- United Kingdom

- /

- Media

- /

- LSE:VOX

Market Cool On Vox Valor Capital Limited's (LON:VOX) Revenues Pushing Shares 29% Lower

Vox Valor Capital Limited (LON:VOX) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 38% in that time.

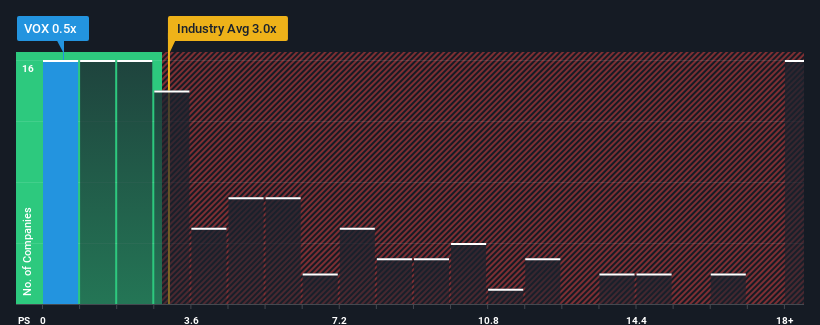

After such a large drop in price, Vox Valor Capital may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.5x, considering almost half of all companies in the Capital Markets industry in the United Kingdom have P/S ratios greater than 3.1x and even P/S higher than 10x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Vox Valor Capital

How Vox Valor Capital Has Been Performing

Recent times have been quite advantageous for Vox Valor Capital as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Vox Valor Capital's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Vox Valor Capital?

The only time you'd be truly comfortable seeing a P/S as depressed as Vox Valor Capital's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. In spite of this unbelievable short-term growth, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Comparing that to the industry, which is predicted to deliver 1.2% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this information, we find it odd that Vox Valor Capital is trading at a P/S lower than the industry. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Bottom Line On Vox Valor Capital's P/S

Having almost fallen off a cliff, Vox Valor Capital's share price has pulled its P/S way down as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

The fact that Vox Valor Capital currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

It is also worth noting that we have found 4 warning signs for Vox Valor Capital (2 are a bit unpleasant!) that you need to take into consideration.

If you're unsure about the strength of Vox Valor Capital's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:VOX

Low and slightly overvalued.

Market Insights

Community Narratives