- United Kingdom

- /

- Aerospace & Defense

- /

- LSE:AVON

3 UK Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices closing lower amid weak trade data from China, highlighting ongoing global economic uncertainties. Despite these headwinds, discerning investors may find opportunities in undervalued stocks that have strong fundamentals and potential for growth.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sage Group (LSE:SGE) | £10.02 | £18.59 | 46.1% |

| Gaming Realms (AIM:GMR) | £0.40 | £0.77 | 48.3% |

| GlobalData (AIM:DATA) | £2.18 | £4.12 | 47.1% |

| Tracsis (AIM:TRCS) | £6.15 | £11.47 | 46.4% |

| AstraZeneca (LSE:AZN) | £126.28 | £239.91 | 47.4% |

| C&C Group (LSE:CCR) | £1.532 | £2.91 | 47.3% |

| Mercia Asset Management (AIM:MERC) | £0.345 | £0.68 | 49.3% |

| Tortilla Mexican Grill (AIM:MEX) | £0.52 | £1.01 | 48.4% |

| Deliveroo (LSE:ROO) | £1.409 | £2.67 | 47.3% |

| Nexxen International (AIM:NEXN) | £2.78 | £5.42 | 48.7% |

Let's review some notable picks from our screened stocks.

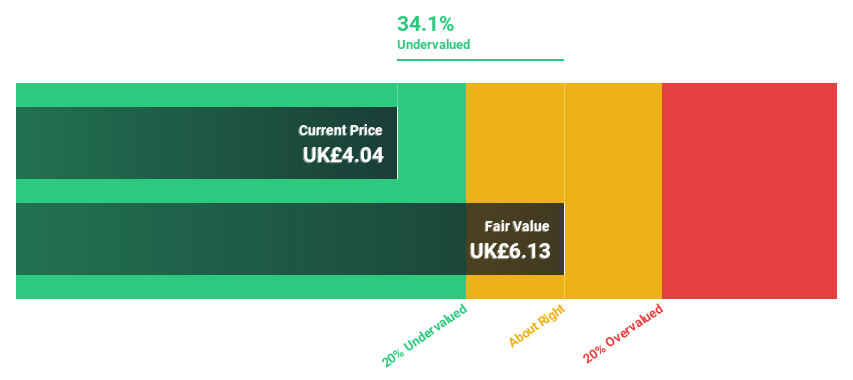

Avon Technologies (LSE:AVON)

Overview: Avon Technologies Plc specializes in respiratory and head protection solutions for military and first responder agencies across the UK, Europe, and the US, with a market cap of £374.36 million.

Operations: Avon Technologies generates revenue from its Team Wendy segment, amounting to $113.60 million, with an additional segment adjustment of $155.70 million.

Estimated Discount To Fair Value: 41.7%

Avon Technologies, trading at £12.48, is significantly undervalued compared to its estimated fair value of £21.42. Despite earnings currently not covering interest payments well and a forecasted low return on equity (10.2%) in three years, the company is expected to become profitable within the same period with above-average market growth. Recent strong financial performance and strategic contract wins, including a $19.5 million order from the U.S., bolster its cash flow prospects further into FY2026.

- Our growth report here indicates Avon Technologies may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Avon Technologies.

