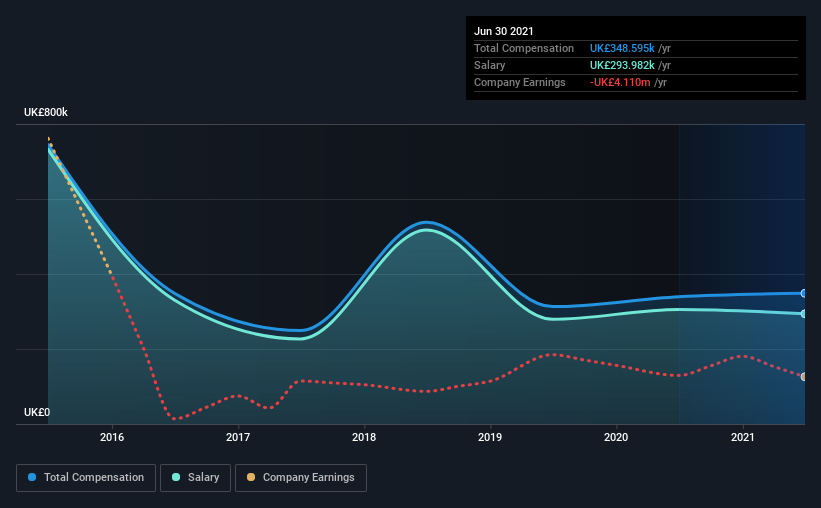

At the time of writing, our data shows that Plexus Holdings plc has a market capitalization of UK£8.0m, and reported total annual CEO compensation of UK£349k for the year to June 2021. That's mostly flat as compared to the prior year's compensation. In particular, the salary of UK£294.0k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the industry with market capitalizations below UK£151m, reported a median total CEO compensation of UK£318k. From this we gather that Ben van Bilderbeek is paid around the median for CEOs in the industry.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | UK£294k | UK£305k | 84% |

| Other | UK£55k | UK£34k | 16% |

| Total Compensation | UK£349k | UK£339k | 100% |

On an industry level, roughly 56% of total compensation represents salary and 44% is other remuneration. According to our research, Plexus Holdings has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Plexus Holdings plc's Growth Numbers

Over the past three years, Plexus Holdings plc has seen its earnings per share (EPS) grow by 4.6% per year. Its revenue is up 284% over the last year.

It's hard to interpret the strong revenue growth as anything other than a positive. With that in mind, the modestly improving EPS seems positive. We wouldn't say this is necessarily top notch growth, but it is certainly promising. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Plexus Holdings plc Been A Good Investment?

The return of -83% over three years would not have pleased Plexus Holdings plc shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Despite the growth in its earnings, the share price decline in the past three years is certainly concerning. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. If there are some unknown variables that are influencing the stock's price, surely shareholders would have some concerns. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 4 warning signs for Plexus Holdings that you should be aware of before investing.

Switching gears from Plexus Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:POS

Plexus Holdings

Provides equipment and services for the oil and gas drilling industry in the United Kingdom, the United States, and internationally.

Good value with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion