- United Kingdom

- /

- Software

- /

- LSE:PINE

Discovering Undiscovered Gems in the United Kingdom May 2025

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 and FTSE 250 indices experience downward pressure due to weak trade data from China, investors are keeping a close eye on how global economic shifts impact domestic markets. In this challenging environment, identifying stocks with strong fundamentals and resilience can be crucial for navigating market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| BioPharma Credit | NA | 7.22% | 7.91% | ★★★★★★ |

| Livermore Investments Group | NA | 9.92% | 13.65% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -7.87% | -8.41% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| MS INTERNATIONAL | NA | 13.42% | 56.55% | ★★★★★★ |

| FW Thorpe | 2.95% | 11.79% | 13.49% | ★★★★★☆ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| AltynGold | 73.21% | 26.90% | 31.85% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

City of London Investment Group (LSE:CLIG)

Simply Wall St Value Rating: ★★★★★★

Overview: City of London Investment Group PLC is a publicly owned investment manager with a market capitalization of approximately £187.28 million.

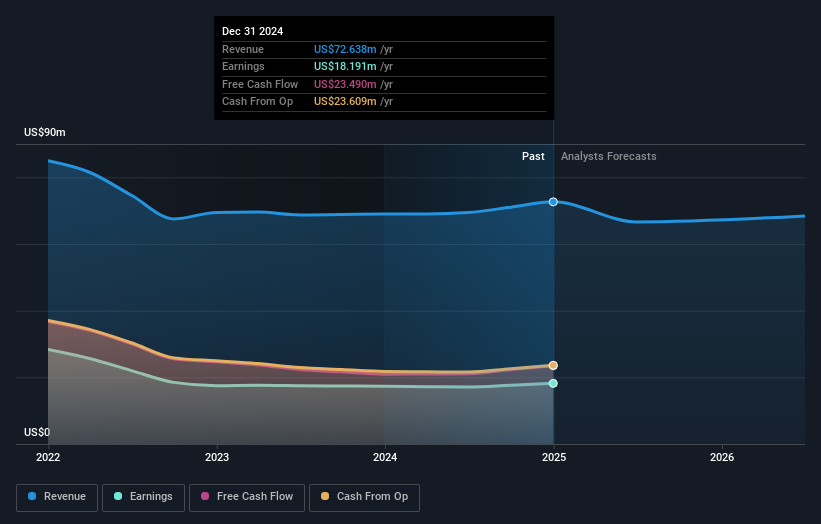

Operations: The primary revenue stream for City of London Investment Group comes from its asset management segment, generating $72.64 million.

City of London Investment Group has been steadily growing, with earnings increasing by 5% annually over the past five years. The company is currently trading at 7.6% below its estimated fair value, suggesting potential for investment appeal. Notably, it remains debt-free, alleviating concerns about interest coverage and enhancing its financial stability. Recent earnings showed a net income of US$9.29 million for the half-year ending December 2024, up from US$8.22 million the previous year. Additionally, CLIG declared an interim dividend of £0.11 per share, reflecting consistency in shareholder returns amidst stable financial health and high-quality earnings performance.

Pinewood Technologies Group (LSE:PINE)

Simply Wall St Value Rating: ★★★★★★

Overview: Pinewood Technologies Group PLC is a cloud-based dealer management software provider serving the automotive industry across various regions including the United Kingdom, Europe, Africa, Asia, the Middle East, and North America with a market cap of £390.59 million.

Operations: Pinewood Technologies Group generates revenue primarily from its cloud-based dealer management software solutions tailored for the automotive industry. The company's net profit margin is 15%, reflecting its efficiency in converting revenue into actual profit after expenses.

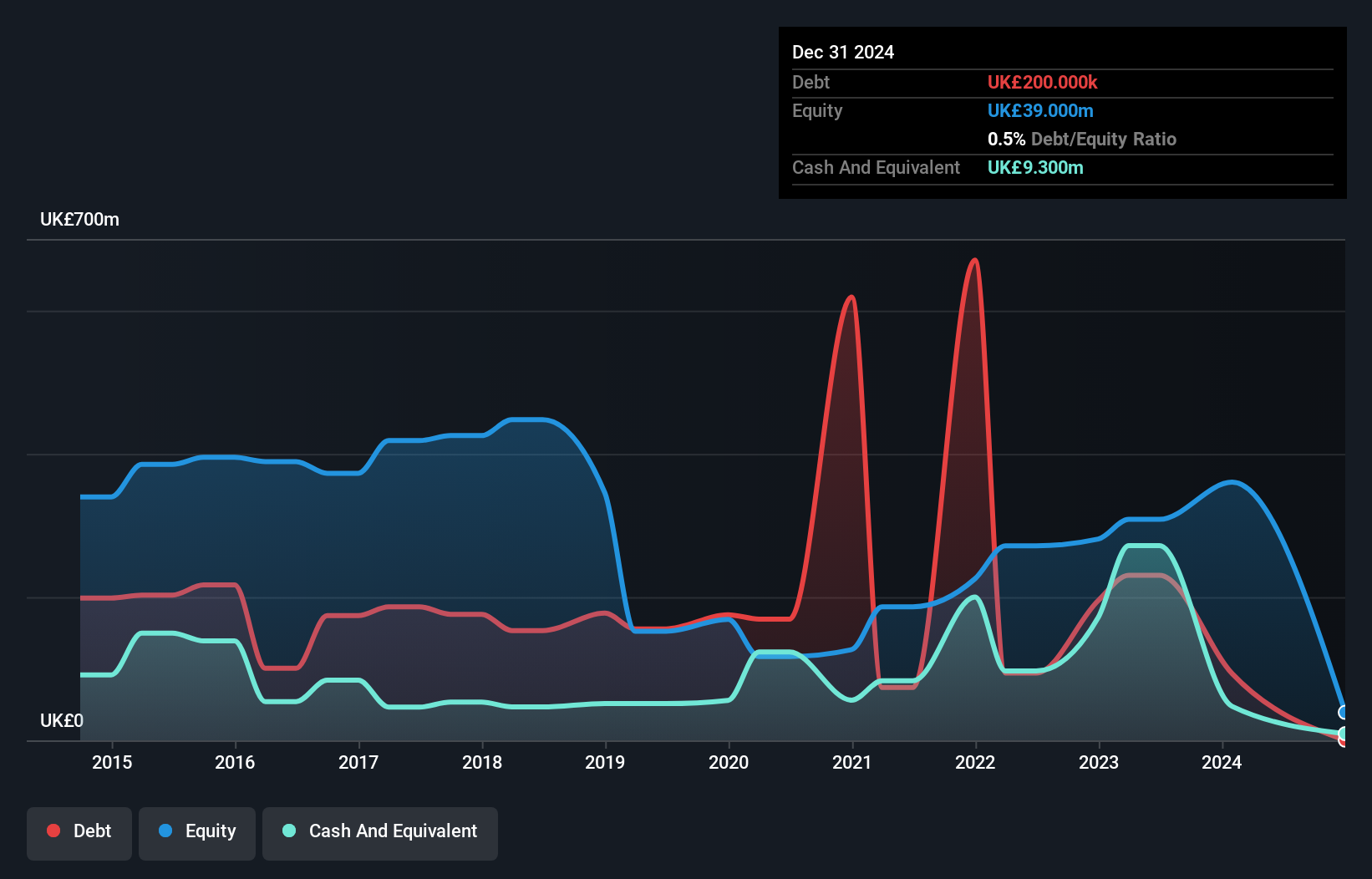

Pinewood Technologies Group, a smaller player in the UK market, is making strategic moves with its acquisition of Seez AI to bolster its dealer management software. This expansion into North America and beyond is supported by a £35.67 million equity raise, signaling investor confidence. The company reported earnings of £5.7 million for 2024 on sales of £31.2 million, with basic EPS at GBP 0.051. Pinewood's debt-to-equity ratio impressively decreased from 103% to 0.5% over five years, showcasing improved financial health despite a one-off loss of £2.4M impacting recent results.

Porvair (LSE:PRV)

Simply Wall St Value Rating: ★★★★★★

Overview: Porvair plc operates in the filtration, laboratory, and environmental technology sectors with a market capitalization of £354.77 million.

Operations: Porvair's revenue is primarily derived from its Laboratory (£65.84 million), Metal Melt Quality (£44.06 million), and Aerospace & Industrial (£84.27 million) segments.

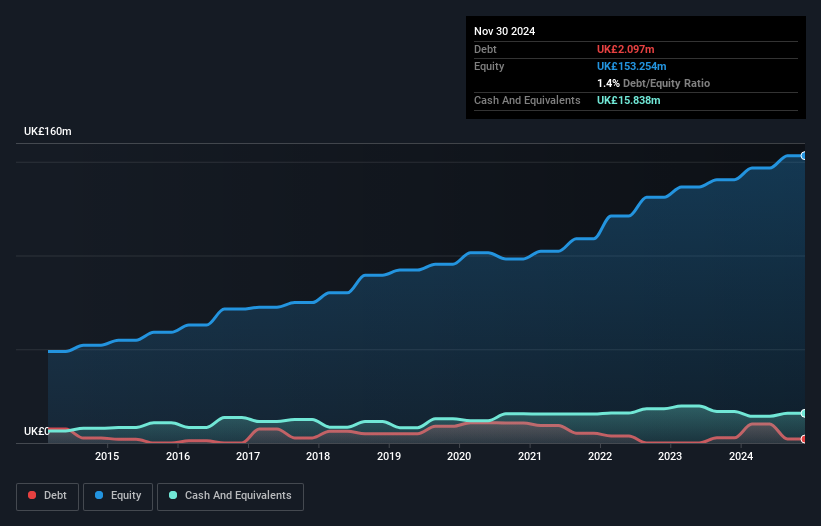

In the UK market, Porvair stands out with a strategic focus on niche markets and organic growth. Earnings grew by 3.2% last year, outpacing the Machinery industry's -2.6%. The company has a debt-to-equity ratio reduced from 9.3 to 1.4 over five years, highlighting financial prudence. With earnings well covering interest payments at 14.9 times, Porvair's financial health seems robust. Recent changes in leadership might impact strategy execution but could also bring fresh perspectives to their ESG initiatives and acquisition strategy like EFC, which may drive future success despite potential cash flow strains from infrastructure investments.

Make It Happen

- Take a closer look at our UK Undiscovered Gems With Strong Fundamentals list of 59 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PINE

Pinewood Technologies Group

Operates as a cloud-based dealer management software provider that offers software solutions to the automotive industry in the United Kingdom, rest of Europe, Africa, Asia, the middle East, and North America.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives