- United Kingdom

- /

- Capital Markets

- /

- LSE:BPT

Market Participants Recognise Bridgepoint Group plc's (LON:BPT) Earnings Pushing Shares 28% Higher

Despite an already strong run, Bridgepoint Group plc (LON:BPT) shares have been powering on, with a gain of 28% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 97% in the last year.

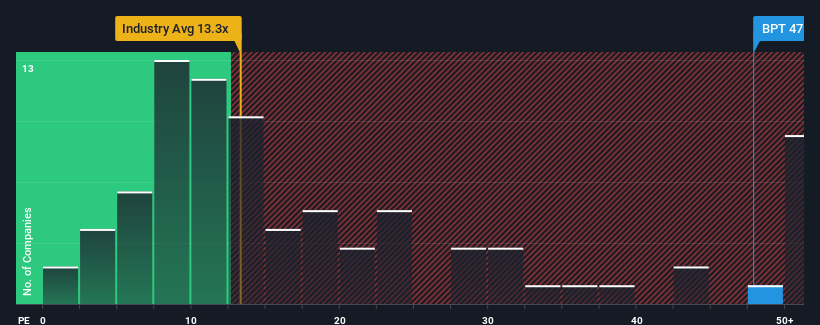

After such a large jump in price, Bridgepoint Group may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 47.9x, since almost half of all companies in the United Kingdom have P/E ratios under 16x and even P/E's lower than 10x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Bridgepoint Group hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Bridgepoint Group

Does Growth Match The High P/E?

In order to justify its P/E ratio, Bridgepoint Group would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 46%. This means it has also seen a slide in earnings over the longer-term as EPS is down 100% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 38% per year as estimated by the eight analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 14% each year, which is noticeably less attractive.

With this information, we can see why Bridgepoint Group is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

The strong share price surge has got Bridgepoint Group's P/E rushing to great heights as well. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Bridgepoint Group maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 4 warning signs for Bridgepoint Group (1 shouldn't be ignored!) that you need to take into consideration.

You might be able to find a better investment than Bridgepoint Group. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Bridgepoint Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:BPT

Bridgepoint Group

A private equity and private credit firm specializing in middle market, lower mid-market, small mid cap, small cap, growth capital, buyouts investments, syndicate debt, infrastructure, direct lending and credit opportunities in private credit investments.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives