- United Kingdom

- /

- Oil and Gas

- /

- AIM:BOR

UK Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 index experiencing a downturn due to weak trade data from China, impacting companies heavily tied to its economy. Despite these broader market fluctuations, certain investment opportunities remain attractive. Penny stocks, though often associated with smaller or newer companies and an outdated term, can still offer significant potential when backed by strong financials. In this context, we will explore several penny stocks that might present promising opportunities for investors seeking under-the-radar companies with long-term potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.56 | £520.84M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.40 | £193.89M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.935 | £14.12M | ✅ 2 ⚠️ 3 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.075 | £14.79M | ✅ 4 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £2.52 | £31.98M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.56 | $325.54M | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.55 | £261.41M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.12 | £178.75M | ✅ 4 ⚠️ 2 View Analysis > |

| Braemar (LSE:BMS) | £2.35 | £71.6M | ✅ 3 ⚠️ 3 View Analysis > |

| ME Group International (LSE:MEGP) | £1.884 | £711.63M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 294 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Borders & Southern Petroleum (AIM:BOR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Borders & Southern Petroleum plc is an independent oil and gas exploration company operating in the Falkland Islands with a market cap of £99.31 million.

Operations: Borders & Southern Petroleum plc currently does not report any revenue segments.

Market Cap: £99.31M

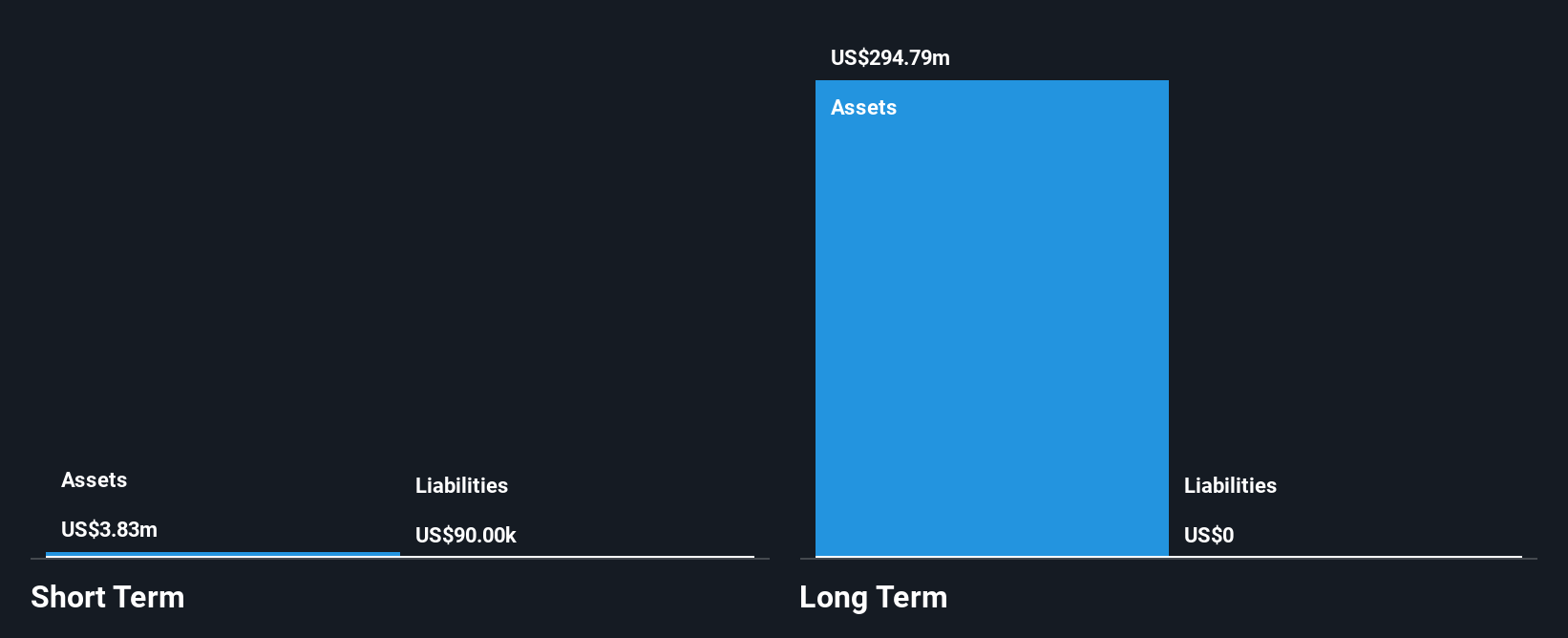

Borders & Southern Petroleum plc, with a market cap of £99.31 million, is pre-revenue and operates without any significant revenue streams. The company reported a net loss of US$0.441 million for the half year ended June 30, 2025, showing slight improvement from the previous year's loss of US$0.578 million. It maintains a debt-free balance sheet and has short-term assets covering its liabilities comfortably at $3.8 million against $90,000 in liabilities. Despite having no long-term liabilities and an experienced board with an average tenure of 4.9 years, the stock remains highly volatile with no profitability expected in the near future.

