- United Kingdom

- /

- Machinery

- /

- AIM:HARL

Reflecting on InfraStrata's (LON:INFA) Share Price Returns Over The Last Five Years

While not a mind-blowing move, it is good to see that the InfraStrata plc (LON:INFA) share price has gained 27% in the last three months. But spare a thought for the long term holders, who have held the stock as it bled value over the last five years. Indeed, the share price is down a whopping 72% in that time. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The million dollar question is whether the company can justify a long term recovery.

Check out our latest analysis for InfraStrata

With just UK£1,482,081 worth of revenue in twelve months, we don't think the market considers InfraStrata to have proven its business plan. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. It seems likely some shareholders believe that InfraStrata will discover or develop fossil fuel before too long.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Some InfraStrata investors have already had a taste of the bitterness stocks like this can leave in the mouth.

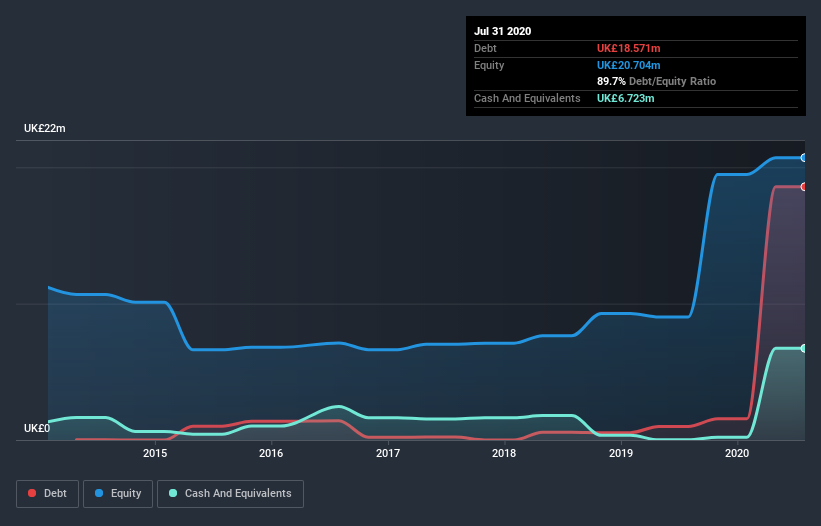

Our data indicates that InfraStrata had UK£18m more in total liabilities than it had cash, when it last reported in July 2020. That makes it extremely high risk, in our view. But with the share price diving 12% per year, over 5 years , it's probably fair to say that some shareholders no longer believe the company will succeed. The image below shows how InfraStrata's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

Of course, the truth is that it is hard to value companies without much revenue or profit. Would it bother you if insiders were selling the stock? It would bother me, that's for sure. It only takes a moment for you to check whether we have identified any insider sales recently.

A Different Perspective

It's good to see that InfraStrata has rewarded shareholders with a total shareholder return of 42% in the last twelve months. That certainly beats the loss of about 12% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 5 warning signs for InfraStrata (3 make us uncomfortable!) that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you’re looking to trade InfraStrata, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Harland & Wolff Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:HARL

Harland & Wolff Group Holdings

A multisite fabrication company, provides offshore and maritime engineering services in the United Kingdom.

Good value slight.

Market Insights

Community Narratives