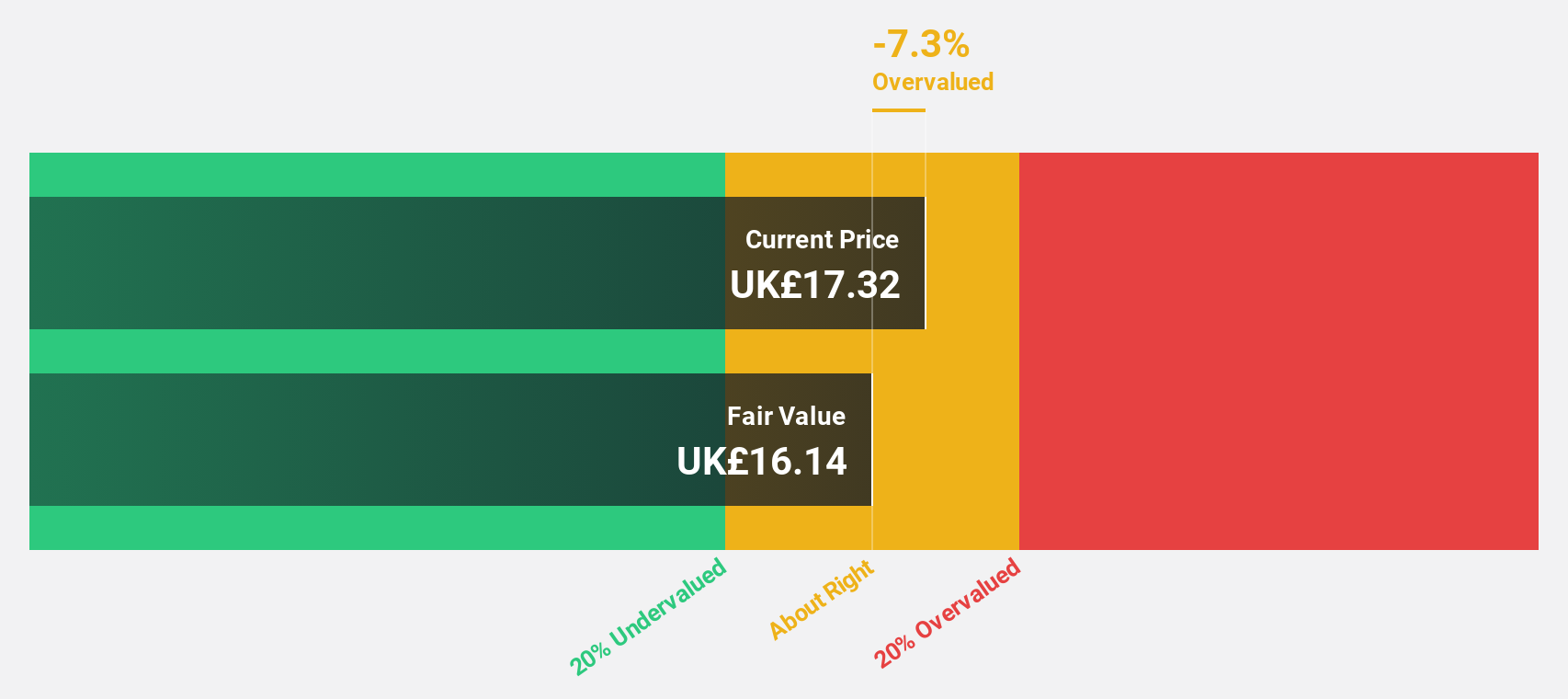

TP ICAP Group (LSE:TCAP)

Overview: TP ICAP Group PLC offers intermediary services, trade execution, pre-trade and settlement services, and data-led solutions across various regions including Europe, the Middle East, Africa, the Americas, and the Asia Pacific with a market cap of £1.75 billion.

Operations: The company's revenue segments are comprised of Global Broking (£1.24 billion), Energy & Commodities (£471 million), Liquidnet (£323 million), and Parameta Solutions (£195 million).

Estimated Discount To Fair Value: 45.8%

TP ICAP Group appears undervalued, trading at £2.31 against an estimated fair value of £4.26. Recent earnings for H1 2024 showed net income rising to £91 million from £66 million year-over-year, with basic EPS increasing to £0.12. The company is exploring a US IPO for its Parameta Solutions unit due to better liquidity prospects and sector expertise in the US market, while also initiating a £30 million share buyback program.

- In light of our recent growth report, it seems possible that TP ICAP Group's financial performance will exceed current levels.

- Get an in-depth perspective on TP ICAP Group's balance sheet by reading our health report here.

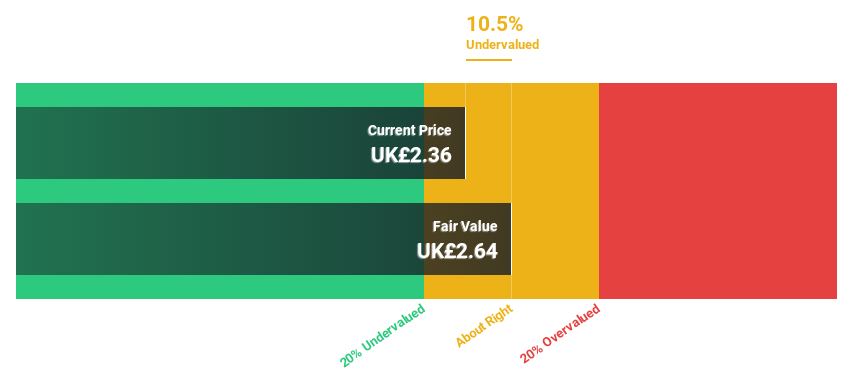

Zotefoams (LSE:ZTF)

Overview: Zotefoams plc, with a market cap of £238.18 million, manufactures, distributes, and sells polyolefin block foams in the UK, Europe, North America, and internationally.

Operations: The company's revenue segments include manufacturing, distributing, and selling polyolefin block foams across the UK, Europe, North America, and international markets.

Estimated Discount To Fair Value: 22.7%

Zotefoams is trading at £4.90, significantly below its estimated fair value of £6.34, indicating it may be undervalued based on cash flows. The company’s revenue growth forecast of 6.6% per year outpaces the UK market average of 3.6%, and earnings are expected to grow by 20% annually over the next three years. Despite recent insider selling and share price volatility, Zotefoams reported improved H1 2024 results with sales increasing to £71.06 million and net income rising to £6.28 million year-over-year.

- According our earnings growth report, there's an indication that Zotefoams might be ready to expand.

- Dive into the specifics of Zotefoams here with our thorough financial health report.

Key Takeaways

- Discover the full array of 53 Undervalued UK Stocks Based On Cash Flows right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AVON

Avon Technologies

Provides respiratory and head protection products for the military and first responder markets in Europe and the United States.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives