- United Kingdom

- /

- Hospitality

- /

- LSE:ENT

3 UK Stocks That May Be Trading Below Intrinsic Value By Up To 30.9%

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid concerns over weak trade data from China and its impact on global demand. In this environment, identifying stocks that may be trading below their intrinsic value can offer potential opportunities for investors seeking to navigate these uncertain conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Pinewood Technologies Group (LSE:PINE) | £3.595 | £7.14 | 49.6% |

| Norcros (LSE:NXR) | £2.95 | £5.26 | 43.9% |

| Nichols (AIM:NICL) | £10.00 | £18.53 | 46% |

| Motorpoint Group (LSE:MOTR) | £1.405 | £2.76 | 49% |

| Forterra (LSE:FORT) | £1.816 | £3.29 | 44.8% |

| Fintel (AIM:FNTL) | £2.08 | £3.79 | 45.2% |

| Essentra (LSE:ESNT) | £0.988 | £1.71 | 42.2% |

| Begbies Traynor Group (AIM:BEG) | £1.12 | £2.19 | 48.9% |

| Airtel Africa (LSE:AAF) | £3.142 | £5.81 | 45.9% |

| Advanced Medical Solutions Group (AIM:AMS) | £2.075 | £4.14 | 49.9% |

Here's a peek at a few of the choices from the screener.

Entain (LSE:ENT)

Overview: Entain Plc is a sports-betting and gaming company with operations in the United Kingdom, Ireland, Italy, the rest of Europe, Australia, New Zealand, and internationally; it has a market cap of £4.83 billion.

Operations: Entain's revenue is primarily derived from its International segment (£2.55 billion), followed by the UK & Ireland (£2.14 billion) and CEE (£500.90 million).

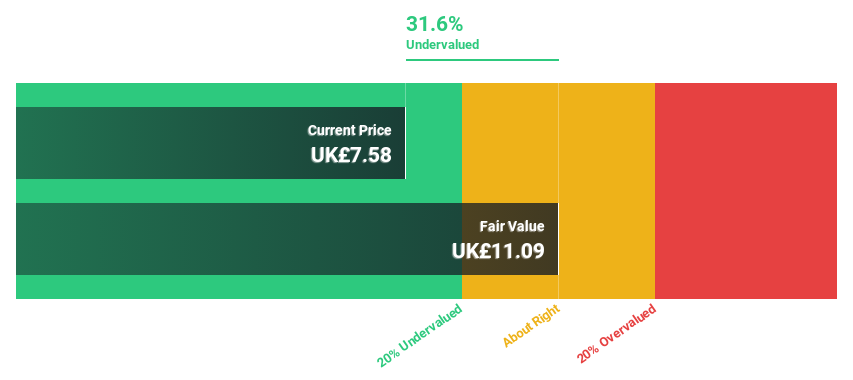

Estimated Discount To Fair Value: 30.9%

Entain is trading at £7.55, significantly below its estimated fair value of £10.93, presenting a strong case for being undervalued based on cash flows. Analysts agree the stock price could rise by 45.2%. Although Entain's revenue growth forecast of 4.5% annually is modest, it surpasses the UK market average of 4.3%. Recent debt refinancing efforts aim to optimize financial structure and reduce interest costs, potentially enhancing future cash flow stability and profitability prospects over three years.

- Our growth report here indicates Entain may be poised for an improving outlook.

- Take a closer look at Entain's balance sheet health here in our report.

M&G (LSE:MNG)

Overview: M&G plc operates in the savings and investment sector both in the United Kingdom and internationally, with a market cap of £6.54 billion.

Operations: The company's revenue is primarily derived from its Asset Management segment, which generated £1.07 billion, and its Life (Including Wealth) segment, contributing £7.57 billion.

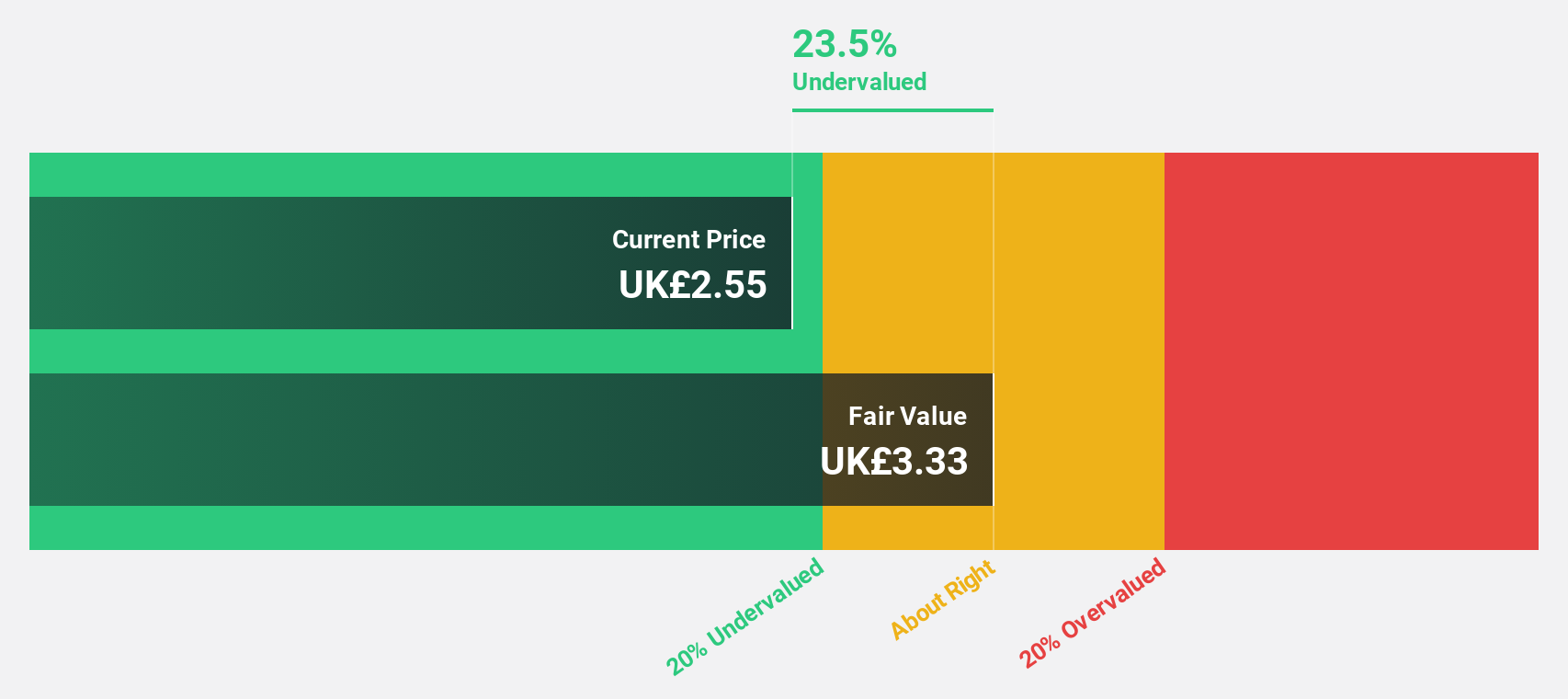

Estimated Discount To Fair Value: 25.1%

M&G is trading at £2.76, below its estimated fair value of £3.68, suggesting it may be undervalued based on cash flows. The company is expected to become profitable within three years with earnings growth forecasted at 33.98% annually, outpacing the market average. However, the dividend yield of 7.33% isn't well covered by earnings, posing a risk to sustainability despite high return on equity projections and recent strategic leadership appointments in UK institutional distribution.

- Our comprehensive growth report raises the possibility that M&G is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of M&G.

QinetiQ Group (LSE:QQ.)

Overview: QinetiQ Group plc delivers science and technology solutions for the defense, security, and infrastructure sectors across the UK, US, Australia, and globally with a market cap of £2.23 billion.

Operations: The company's revenue is divided into two main segments: EMEA Services, contributing £1.47 billion, and Global Solutions, accounting for £417 million.

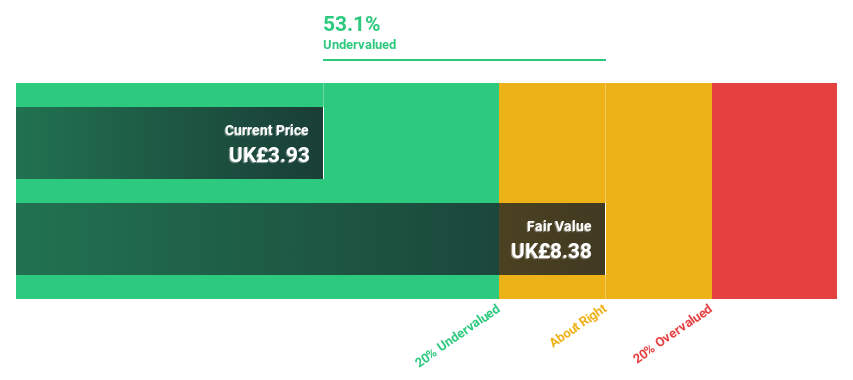

Estimated Discount To Fair Value: 24.2%

QinetiQ Group is trading at £4.18, below its estimated fair value of £5.51, highlighting potential undervaluation based on cash flows. Despite a decline in recent earnings and sales, the company is forecasted to achieve above-market profit growth over the next three years with a high future return on equity of 30.4%. Recent strategic board appointments may enhance business scaling efforts, although the current dividend yield isn't well covered by earnings, presenting sustainability concerns.

- Our earnings growth report unveils the potential for significant increases in QinetiQ Group's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of QinetiQ Group.

Where To Now?

- Delve into our full catalog of 51 Undervalued UK Stocks Based On Cash Flows here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Entain might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ENT

Entain

Operates as a sports-betting and gaming company in the United Kingdom, Ireland, Italy, rest of Europe, Australia, New Zealand, and internationally.

Very undervalued with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026