Stock Analysis

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that IGas Energy plc (LON:IGAS) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for IGas Energy

What Is IGas Energy's Debt?

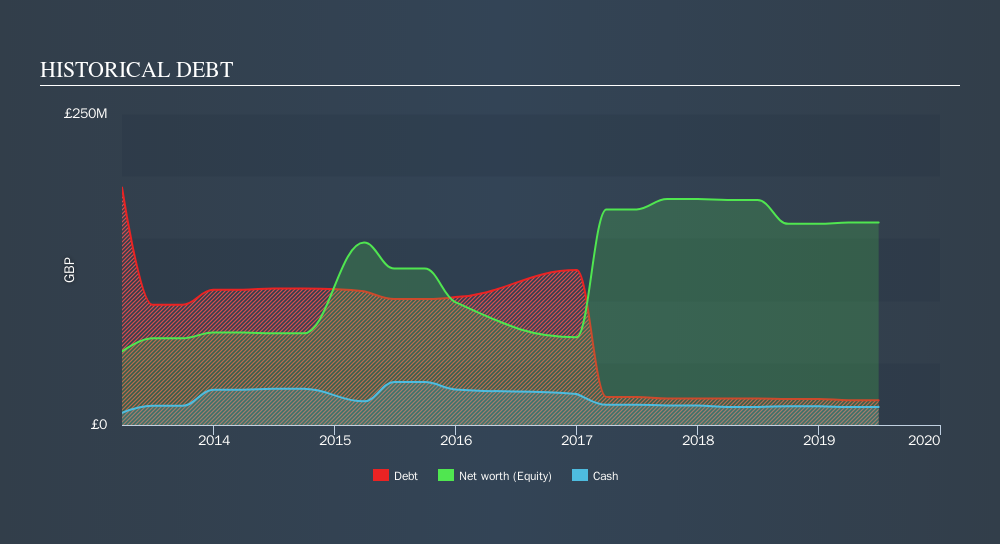

The image below, which you can click on for greater detail, shows that IGas Energy had debt of UK£19.9m at the end of June 2019, a reduction from UK£21.3m over a year. However, because it has a cash reserve of UK£14.4m, its net debt is less, at about UK£5.50m.

How Strong Is IGas Energy's Balance Sheet?

The latest balance sheet data shows that IGas Energy had liabilities of UK£11.4m due within a year, and liabilities of UK£72.8m falling due after that. On the other hand, it had cash of UK£14.4m and UK£6.64m worth of receivables due within a year. So it has liabilities totalling UK£63.2m more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of UK£64.7m, so it does suggest shareholders should keep an eye on IGas Energy's use of debt. This suggests shareholders would heavily diluted if the company needed to shore up its balance sheet in a hurry. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine IGas Energy's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year IGas Energy wasn't profitable at an EBIT level, but managed to grow its revenue by7.2%, to UK£43m. We usually like to see faster growth from unprofitable companies, but each to their own.

Caveat Emptor

Over the last twelve months IGas Energy produced an earnings before interest and tax (EBIT) loss. Its EBIT loss was a whopping UK£21m. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. We would feel better if it turned its trailing twelve month loss of UK£19m into a profit. So in short it's a really risky stock. When we look at a riskier company, we like to check how their profits (or losses) are trending over time. Today, we're providing readers this interactive graph showing how IGas Energy's profit, revenue, and operating cashflow have changed over the last few years.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About AIM:STAR

Star Energy Group

Operates as an oil and gas exploration, development, processing, and production company in the United Kingdom.

Adequate balance sheet and fair value.