- United Kingdom

- /

- Luxury

- /

- LSE:DOCS

UK Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As the FTSE 100 and FTSE 250 indices face downward pressure from weak trade data out of China, investors in the United Kingdom are closely monitoring global economic cues that have impacted commodity prices and corporate earnings. In this environment, identifying stocks that may be trading below their estimated value can offer potential opportunities for investors seeking to navigate market volatility while focusing on long-term fundamentals.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| AstraZeneca (LSE:AZN) | £100.22 | £191.51 | 47.7% |

| Dr. Martens (LSE:DOCS) | £0.5945 | £1.13 | 47.3% |

| Aptitude Software Group (LSE:APTD) | £2.96 | £5.15 | 42.6% |

| Gooch & Housego (AIM:GHH) | £4.71 | £8.99 | 47.6% |

| Victorian Plumbing Group (AIM:VIC) | £0.808 | £1.41 | 42.5% |

| Informa (LSE:INF) | £7.986 | £15.26 | 47.7% |

| Duke Capital (AIM:DUKE) | £0.285 | £0.54 | 47.3% |

| Huddled Group (AIM:HUD) | £0.0325 | £0.065 | 49.9% |

| Vistry Group (LSE:VTY) | £6.134 | £11.34 | 45.9% |

| Deliveroo (LSE:ROO) | £1.75 | £3.08 | 43.1% |

Let's dive into some prime choices out of the screener.

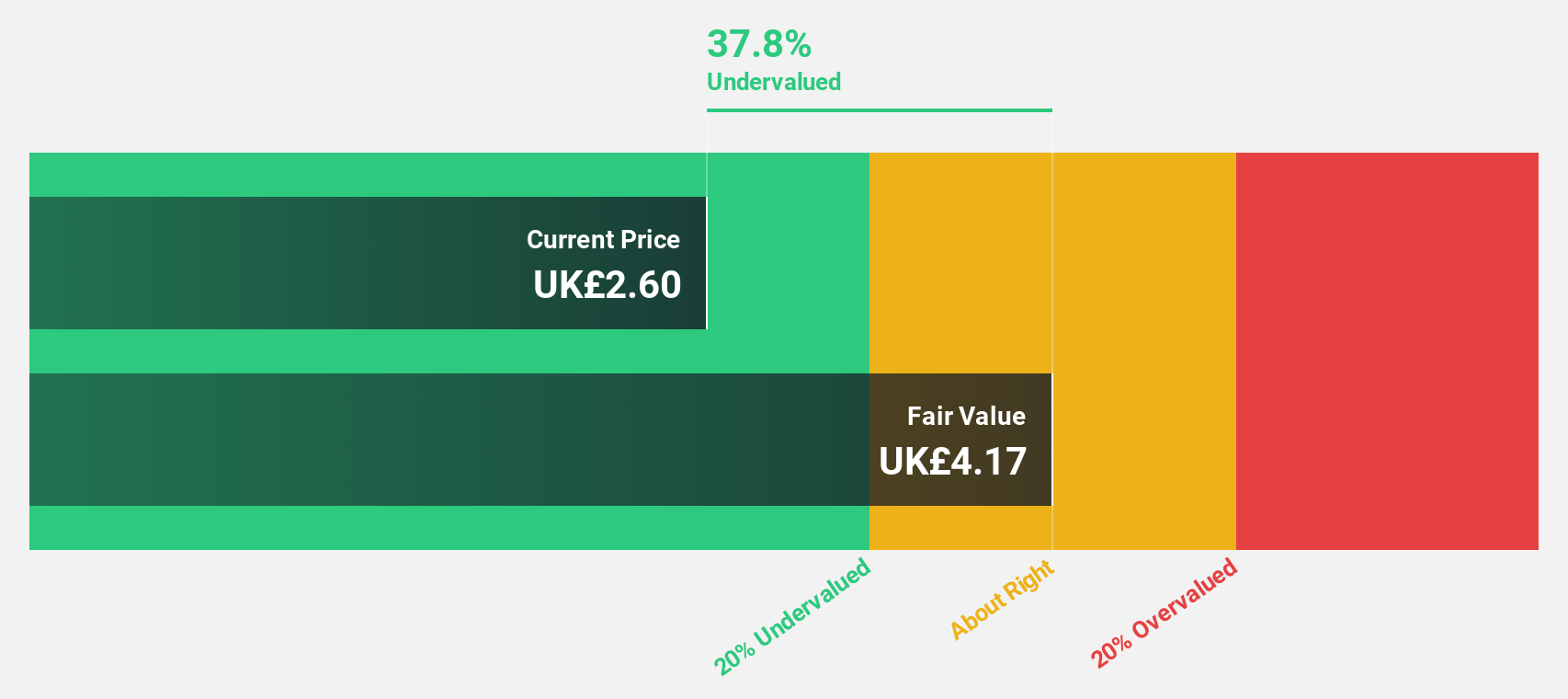

Restore (AIM:RST)

Overview: Restore plc, with a market cap of £338.20 million, offers services to offices and workplaces in both the public and private sectors primarily in the United Kingdom.

Operations: The company's revenue segments consist of Datashred (£36 million), Technology (£36.10 million), Harrow Green (£35.30 million), and Information Management (£167.90 million).

Estimated Discount To Fair Value: 38.8%

Restore is trading at £2.47, significantly below its estimated fair value of £4.04, suggesting it may be undervalued based on cash flows. The company recently reported a net income of £12.4 million for 2024, rebounding from a loss the previous year. Earnings are forecast to grow at 24.8% annually, outpacing the UK market's growth rate and indicating strong future potential despite an unstable dividend history and lower revenue growth expectations relative to earnings growth.

- The growth report we've compiled suggests that Restore's future prospects could be on the up.

- Dive into the specifics of Restore here with our thorough financial health report.

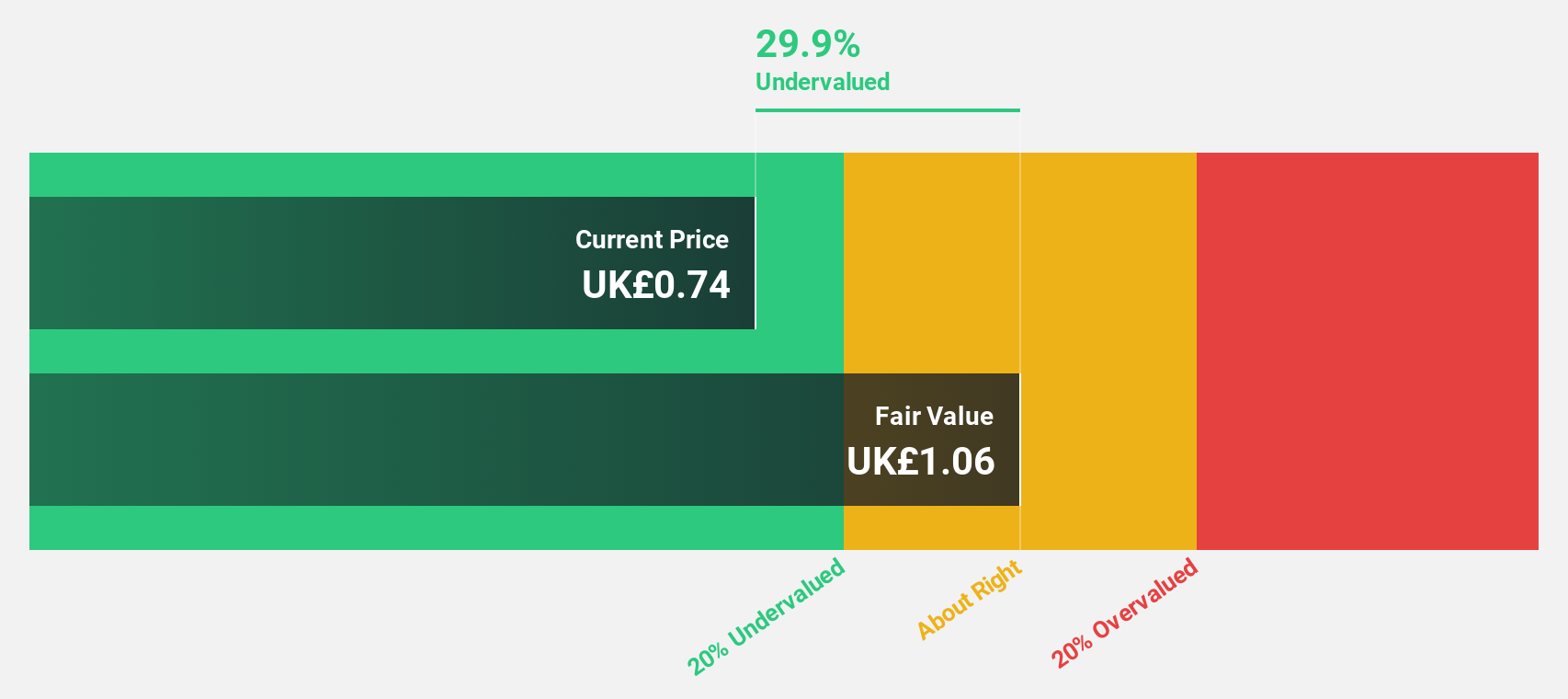

Dr. Martens (LSE:DOCS)

Overview: Dr. Martens plc designs, develops, procures, markets, sells, and distributes footwear under the Dr. Martens brand and has a market cap of approximately £573.81 million.

Operations: The company's revenue is primarily derived from its footwear segment, totaling £805.90 million.

Estimated Discount To Fair Value: 47.3%

Dr. Martens is trading at £0.59, below its estimated fair value of £1.13, highlighting potential undervaluation based on cash flows. Despite a lower profit margin this year compared to last, earnings are expected to grow significantly at 39.72% annually over the next three years, outpacing the UK market's growth rate of 14.1%. However, interest payments are not well covered by earnings and the dividend track record remains unstable.

- Our earnings growth report unveils the potential for significant increases in Dr. Martens' future results.

- Get an in-depth perspective on Dr. Martens' balance sheet by reading our health report here.

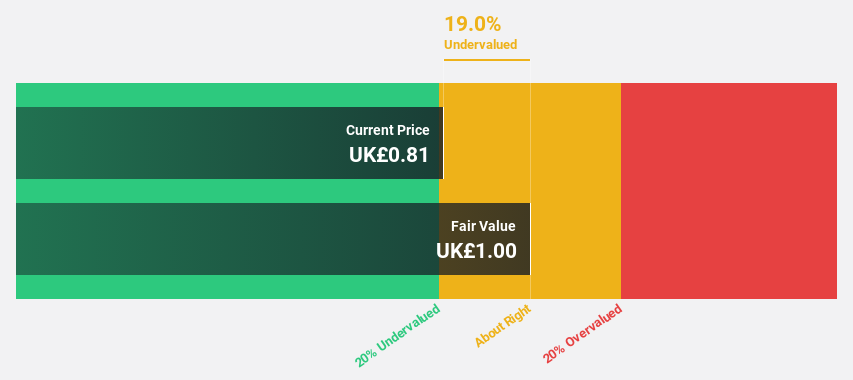

Vanquis Banking Group (LSE:VANQ)

Overview: Vanquis Banking Group plc provides personal credit products to the non-standard lending market in the United Kingdom and the Republic of Ireland, with a market cap of £192.11 million.

Operations: The company's revenue is generated from several segments, including Cards (£238.10 million), Loans (£6.30 million), Vehicle Finance (£34.20 million), and Second Charge Mortgages (£1.70 million).

Estimated Discount To Fair Value: 24.8%

Vanquis Banking Group is trading at £0.75, below its estimated fair value of £1, suggesting potential undervaluation based on cash flows. Despite a significant net loss of £119.3 million in 2024, revenue is forecast to grow at 16.1% annually, outpacing the UK market's growth rate of 3.9%. However, the company's debt coverage by operating cash flow is weak and no final dividend was recommended for the financial year ended December 2024.

- According our earnings growth report, there's an indication that Vanquis Banking Group might be ready to expand.

- Take a closer look at Vanquis Banking Group's balance sheet health here in our report.

Where To Now?

- Gain an insight into the universe of 48 Undervalued UK Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:DOCS

Dr. Martens

Engages in the design, development, procurement, marketing, sale, and distribution of footwear.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives