- United Kingdom

- /

- Biotech

- /

- LSE:OXB

High Growth Tech Stocks To Watch This August 2024

Reviewed by Simply Wall St

Over the last 7 days, the United Kingdom market has risen 1.7%, and it is up 13% over the last 12 months with earnings forecasted to grow by 14% annually. In this favorable environment, identifying high growth tech stocks that align with these trends can be crucial for investors looking to capitalize on market momentum.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Filtronic | 21.64% | 33.46% | ★★★★★★ |

| YouGov | 14.30% | 29.79% | ★★★★★☆ |

| STV Group | 13.43% | 47.09% | ★★★★★☆ |

| Trustpilot Group | 16.23% | 31.98% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| LungLife AI | 83.65% | 88.65% | ★★★★★☆ |

| IQGeo Group | 11.49% | 63.61% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

| Seeing Machines | 24.29% | 94.35% | ★★★★★☆ |

Click here to see the full list of 50 stocks from our UK High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

IDOX (AIM:IDOX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: IDOX plc, with a market cap of £279.11 million, provides software and services for managing local government and other organizations across the United Kingdom, the United States, Europe, and internationally through its subsidiaries.

Operations: IDOX generates revenue primarily through three segments: Assets (£14.75 million), Communities (COMM) (£14.99 million), and Land Property & Public Protection (LPPP) (£50.91 million). The company offers software and services aimed at local government management and other organizations across various regions, including the UK, US, Europe, and internationally.

IDOX, a tech company in the UK, is forecasted to see its earnings grow at an impressive 23.9% per year over the next three years, outpacing the UK market's average of 14.3%. Despite a recent -6.4% dip in earnings growth compared to the industry average of 19.9%, IDOX's revenue is expected to increase by 7.4% annually, faster than the UK's overall market growth rate of 3.7%. The firm has also been investing significantly in R&D, with expenses totaling £15 million last year, underscoring its commitment to innovation and future growth potential. Recent leadership changes include appointing Mark Milner as a Non-Executive Director; his extensive experience with turnarounds and digital strategies will likely benefit IDOX’s strategic goals moving forward. The company's half-year results showed sales rising from £35.78 million to £43.15 million year-over-year, though net income slightly decreased from £3.34 million to £3.25 million during this period—reflecting strong top-line performance but highlighting areas for operational efficiency improvements.

- Click here to discover the nuances of IDOX with our detailed analytical health report.

Gain insights into IDOX's historical performance by reviewing our past performance report.

Capita (LSE:CPI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capita plc, with a market cap of £308.33 million, offers consulting, digital, and software products and services to private and public sector clients in the UK and internationally.

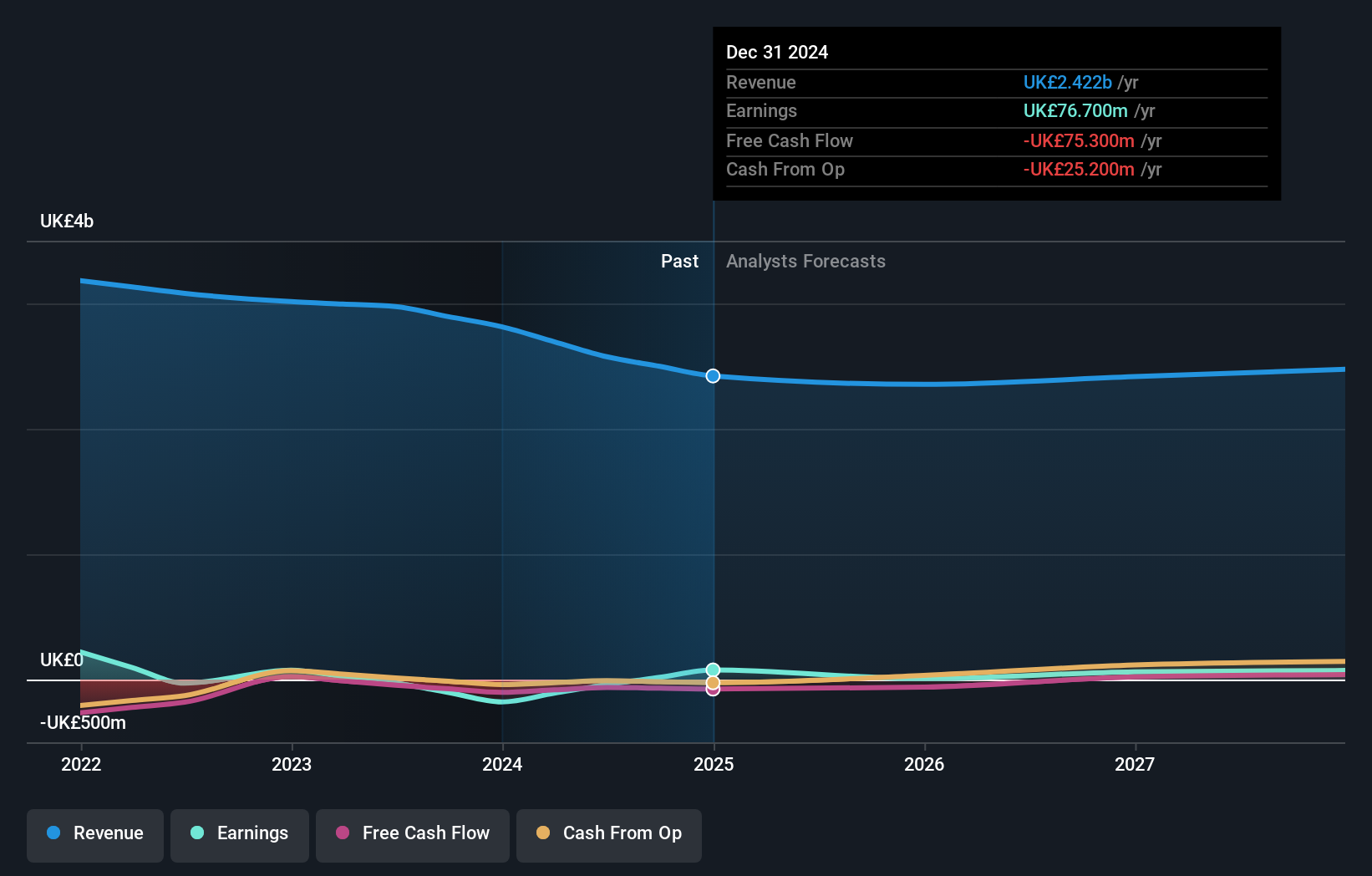

Operations: Capita generates revenue primarily through its Capita Experience and Capita Public Service segments, with the former contributing £1.12 billion and the latter £1.49 billion. The company's offerings span consulting, digital, and software products and services to a diverse client base across private and public sectors both in the UK and internationally.

Capita's recent earnings report for H1 2024 showed a net income of £53 million, reversing a previous net loss of £84.4 million. Despite a 16% drop in sales to £1.24 billion, the company’s strategic focus on R&D is evident with significant investments aimed at enhancing their digital capabilities through Microsoft Dynamics and other hyperscalers. The renewal of their contract with the Cabinet Office valued at £48 million over eight years underscores Capita's commitment to long-term client relationships and service quality improvements, particularly in pension administration for over 350,000 RMSPS members.

- Click to explore a detailed breakdown of our findings in Capita's health report.

Understand Capita's track record by examining our Past report.

Oxford Biomedica (LSE:OXB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Oxford Biomedica plc, a contract development and manufacturing organization, focuses on delivering therapies to patients worldwide and has a market cap of £371.27 million.

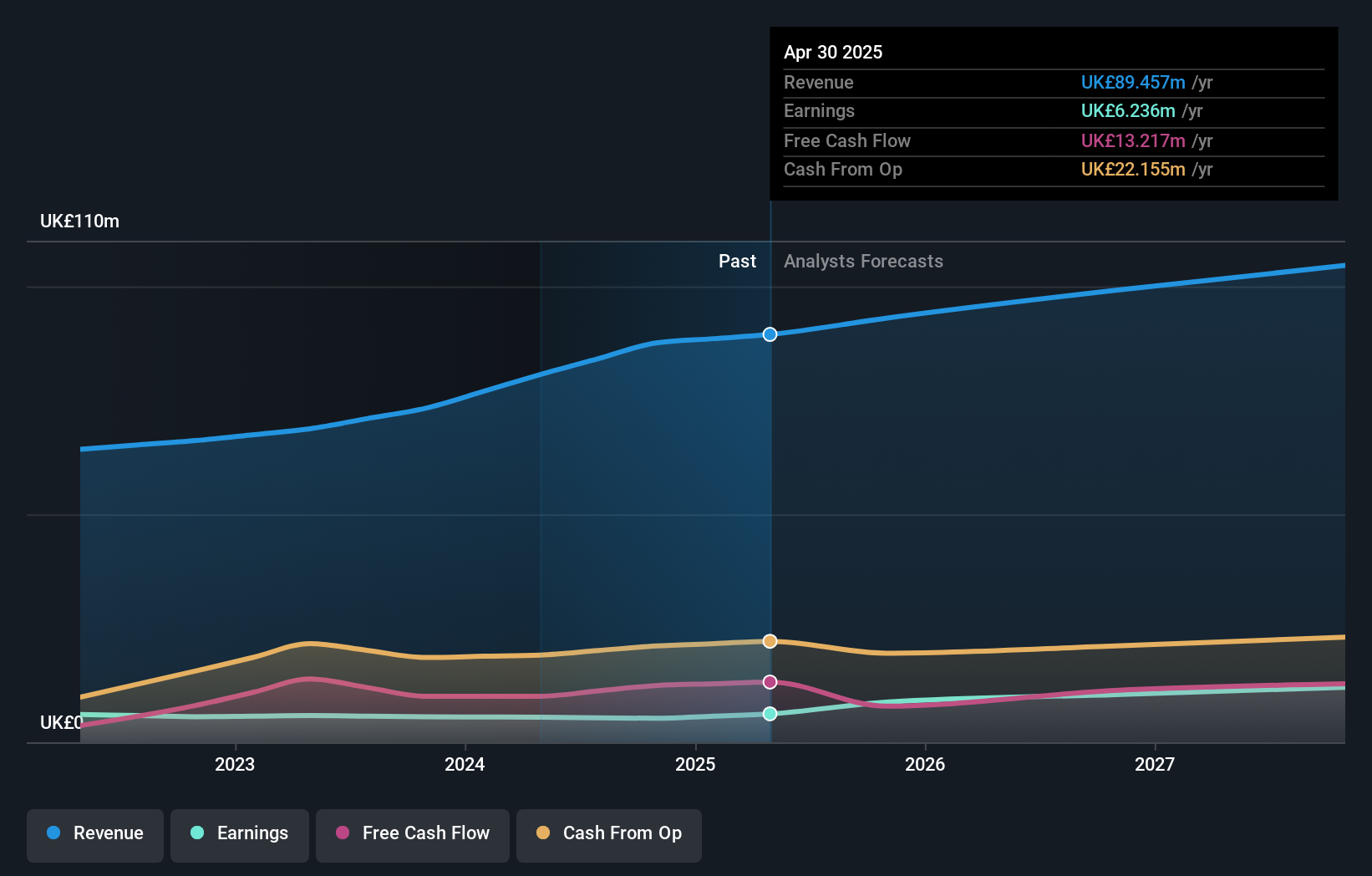

Operations: The company generates revenue primarily from its Platform segment (£89.41 million) and a smaller portion from Product sales (£0.13 million).

Oxford Biomedica's forecasted revenue growth of 19.9% annually outpaces the UK market's 3.7%, driven by robust R&D investments, with expenses reaching £24 million last year. Despite being unprofitable, earnings are expected to surge by 99.5% per year over the next three years, indicating a significant turnaround potential. The recent appointment of Laurence Espinasse and Lucinda Crabtree strengthens their leadership team as they aim for profitability and sustained growth in the biotech sector.

- Delve into the full analysis health report here for a deeper understanding of Oxford Biomedica.

Gain insights into Oxford Biomedica's past trends and performance with our Past report.

Make It Happen

- Click here to access our complete index of 50 UK High Growth Tech and AI Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:OXB

Oxford Biomedica

A contract development and manufacturing organization, focuses on delivering therapies to patients worldwide.

High growth potential and good value.