- United Kingdom

- /

- Aerospace & Defense

- /

- LSE:SNR

Discovering Undiscovered Gems in the UK This August 2024

Reviewed by Simply Wall St

The United Kingdom market has shown robust performance, climbing 1.7% in the last 7 days and 13% over the past year, with earnings expected to grow by 14% annually in the coming years. In this favorable environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding; here are three undiscovered gems worth considering this August 2024.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| London Security | 0.31% | 9.47% | 7.41% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| Fix Price Group | 43.59% | 12.53% | 23.49% | ★★★★★☆ |

| Goodwin | 59.96% | 9.26% | 13.12% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 6.58% | 9.90% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

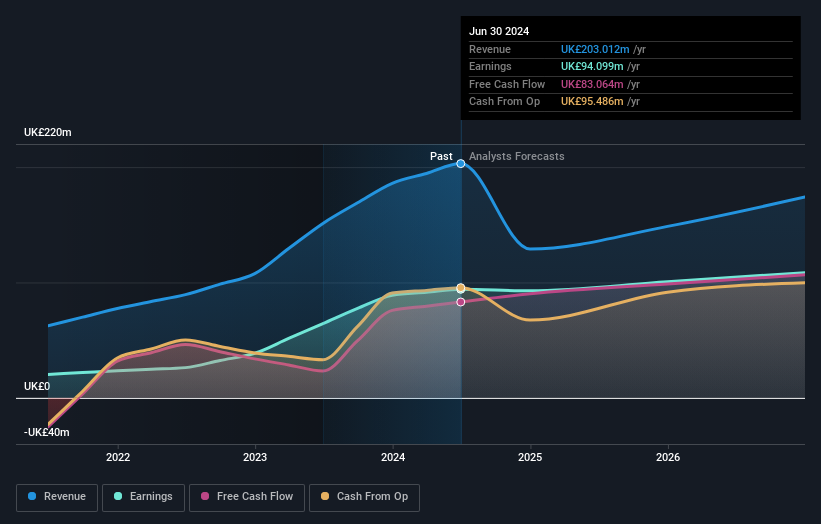

Alpha Group International (LSE:ALPH)

Simply Wall St Value Rating: ★★★★★★

Overview: Alpha Group International plc offers foreign exchange risk management and alternative banking solutions across the UK, Europe, Canada, and globally, with a market cap of £1.08 billion.

Operations: Alpha Group International plc generates revenue primarily from its Alpha Pay (£64.30 million), Institutional (£61.29 million), and Corporate London excluding Corporate Amsterdam (£45.42 million) segments, with smaller contributions from Corporate Amsterdam (£8.70 million), Corporate Toronto (£4.23 million), and Cobase (£0.19 million).

Alpha Group International, with a price-to-earnings ratio of 12.2x compared to the UK market's 16.8x, has shown impressive earnings growth of 130% over the past year, outpacing its industry’s mere 0.3%. The company is debt-free and recently commenced share repurchases authorized at up to 4.32 million shares or roughly 10% of its issued capital as of April this year. Additionally, Alpha was added to several FTSE indices in June, enhancing its visibility among investors.

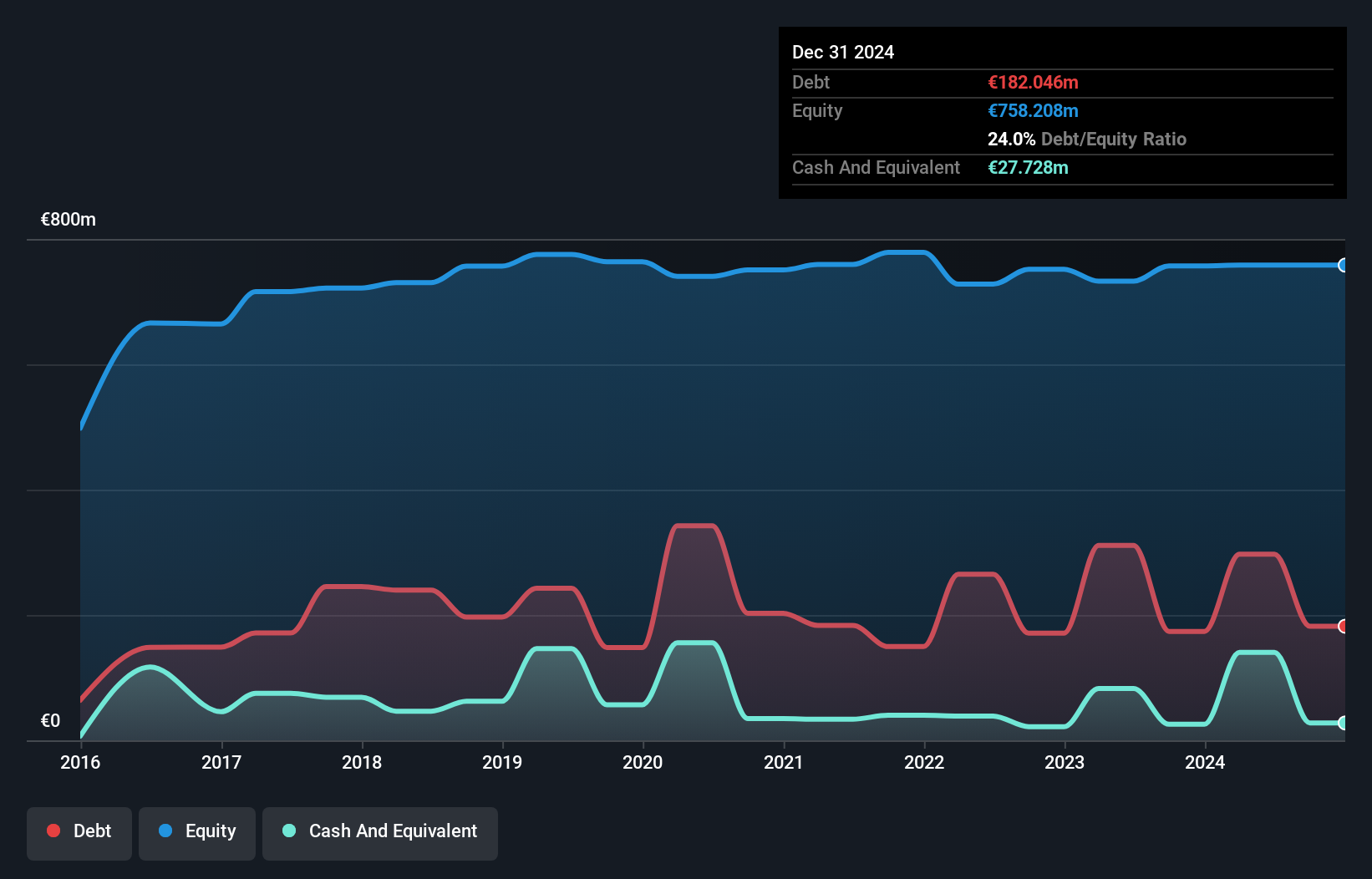

Cairn Homes (LSE:CRN)

Simply Wall St Value Rating: ★★★★★★

Overview: Cairn Homes plc, a holding company with a market cap of £1.03 billion, operates as a home and community builder in Ireland.

Operations: Cairn Homes generates revenue primarily from building and property development, amounting to €666.81 million.

Cairn Homes, a prominent player in the UK housing market, has shown promising financial health. Its net debt to equity ratio stands at 19.6%, which is satisfactory and indicates prudent financial management. Over the past year, earnings grew by 5.4%, outpacing the Consumer Durables industry’s -14%. The company’s price-to-earnings ratio of 14.1x is attractive compared to the UK market average of 16.8x, suggesting potential undervaluation for investors seeking growth opportunities in this sector.

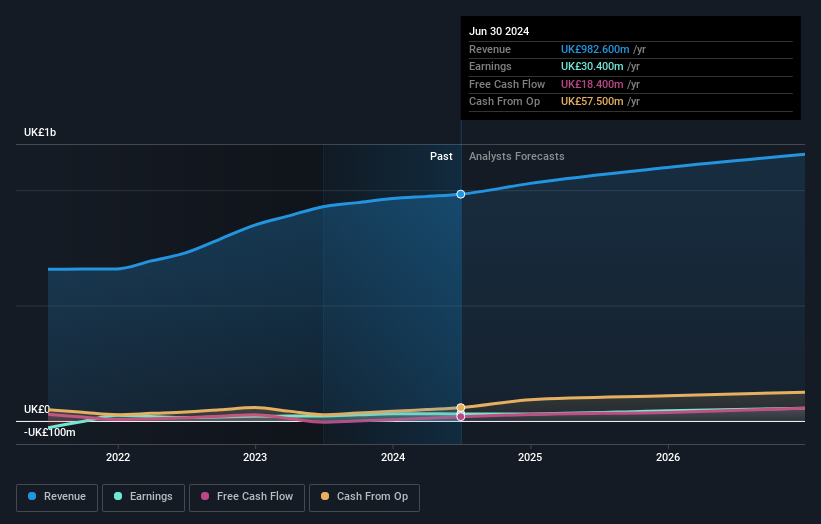

Senior (LSE:SNR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Senior plc designs, manufactures, and sells high-technology components and systems for major original equipment manufacturers in the aerospace, defense, land vehicle, and power and energy markets globally; it has a market cap of £696.60 million.

Operations: Senior plc generates revenue primarily from its Aerospace segment (£651.10 million) and Flexonics segment (£333 million), with a minor adjustment for central costs (-£1.50 million).

Senior plc, a small cap aerospace and defense company, has shown impressive earnings growth of 40.1% over the past year, outpacing the industry average of 14.8%. Trading at 66.9% below its estimated fair value, it represents good relative value compared to peers. However, interest payments on debt are not well covered by EBIT (2.8x coverage), and its debt to equity ratio has increased from 35.5% to 42.4% over five years.

- Click here and access our complete health analysis report to understand the dynamics of Senior.

Explore historical data to track Senior's performance over time in our Past section.

Where To Now?

- Navigate through the entire inventory of 79 UK Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SNR

Senior

Designs, manufactures, and sells high-technology components and systems for the principal original equipment manufacturers in the aerospace, defense, land vehicle, and power and energy markets in the United States, the United Kingdom, and internationally.

Very undervalued with solid track record.