- United Kingdom

- /

- Oil and Gas

- /

- AIM:HE1

We Think Helium One Global (LON:HE1) Can Afford To Drive Business Growth

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

Given this risk, we thought we'd take a look at whether Helium One Global (LON:HE1) shareholders should be worried about its cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

Check out our latest analysis for Helium One Global

How Long Is Helium One Global's Cash Runway?

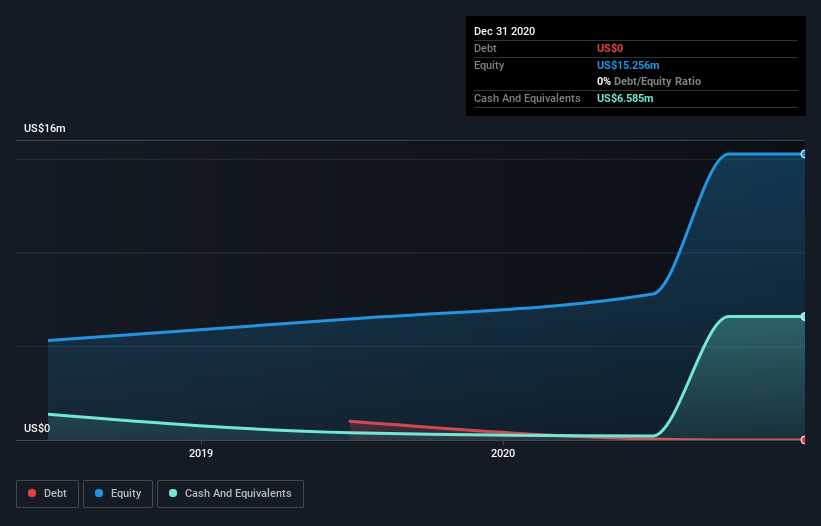

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. In December 2020, Helium One Global had US$6.6m in cash, and was debt-free. In the last year, its cash burn was US$2.7m. So it had a cash runway of about 2.5 years from December 2020. That's decent, giving the company a couple years to develop its business. Depicted below, you can see how its cash holdings have changed over time.

How Is Helium One Global's Cash Burn Changing Over Time?

Because Helium One Global isn't currently generating revenue, we consider it an early-stage business. Nonetheless, we can still examine its cash burn trajectory as part of our assessment of its cash burn situation. With the cash burn rate up 47% in the last year, it seems that the company is ratcheting up investment in the business over time. However, the company's true cash runway will therefore be shorter than suggested above, if spending continues to increase. Admittedly, we're a bit cautious of Helium One Global due to its lack of significant operating revenues. So we'd generally prefer stocks from this list of stocks that have analysts forecasting growth.

Can Helium One Global Raise More Cash Easily?

Given its cash burn trajectory, Helium One Global shareholders may wish to consider how easily it could raise more cash, despite its solid cash runway. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Helium One Global has a market capitalisation of US$226m and burnt through US$2.7m last year, which is 1.2% of the company's market value. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

So, Should We Worry About Helium One Global's Cash Burn?

It may already be apparent to you that we're relatively comfortable with the way Helium One Global is burning through its cash. In particular, we think its cash burn relative to its market cap stands out as evidence that the company is well on top of its spending. Although its increasing cash burn does give us reason for pause, the other metrics we discussed in this article form a positive picture overall. After taking into account the various metrics mentioned in this report, we're pretty comfortable with how the company is spending its cash, as it seems on track to meet its needs over the medium term. Taking a deeper dive, we've spotted 2 warning signs for Helium One Global you should be aware of, and 1 of them is concerning.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

When trading Helium One Global or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Helium One Global might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:HE1

Helium One Global

Engages in the exploration and production of helium gas.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives