- United Kingdom

- /

- Diversified Financial

- /

- LSE:EWG

Analysts Have Just Cut Their W.A.G payment solutions plc (LON:WPS) Revenue Estimates By 44%

One thing we could say about the analysts on W.A.G payment solutions plc (LON:WPS) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative.

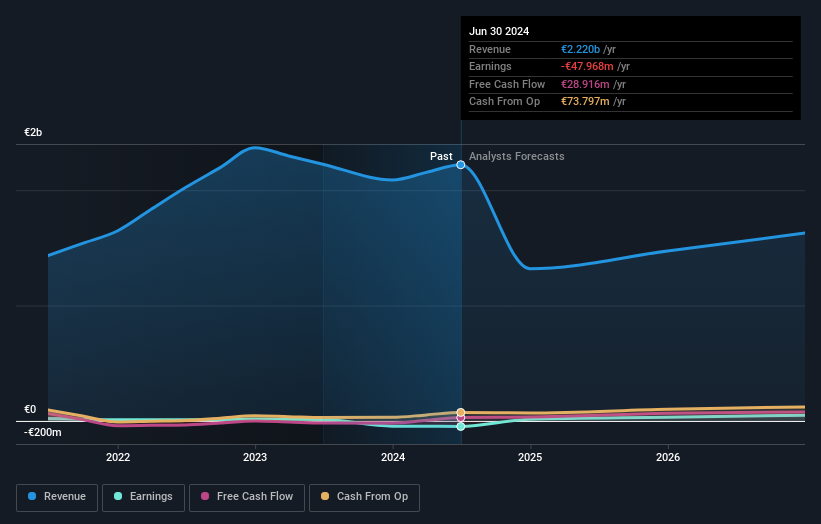

Following the latest downgrade, the seven analysts covering W.A.G payment solutions provided consensus estimates of €1.3b revenue in 2024, which would reflect a sizeable 41% decline on its sales over the past 12 months. Before the latest update, the analysts were foreseeing €2.3b of revenue in 2024. It looks like forecasts have become a fair bit less optimistic on W.A.G payment solutions, given the sizeable cut to revenue estimates.

Check out our latest analysis for W.A.G payment solutions

There was no particular change to the consensus price target of €1.43, with W.A.G payment solutions' latest outlook seemingly not enough to result in a change of valuation. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. There are some variant perceptions on W.A.G payment solutions, with the most bullish analyst valuing it at €1.62 and the most bearish at €1.01 per share. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 65% by the end of 2024. This indicates a significant reduction from annual growth of 12% over the last three years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue decline 15% annually for the foreseeable future. The forecasts do look bearish for W.A.G payment solutions, since they're expecting it to shrink faster than the industry.

The Bottom Line

The clear low-light was that analysts slashing their revenue forecasts for W.A.G payment solutions this year. Analysts also expect revenues to shrink faster than the wider market. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on W.A.G payment solutions after today.

Want to learn more? At least one of W.A.G payment solutions' seven analysts has provided estimates out to 2026, which can be seen for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if W.A.G payment solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:EWG

W.A.G payment solutions

Operates integrated payments and mobility platform that focuses on the commercial road transportation industry in Europe.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.