- United Kingdom

- /

- Oil and Gas

- /

- AIM:EOG

Why Investors Shouldn't Be Surprised By Europa Oil & Gas (Holdings) plc's (LON:EOG) 40% Share Price Surge

Europa Oil & Gas (Holdings) plc (LON:EOG) shares have had a really impressive month, gaining 40% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 40% in the last twelve months.

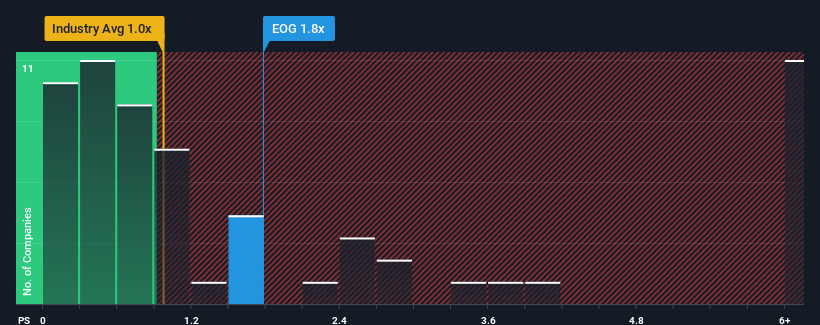

After such a large jump in price, when almost half of the companies in the United Kingdom's Oil and Gas industry have price-to-sales ratios (or "P/S") below 1x, you may consider Europa Oil & Gas (Holdings) as a stock probably not worth researching with its 1.8x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Europa Oil & Gas (Holdings)

What Does Europa Oil & Gas (Holdings)'s P/S Mean For Shareholders?

Recent times have been quite advantageous for Europa Oil & Gas (Holdings) as its revenue has been rising very briskly. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Europa Oil & Gas (Holdings) will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Europa Oil & Gas (Holdings)'s is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company grew revenue by an impressive 165% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to shrink 10% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

With this in mind, it's clear to us why Europa Oil & Gas (Holdings)'s P/S exceeds that of its industry peers. Investors are willing to pay more for a stock they hope will buck the trend of the broader industry going backwards. However, its current revenue trajectory will be very difficult to maintain against the headwinds other companies are facing at the moment.

The Final Word

Europa Oil & Gas (Holdings) shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As detailed previously, the strength of Europa Oil & Gas (Holdings)'s recent revenue trends over the medium-term relative to a declining industry is part of the reason why it trades at a higher P/S than its industry counterparts. It could be said that investors feel this revenue growth will continue into the future, justifying a higher P/S ratio. We still remain cautious about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. Although, if the company's relative performance doesn't change it will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Europa Oil & Gas (Holdings) you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Europa Oil & Gas (Holdings) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:EOG

Europa Oil & Gas (Holdings)

Engages in the exploration, appraisal, development, and production of oil and gas properties in the United Kingdom, Equatorial Guinea, and Ireland.

Slight with mediocre balance sheet.

Market Insights

Community Narratives