- United Kingdom

- /

- Capital Markets

- /

- LSE:SBSI

Schroder BSC Social Impact Trust's (LON:SBSI) Dividend Will Be Increased To £0.0294

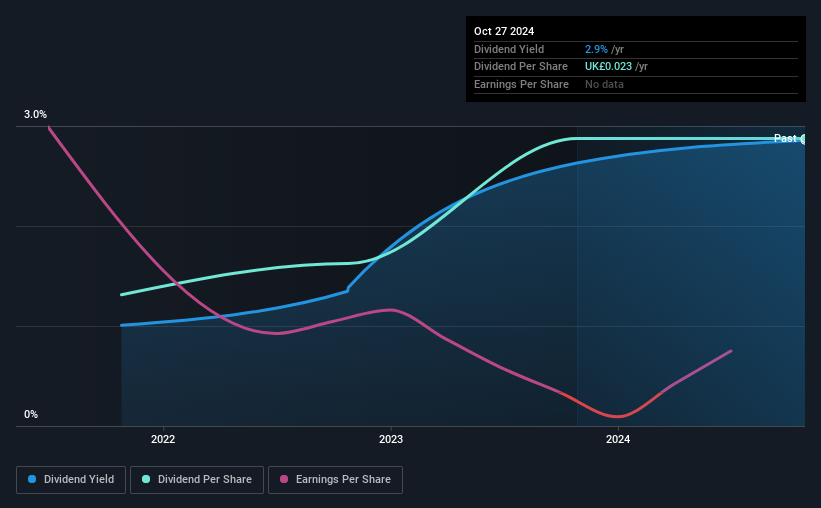

Schroder BSC Social Impact Trust plc's (LON:SBSI) periodic dividend will be increasing on the 20th of December to £0.0294, with investors receiving 28% more than last year's £0.023. The payment will take the dividend yield to 2.9%, which is in line with the average for the industry.

Check out our latest analysis for Schroder BSC Social Impact Trust

Schroder BSC Social Impact Trust's Projections Indicate Future Payments May Be Unsustainable

Estimates Indicate Schroder BSC Social Impact Trust's Could Struggle to Maintain Dividend Payments In The Future

Schroder BSC Social Impact Trust's Future Dividends May Potentially Be At Risk

Solid dividend yields are great, but they only really help us if the payment is sustainable. Despite not being profitable, Schroder BSC Social Impact Trust is paying out most of its free cash flow as a dividend. Generally paying a dividend without making profits isn't a great idea and we are also worried that there is limited reinvestment into the business.

EPS is set to fall by 30.7% over the next 12 months if recent trends continue. If the dividend continues along the path it has been on recently, the payout ratio in 12 months could be 427%, which is definitely a bit high to be sustainable going forward.

Schroder BSC Social Impact Trust Doesn't Have A Long Payment History

Looking back, the dividend has been stable, but the company hasn't been paying a dividend for very long so we can't be confident that the dividend will remain stable through all economic environments. Since 2021, the dividend has gone from £0.0105 total annually to £0.023. This implies that the company grew its distributions at a yearly rate of about 30% over that duration. The dividend has been growing rapidly, however with such a short payment history we can't know for sure if payment can continue to grow over the long term, so caution may be warranted.

The Dividend Has Limited Growth Potential

The company's investors will be pleased to have been receiving dividend income for some time. Let's not jump to conclusions as things might not be as good as they appear on the surface. Schroder BSC Social Impact Trust's EPS has fallen by approximately 31% per year during the past five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in.

The Dividend Could Prove To Be Unreliable

Overall, we always like to see the dividend being raised, but we don't think Schroder BSC Social Impact Trust will make a great income stock. The payments are bit high to be considered sustainable, and the track record isn't the best. We would be a touch cautious of relying on this stock primarily for the dividend income.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. For example, we've identified 3 warning signs for Schroder BSC Social Impact Trust (1 shouldn't be ignored!) that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:SBSI

Schroder BSC Social Impact Trust

Schroder BSC Social Impact Trust PLC is a principal investment firm.

Flawless balance sheet slight.

Market Insights

Community Narratives