- United Kingdom

- /

- Capital Markets

- /

- LSE:N91

Is Now The Time To Put Ninety One Group (LON:N91) On Your Watchlist?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Ninety One Group (LON:N91). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Ninety One Group

Ninety One Group's Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So EPS growth can certainly encourage an investor to take note of a stock. It's good to see that Ninety One Group's EPS have grown from UK£0.17 to UK£0.20 over twelve months. That's a 18% gain; respectable growth in the broader scheme of things.

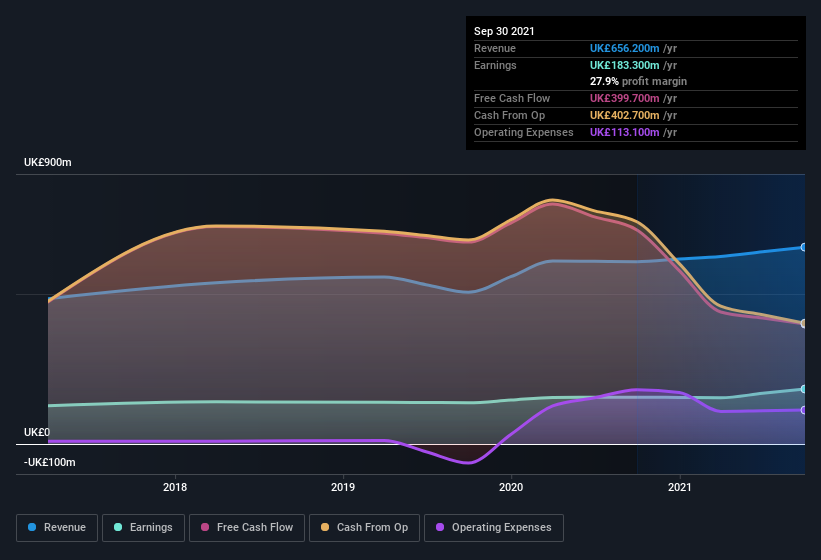

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Ninety One Group shareholders can take confidence from the fact that EBIT margins are up from 32% to 34%, and revenue is growing. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Ninety One Group's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Ninety One Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news for Ninety One Group shareholders is that no insiders reported selling shares in the last year. With that in mind, it's heartening that Victoria Cochrane, the Independent Non-Executive Director of the company, paid UK£25k for shares at around UK£2.61 each.

Does Ninety One Group Deserve A Spot On Your Watchlist?

One positive for Ninety One Group is that it is growing EPS. That's nice to see. While some companies are struggling to grow EPS, Ninety One Group seems free from that morose affliction. The cherry on top is that we have an insider buying shares. That encourages me further to keep an eye on this stock. It is worth noting though that we have found 2 warning signs for Ninety One Group (1 is concerning!) that you need to take into consideration.

As a growth investor I do like to see insider buying. But Ninety One Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Ninety One Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:N91

Ninety One Group

Operates as an independent global asset manager worldwide.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives