- United Kingdom

- /

- Capital Markets

- /

- LSE:POLN

Exploring 3 Hidden UK Small Caps with Promising Potential

Reviewed by Simply Wall St

Amidst ongoing challenges in global trade and the impact of China's economic slowdown, the UK market has seen its major indices such as the FTSE 100 and FTSE 250 experience declines, highlighting vulnerabilities tied to international demand. In this environment, identifying promising small-cap stocks requires a focus on companies with strong fundamentals and resilience to external pressures, offering potential opportunities for investors seeking growth beyond traditional blue-chip holdings.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 38.21% | 41.39% | ★★★★★★ |

| BioPharma Credit | NA | 7.22% | 7.91% | ★★★★★★ |

| MS INTERNATIONAL | NA | 13.42% | 56.55% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -7.87% | -8.41% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.08% | 5.03% | ★★★★★★ |

| Nationwide Building Society | 277.32% | 10.61% | 23.42% | ★★★★★☆ |

| FW Thorpe | 2.95% | 11.79% | 13.49% | ★★★★★☆ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| AltynGold | 73.21% | 26.90% | 31.85% | ★★★★☆☆ |

| Law Debenture | 17.80% | 11.81% | 7.59% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Fonix (AIM:FNX)

Simply Wall St Value Rating: ★★★★★★

Overview: Fonix Plc operates in the United Kingdom, offering mobile payments and messaging services, along with managed services for sectors such as media, charity, gaming, and e-mobility; it has a market capitalization of £222.42 million.

Operations: Revenue primarily comes from facilitating mobile payments and messaging, amounting to £75.18 million.

Fonix, a nimble player in the UK market, has shown impressive financial health with no debt over the past five years and a robust earnings growth of 14.1% last year, outpacing its industry peers. The company boasts high-quality earnings and remains free cash flow positive, with recent figures indicating a levered free cash flow of A$9.48 million as of September 2024. Despite these strengths, future earnings are projected to dip slightly by an average of 0.2% annually over the next three years, while revenue is expected to grow at a healthy rate of 10.27% per year.

- Delve into the full analysis health report here for a deeper understanding of Fonix.

Understand Fonix's track record by examining our Past report.

ME Group International (LSE:MEGP)

Simply Wall St Value Rating: ★★★★★★

Overview: ME Group International plc operates, sells, and services a range of instant-service equipment in the United Kingdom with a market capitalization of £861.81 million.

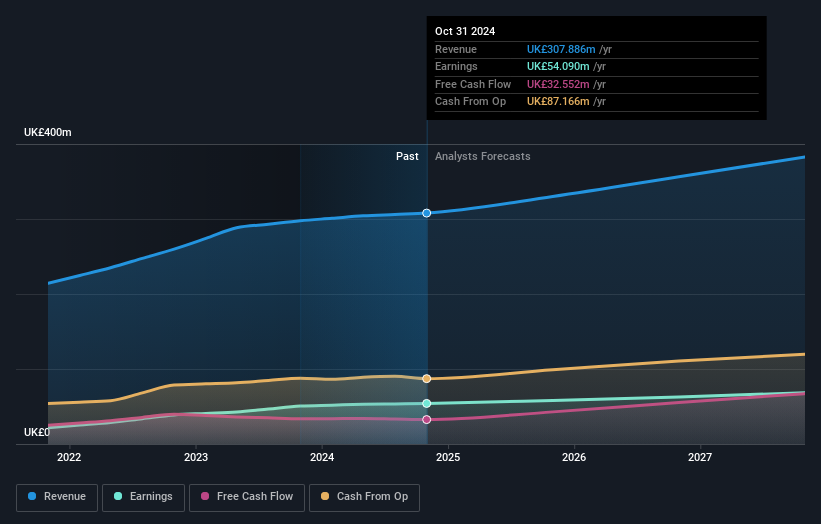

Operations: ME Group International generates revenue primarily from its personal services segment, amounting to £307.89 million.

ME Group International seems to be an intriguing prospect with its strategic expansion into laundry operations and the Kee.ME automated key cutting service. The company has managed to reduce its debt-to-equity ratio from 44.8% to 26.7% over five years, reflecting solid financial management. Trading at 51.5% below estimated fair value, it offers potential upside for investors, especially with earnings growth of 6.8% last year outpacing the industry average. However, challenges like currency fluctuations and reliance on new ventures could impact returns. With a projected PE ratio of 20x against an industry average of 16.4x, careful consideration is advised for potential investors evaluating this opportunity at £2.02 per share amidst ongoing strategic evaluations that might enhance shareholder value further.

Pollen Street Group (LSE:POLN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Pollen Street Group, founded in 2015 and headquartered in London, operates as an investment management company with a market capitalization of £469.47 million.

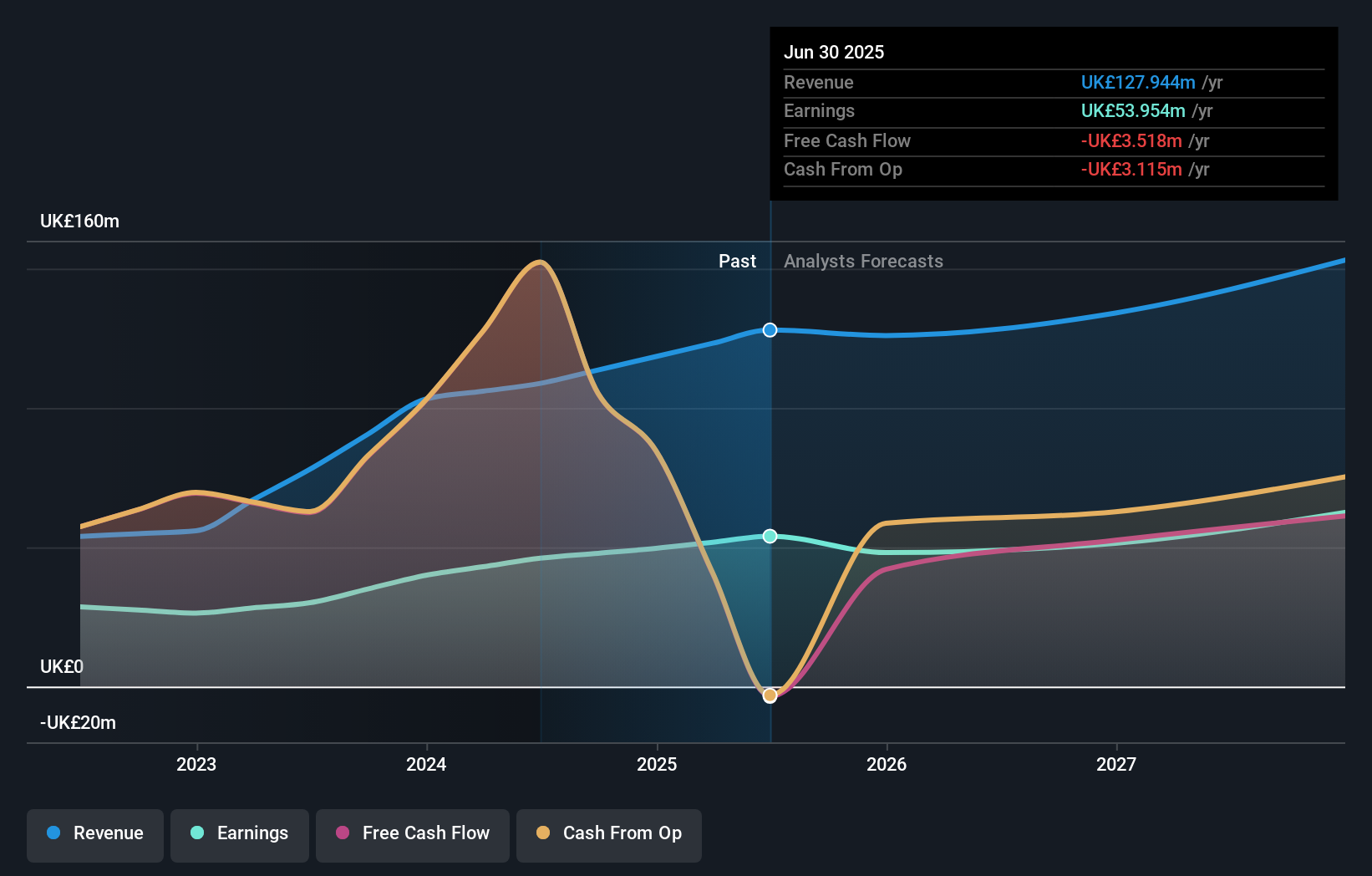

Operations: Pollen Street Group generates revenue primarily from its Asset Manager and Investment Company segments, with contributions of £66.80 million and £60.38 million, respectively. The Central segment recorded a negative figure of -£8.73 million, impacting overall financials.

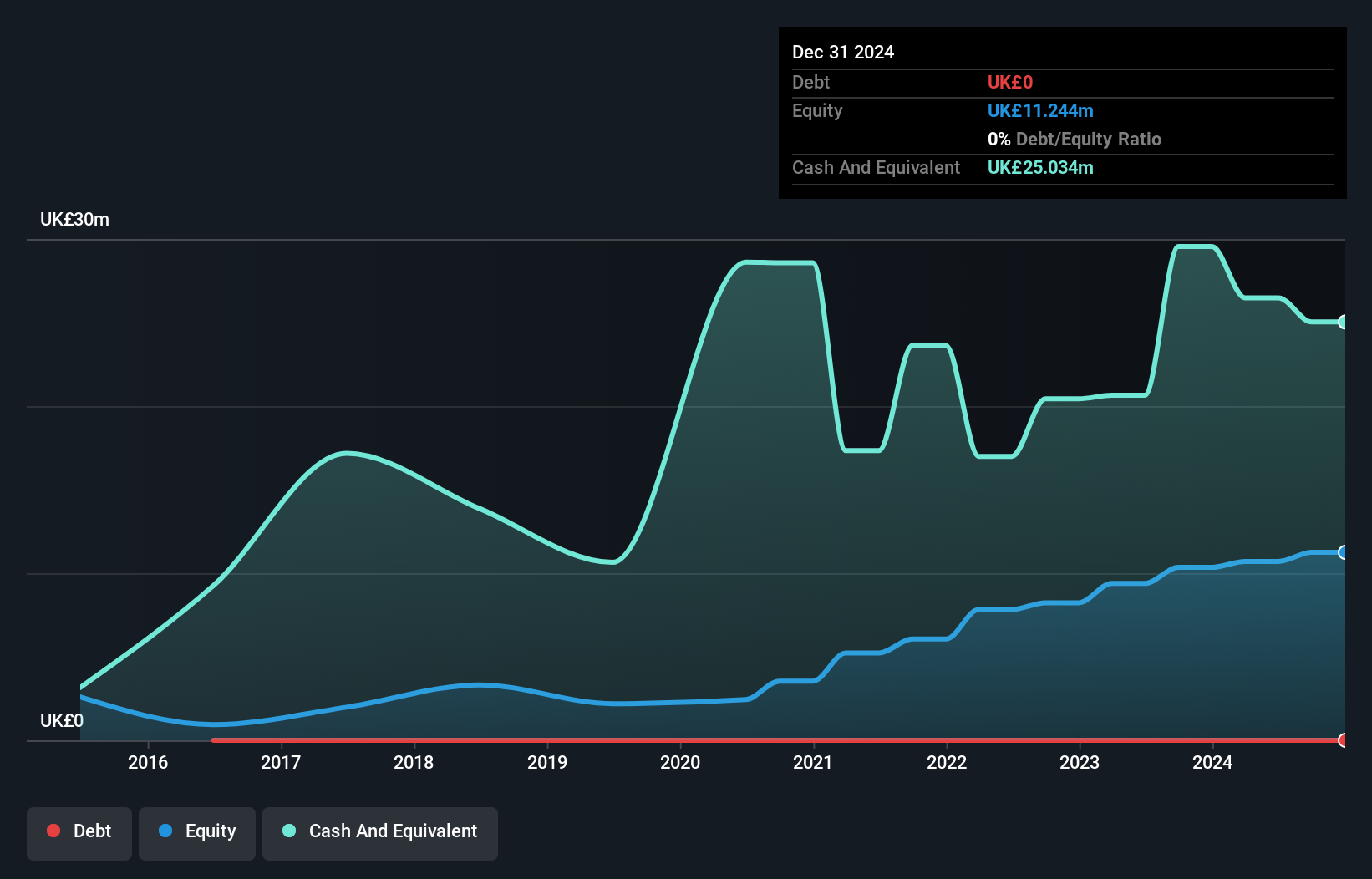

Pollen Street Group, a dynamic player in the financial sector, showcases promising potential with its earnings growth of 24% over the past year, outpacing the Capital Markets industry. Trading at a price-to-earnings ratio of 9.5x compared to the UK market's 16.4x indicates good value. The company has improved its net debt to equity ratio from 51.7% to 32.5% over five years, reflecting prudent financial management while maintaining high-quality earnings and robust EBIT coverage at 4.6x interest payments. Recent leadership changes and strategic moves like share buybacks worth £22.9 million highlight its focus on enhancing shareholder value amidst ongoing M&A discussions with KKR & Co Inc., potentially boosting future prospects despite market challenges.

Seize The Opportunity

- Unlock more gems! Our UK Undiscovered Gems With Strong Fundamentals screener has unearthed 54 more companies for you to explore.Click here to unveil our expertly curated list of 57 UK Undiscovered Gems With Strong Fundamentals.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:POLN

Pollen Street Group

Pollen Street PLC was founded in 2015 and is headquartered in London, Greater London, United Kingdom.

Adequate balance sheet and fair value.

Market Insights

Community Narratives