- United Kingdom

- /

- Capital Markets

- /

- LSE:BRW

I Ran A Stock Scan For Earnings Growth And Brewin Dolphin Holdings (LON:BRW) Passed With Ease

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Brewin Dolphin Holdings (LON:BRW). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Brewin Dolphin Holdings

How Fast Is Brewin Dolphin Holdings Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Like a wedge-tailed eagle on the wind, Brewin Dolphin Holdings's EPS soared from UK£0.16 to UK£0.20, in just one year. That's a commendable gain of 26%.

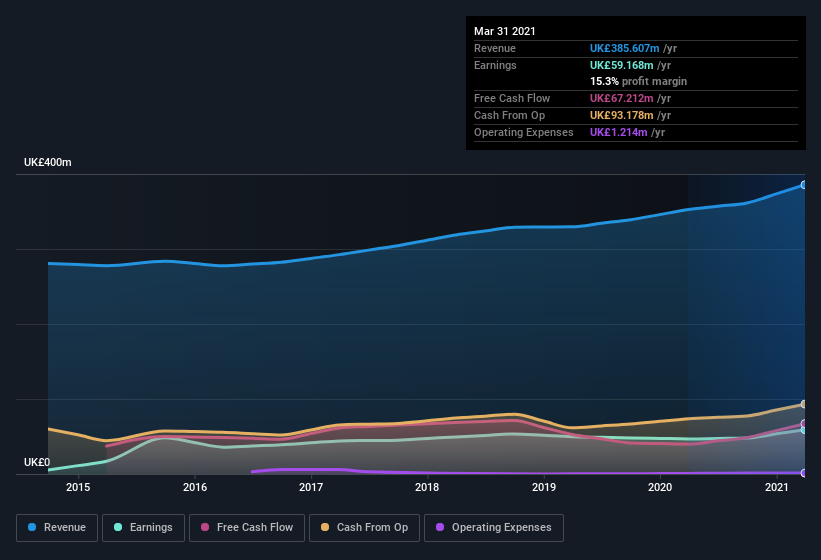

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Brewin Dolphin Holdings's EBIT margins were flat over the last year, revenue grew by a solid 9.4% to UK£386m. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Brewin Dolphin Holdings's future profits.

Are Brewin Dolphin Holdings Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We note that Brewin Dolphin Holdings insiders spent UK£124k on stock, over the last year; in contrast, we didn't see any selling. That puts the company in a nice light, as it makes me think its leaders are feeling confident. It is also worth noting that it was CEO & Director Robin Beer who made the biggest single purchase, worth UK£101k, paying UK£2.66 per share.

I do like that insiders have been buying shares in Brewin Dolphin Holdings, but there is more evidence of shareholder friendly management. Specifically, the CEO is paid quite reasonably for a company of this size. I discovered that the median total compensation for the CEOs of companies like Brewin Dolphin Holdings with market caps between UK£718m and UK£2.3b is about UK£990k.

Brewin Dolphin Holdings offered total compensation worth UK£590k to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add Brewin Dolphin Holdings To Your Watchlist?

For growth investors like me, Brewin Dolphin Holdings's raw rate of earnings growth is a beacon in the night. And that's not the only positive, either. We have both insider buying and reasonable and remuneration to consider. The message I'd take from this quick rundown is that, yes, this stock is worth investigating further. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of Brewin Dolphin Holdings.

The good news is that Brewin Dolphin Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Brewin Dolphin Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Brewin Dolphin Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:BRW

Brewin Dolphin Holdings

Brewin Dolphin Holdings PLC, together with its subsidiaries, provides wealth management services in the United Kingdom, the Channel Islands, and the Republic of Ireland.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives