- United Kingdom

- /

- Oil and Gas

- /

- AIM:ENW

If You Had Bought Enwell Energy (LON:ENW) Shares Five Years Ago You'd Have Earned 758% Returns

We think all investors should try to buy and hold high quality multi-year winners. And highest quality companies can see their share prices grow by huge amounts. Don't believe it? Then look at the Enwell Energy plc (LON:ENW) share price. It's 758% higher than it was five years ago. And this is just one example of the epic gains achieved by some long term investors. On top of that, the share price is up 73% in about a quarter.

Anyone who held for that rewarding ride would probably be keen to talk about it.

Check out our latest analysis for Enwell Energy

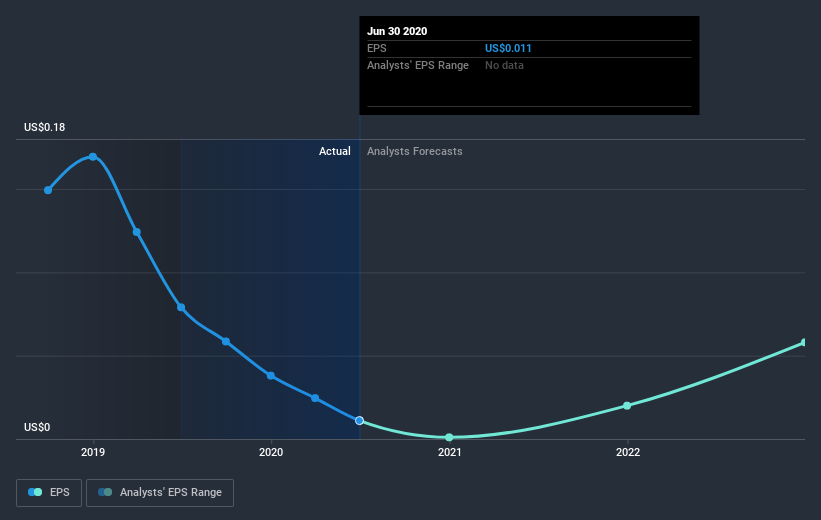

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last half decade, Enwell Energy became profitable. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into Enwell Energy's key metrics by checking this interactive graph of Enwell Energy's earnings, revenue and cash flow.

A Different Perspective

It's nice to see that Enwell Energy shareholders have received a total shareholder return of 6.7% over the last year. Having said that, the five-year TSR of 54% a year, is even better. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. It's always interesting to track share price performance over the longer term. But to understand Enwell Energy better, we need to consider many other factors. Even so, be aware that Enwell Energy is showing 3 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you decide to trade Enwell Energy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Enwell Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:ENW

Enwell Energy

Engages in the exploration, development, and production of oil and gas properties in Ukraine.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success