- Click here to discover the nuances of Borders & Southern Petroleum with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Borders & Southern Petroleum's future.

Warpaint London (AIM:W7L)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Warpaint London PLC, with a market cap of £193.89 million, produces and sells cosmetics through its subsidiaries.

Operations: The company generates revenue through two main segments: Close-Out, contributing £2.15 million, and Own Brand, which accounts for £102.66 million.

Market Cap: £193.89M

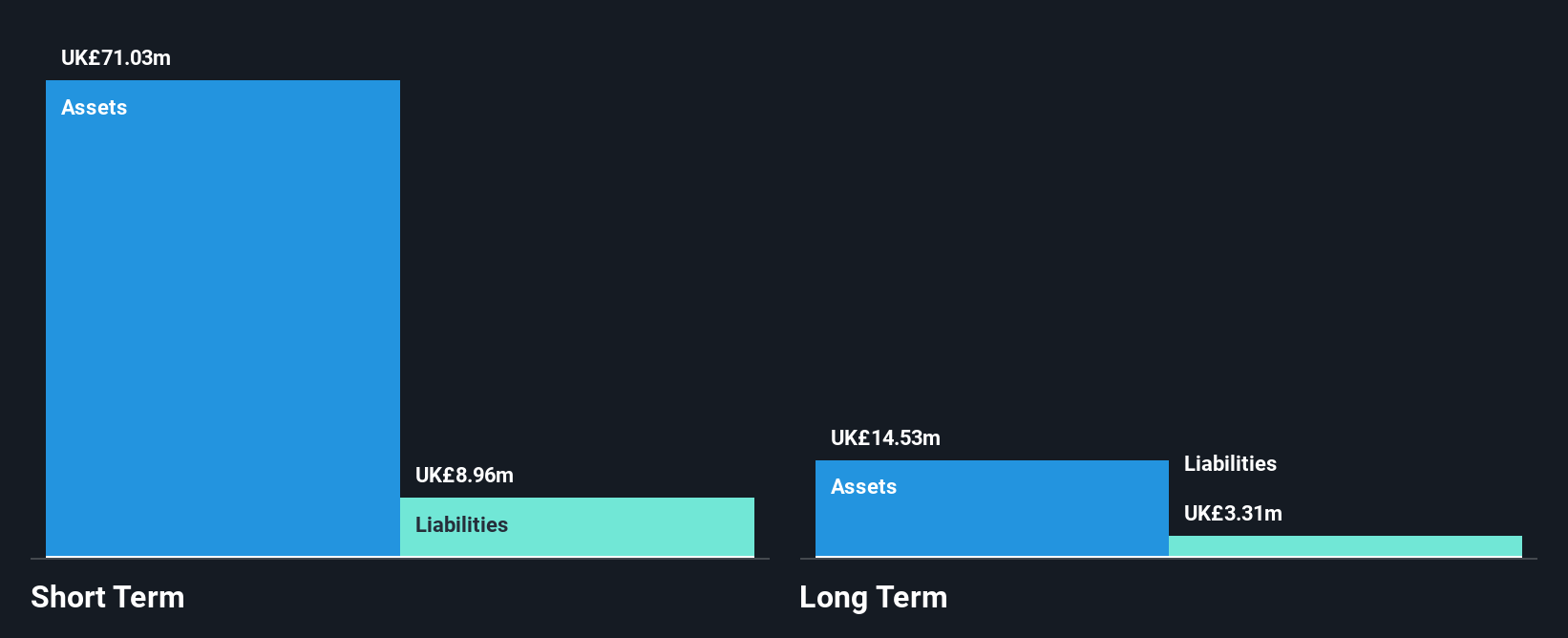

Warpaint London PLC, with a market cap of £193.89 million, stands out for its debt-free balance sheet and seasoned management team. The company reported half-year sales of £49.3 million, an increase from the previous year, though net income declined to £5.43 million from £8.02 million. Despite this dip in profit margins and volatile share price over recent months, Warpaint trades at a good value relative to peers and is 31% below estimated fair value. Analysts forecast earnings growth of 6.74% annually with strong asset coverage for both short-term (£76.7M) and long-term liabilities (£10M).

- Jump into the full analysis health report here for a deeper understanding of Warpaint London.

- Evaluate Warpaint London's prospects by accessing our earnings growth report.

Stelrad Group (LSE:SRAD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Stelrad Group PLC manufactures and distributes radiators across the United Kingdom, Ireland, Europe, Turkey, and internationally, with a market cap of £216.50 million.

Operations: The company's revenue of £283.94 million is derived from its operations in the manufacture and distribution of radiators.

Market Cap: £216.5M

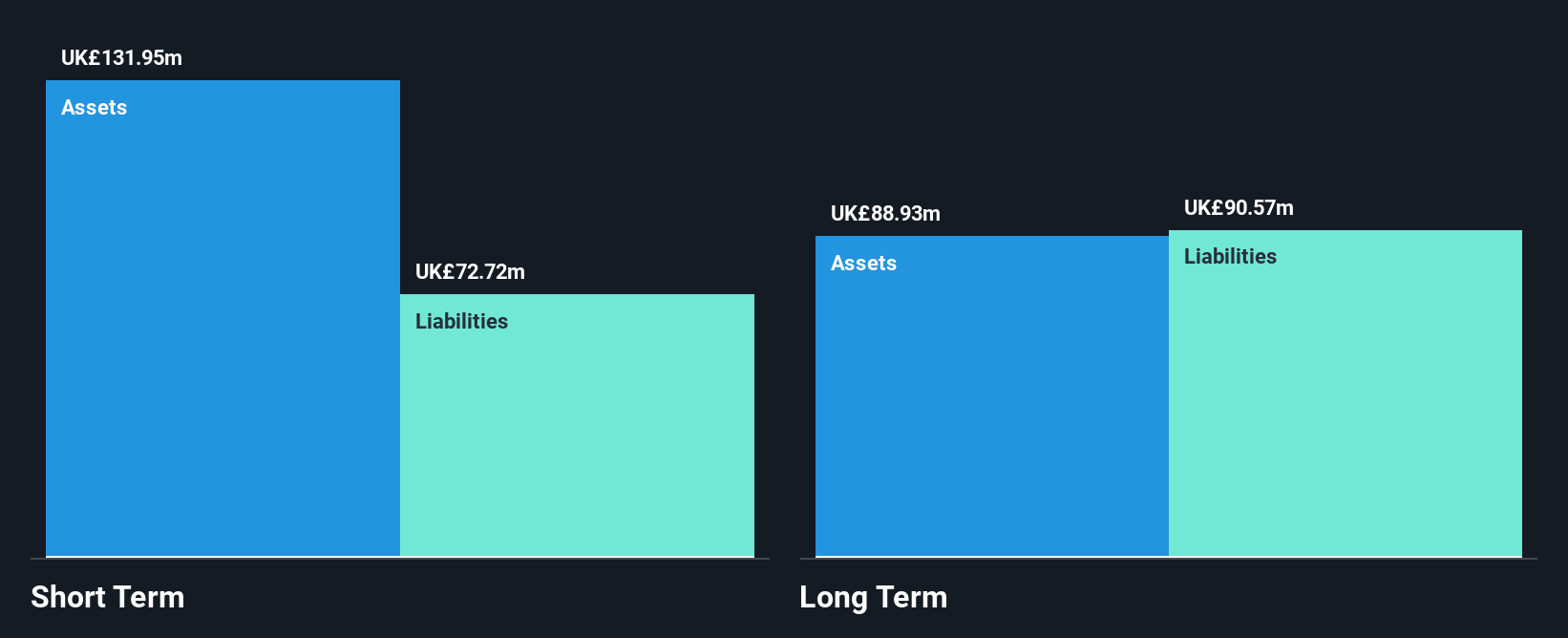

Stelrad Group PLC, with a market cap of £216.50 million, faces challenges as it reported a net loss of £3.45 million for the first half of 2025 despite generating sales of £136.48 million. The company's financial health shows strengths and weaknesses; short-term assets cover both short-term (£71.7M) and long-term liabilities (£94.3M), yet its high net debt to equity ratio (125.3%) is concerning despite improvements from previous levels. A significant one-off loss impacted recent earnings, affecting profit margins now at 1.8%, down from last year's 5.3%. Stelrad's shares trade below estimated fair value by 32%.

- Navigate through the intricacies of Stelrad Group with our comprehensive balance sheet health report here.

- Gain insights into Stelrad Group's outlook and expected performance with our report on the company's earnings estimates.

Seize The Opportunity

- Click through to start exploring the rest of the 291 UK Penny Stocks now.

- Seeking Other Investments? Uncover 16 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Borders & Southern Petroleum might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BOR

Borders & Southern Petroleum

Operates as an independent oil and gas exploration company in the Falkland Islands.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives