- United Kingdom

- /

- Metals and Mining

- /

- LSE:HOC

UK Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

The market in the United Kingdom has seen a 1.7% increase over the last week and is up 13% over the past 12 months, with earnings forecasted to grow by 14% annually. In this favorable environment, identifying growth companies with high insider ownership can be particularly promising, as it often indicates strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Filtronic (AIM:FTC) | 28.6% | 33.5% |

| Plant Health Care (AIM:PHC) | 34.2% | 121.3% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 74.6% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 23.5% |

| Helios Underwriting (AIM:HUW) | 23.9% | 14.7% |

| Foresight Group Holdings (LSE:FSG) | 31.9% | 27.9% |

| B90 Holdings (AIM:B90) | 24.4% | 142.7% |

| Velocity Composites (AIM:VEL) | 27.6% | 173.3% |

| Judges Scientific (AIM:JDG) | 11.9% | 27.1% |

| Hochschild Mining (LSE:HOC) | 38.4% | 53.8% |

Let's take a closer look at a couple of our picks from the screened companies.

Evoke (LSE:EVOK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Evoke plc, with a market cap of £299.13 million, offers online betting and gaming products and solutions in the United Kingdom, Ireland, Italy, Spain, and internationally.

Operations: The company's revenue segments include £514 million from Retail, £661.20 million from UK&I Online, and £516.10 million from International operations.

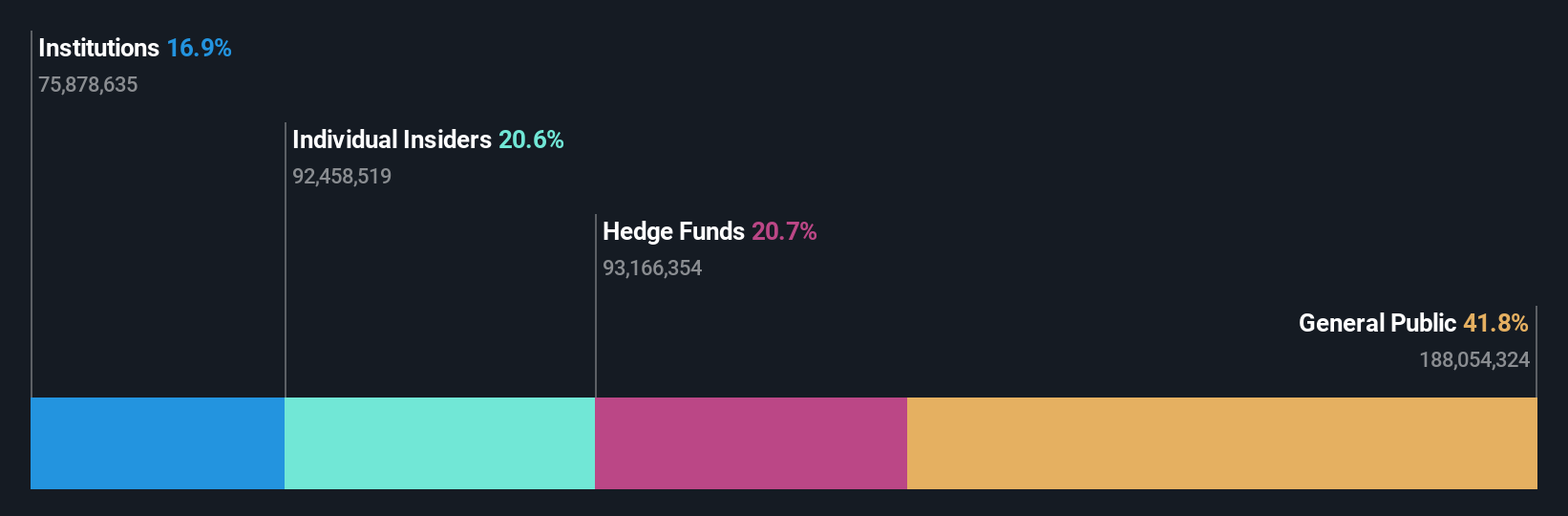

Insider Ownership: 20.4%

Earnings Growth Forecast: 110.9% p.a.

Evoke plc, a growth company with significant insider ownership, is forecasted to become profitable within three years, outpacing the average market growth. Recent guidance indicates revenue growth in line with its 5-9% target for the second half of 2024, driven by successful product launches and effective promotions. Despite high share price volatility and interest payments not well covered by earnings, substantial insider buying over the past three months suggests strong internal confidence.

- Click here and access our complete growth analysis report to understand the dynamics of Evoke.

- Insights from our recent valuation report point to the potential undervaluation of Evoke shares in the market.

Hochschild Mining (LSE:HOC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market cap of £943.52 million.

Operations: Hochschild Mining generates revenue primarily from its San Jose ($242.46 million), Inmaculada ($396.64 million), and Pallancata ($54.05 million) operations.

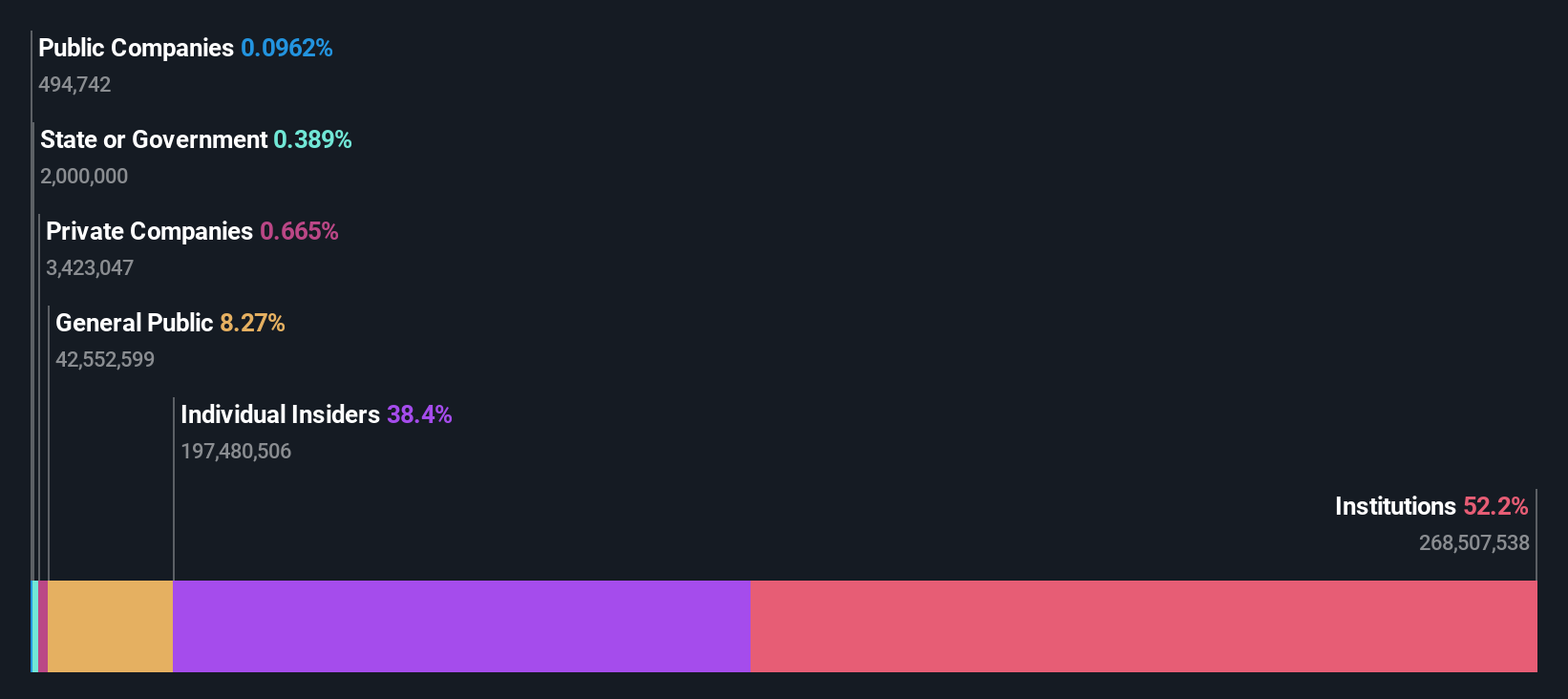

Insider Ownership: 38.4%

Earnings Growth Forecast: 53.8% p.a.

Hochschild Mining, with substantial insider ownership, is forecast to grow revenue at 11.1% per year and become profitable within three years, surpassing average market growth. Trading at 39.8% below fair value estimates and with analysts predicting a 25.2% price rise, the company shows strong potential despite slower-than-20% revenue growth. Recent production guidance for up to 360,000 gold equivalent ounces and significant insider buying further underscore internal confidence in its prospects.

- Navigate through the intricacies of Hochschild Mining with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Hochschild Mining is trading behind its estimated value.

TBC Bank Group (LSE:TBCG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TBC Bank Group PLC, with a market cap of £1.67 billion, offers banking, leasing, insurance, brokerage, and card processing services to corporate and individual customers in Georgia, Azerbaijan, and Uzbekistan through its subsidiaries.

Operations: The company's revenue segments include Uzbekistan Operations, which generated GEL 236.42 million, and Segment Adjustment, accounting for GEL 2.13 billion.

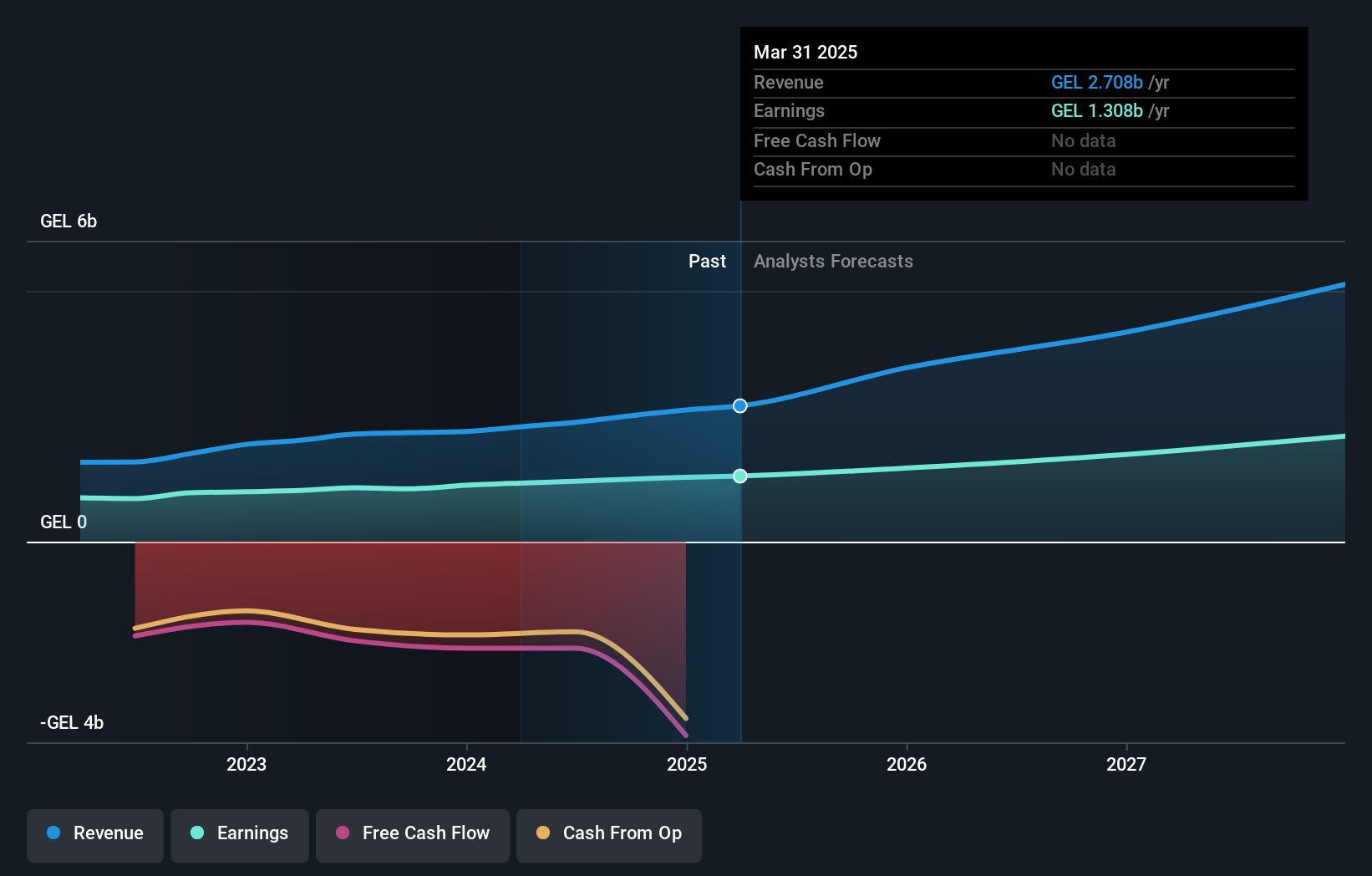

Insider Ownership: 17.8%

Earnings Growth Forecast: 15.3% p.a.

TBC Bank Group, with significant insider ownership, is forecast to grow revenue at 18.9% annually, outpacing the UK market's 3.7%. Trading at 48.2% below its estimated fair value and showing good relative value compared to peers, TBCG reported a net income increase to GEL 617.4 million for H1 2024. Despite an unstable dividend track record, earnings are projected to grow by 15.3% per year with a high return on equity forecast of 24.9%.

- Get an in-depth perspective on TBC Bank Group's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that TBC Bank Group is priced lower than what may be justified by its financials.

Where To Now?

- Reveal the 66 hidden gems among our Fast Growing UK Companies With High Insider Ownership screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hochschild Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HOC

Hochschild Mining

A precious metals company, engages in the exploration, mining, processing, and sale of gold and silver deposits in Peru, Argentina, the United States, Canada, Brazil, and Chile.

Reasonable growth potential and fair value.