- United Kingdom

- /

- Capital Markets

- /

- LSE:EJFI

EJF Investments (LON:EJFI) Is Due To Pay A Dividend Of £0.0268

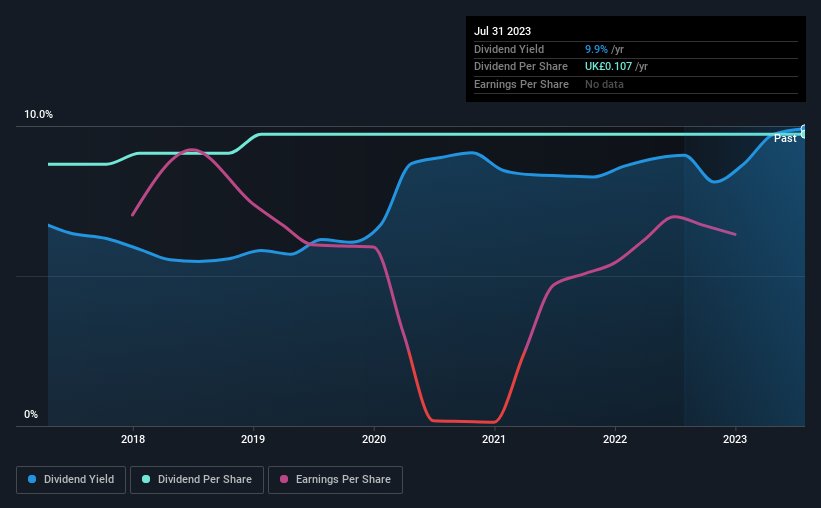

EJF Investments Limited's (LON:EJFI) investors are due to receive a payment of £0.0268 per share on 31st of August. This means the annual payment is 9.9% of the current stock price, which is above the average for the industry.

View our latest analysis for EJF Investments

EJF Investments' Payment Has Solid Earnings Coverage

If the payments aren't sustainable, a high yield for a few years won't matter that much. Prior to this announcement, EJF Investments' dividend was comfortably covered by both cash flow and earnings. This indicates that a lot of the earnings are being reinvested into the business, with the aim of fueling growth.

Looking forward, EPS could fall by 3.0% if the company can't turn things around from the last few years. If the dividend continues along recent trends, we estimate the payout ratio could be 49%, which we consider to be quite comfortable, with most of the company's earnings left over to grow the business in the future.

EJF Investments Is Still Building Its Track Record

It is great to see that EJF Investments has been paying a stable dividend for a number of years now, however we want to be a bit cautious about whether this will remain true through a full economic cycle. Since 2017, the dividend has gone from £0.096 total annually to £0.107. This works out to be a compound annual growth rate (CAGR) of approximately 1.8% a year over that time. EJF Investments hasn't been paying a dividend for very long, so we wouldn't get to excited about its record of growth just yet.

EJF Investments May Find It Hard To Grow The Dividend

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. However, things aren't all that rosy. EJF Investments has seen earnings per share falling at 3.0% per year over the last five years. A modest decline in earnings isn't great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed.

Our Thoughts On EJF Investments' Dividend

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. Overall, we don't think this company has the makings of a good income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Just as an example, we've come across 3 warning signs for EJF Investments you should be aware of, and 1 of them makes us a bit uncomfortable. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if EJF Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:EJFI

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success