- United Kingdom

- /

- Electrical

- /

- LSE:DSCV

3 UK Stocks That May Be Trading Below Their Intrinsic Value By Up To 36%

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines influenced by weak trade data from China, highlighting concerns over global economic recovery. In such a fluctuating environment, identifying stocks that may be undervalued can offer investors potential opportunities to invest in companies trading below their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Aptitude Software Group (LSE:APTD) | £2.78 | £5.13 | 45.8% |

| Informa (LSE:INF) | £7.87 | £15.23 | 48.3% |

| Victrex (LSE:VCT) | £7.82 | £15.42 | 49.3% |

| SDI Group (AIM:SDI) | £0.72 | £1.37 | 47.4% |

| Duke Capital (AIM:DUKE) | £0.2875 | £0.53 | 45.4% |

| Franchise Brands (AIM:FRAN) | £1.44 | £2.50 | 42.4% |

| Huddled Group (AIM:HUD) | £0.0305 | £0.06 | 49.1% |

| Vistry Group (LSE:VTY) | £5.902 | £11.27 | 47.7% |

| Entain (LSE:ENT) | £7.316 | £13.66 | 46.4% |

| Burberry Group (LSE:BRBY) | £9.618 | £16.88 | 43% |

Let's explore several standout options from the results in the screener.

discoverIE Group (LSE:DSCV)

Overview: discoverIE Group plc designs, manufactures, and supplies components for electronic applications globally, with a market cap of approximately £579.22 million.

Operations: The company generates revenue through its Magnetics & Controls segment, which accounts for £256.50 million, and its Sensing & Connectivity segment, contributing £169.60 million.

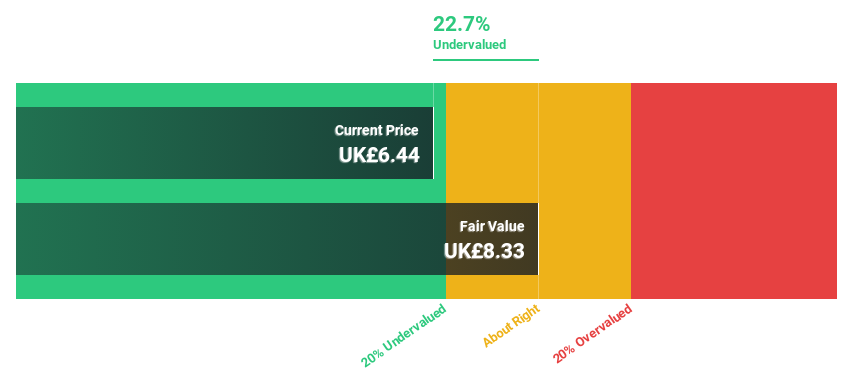

Estimated Discount To Fair Value: 23.5%

discoverIE Group is trading at £6.03, significantly below its estimated fair value of £7.88, indicating it may be undervalued based on cash flows. Despite a forecasted low return on equity of 10.9%, the company shows promising annual earnings growth of 20.08%, outpacing the UK market's 14.5%. Revenue growth is expected at 3.7% per year, slightly higher than the market average, highlighting potential for investors focused on cash flow valuation metrics.

- In light of our recent growth report, it seems possible that discoverIE Group's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of discoverIE Group stock in this financial health report.

Foresight Group Holdings (LSE:FSG)

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the UK, Italy, Luxembourg, Ireland, Spain, and Australia with a market cap of £421.42 million.

Operations: The company's revenue is primarily generated from its infrastructure segment (£87.79 million), private equity (£50.78 million), and Foresight Capital Management (£8.10 million).

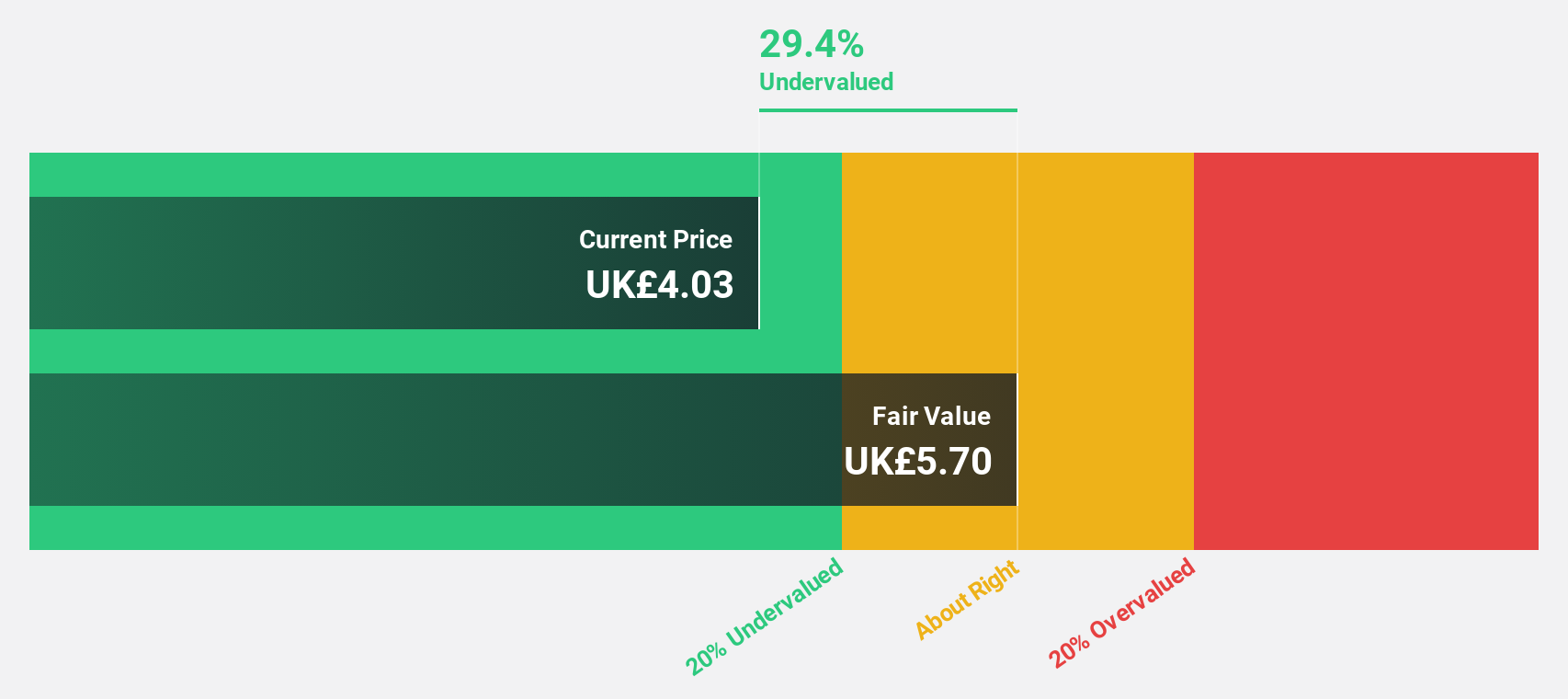

Estimated Discount To Fair Value: 36%

Foresight Group Holdings is currently trading at £3.74, well below its estimated fair value of £5.84, highlighting potential undervaluation based on cash flows. The company's earnings grew by 45.9% last year and are expected to grow significantly at 26.6% annually over the next three years, outpacing the UK market's growth rate of 14.5%. Additionally, a share buyback program worth up to £50 million may enhance shareholder value further.

- Insights from our recent growth report point to a promising forecast for Foresight Group Holdings' business outlook.

- Click to explore a detailed breakdown of our findings in Foresight Group Holdings' balance sheet health report.

Pinewood Technologies Group (LSE:PINE)

Overview: Pinewood Technologies Group PLC is a cloud-based dealer management software provider operating in the United Kingdom, Europe, Africa, Asia, and the Middle East with a market cap of £376.01 million.

Operations: Pinewood Technologies Group PLC generates revenue from its cloud-based dealer management software services across regions including the United Kingdom, Europe, Africa, Asia, and the Middle East.

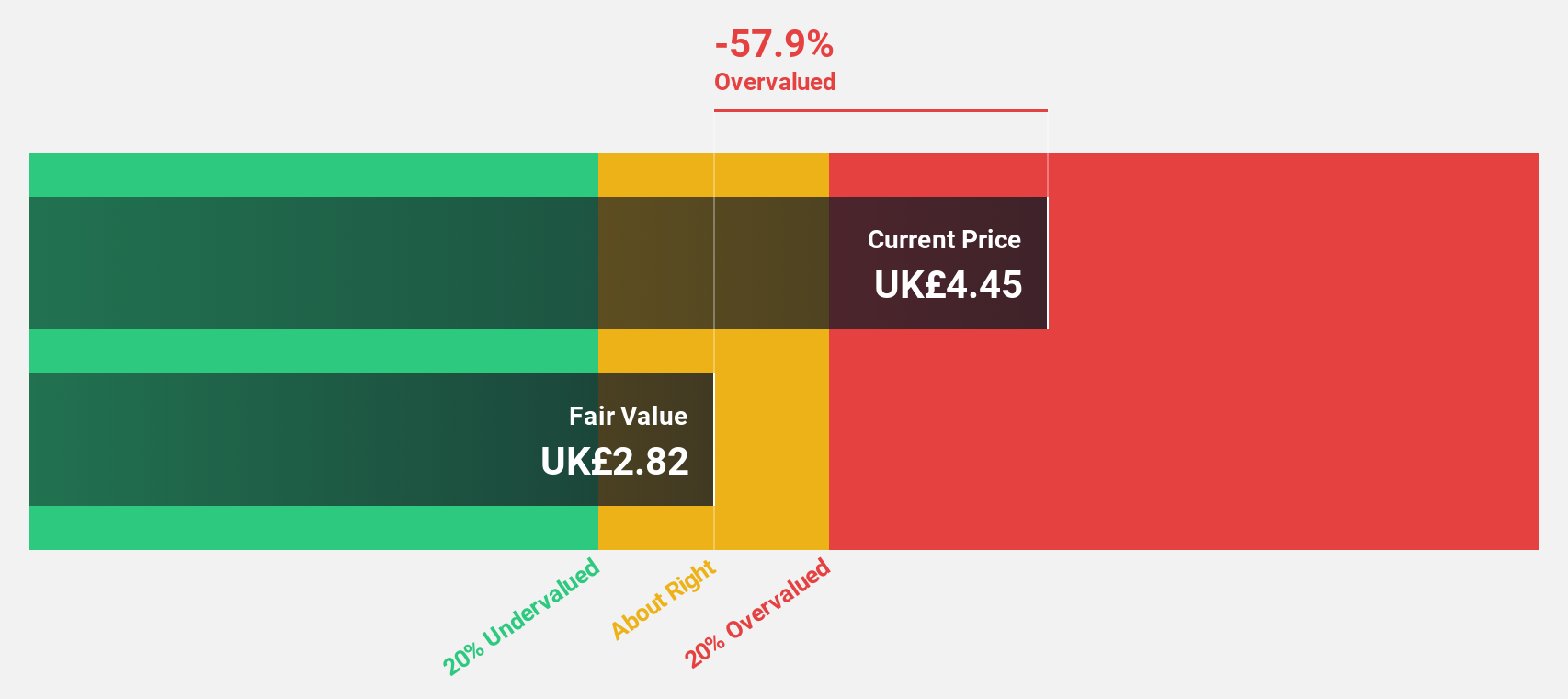

Estimated Discount To Fair Value: 17.4%

Pinewood Technologies Group is trading at £3.74, slightly undervalued compared to its fair value of £4.53, with earnings projected to grow significantly at 42.2% annually, surpassing the UK market's growth rate. Despite recent shareholder dilution and large one-off items affecting earnings quality, a new five-year contract with Volkswagen Group Japan could enhance future cash flows and revenue growth, which is forecasted at 25% per year.

- Our earnings growth report unveils the potential for significant increases in Pinewood Technologies Group's future results.

- Delve into the full analysis health report here for a deeper understanding of Pinewood Technologies Group.

Key Takeaways

- Click through to start exploring the rest of the 50 Undervalued UK Stocks Based On Cash Flows now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:DSCV

discoverIE Group

Designs, manufactures, and supplies specialist electronic components for industrial applications in the United Kingdom, Europe, North America, Asia, and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives