- United Kingdom

- /

- Capital Markets

- /

- LSE:AJB

AJ Bell (LON:AJB) Shareholders Have Enjoyed A 15% Share Price Gain

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But investors can boost returns by picking market-beating companies to own shares in. To wit, the AJ Bell plc (LON:AJB) share price is 15% higher than it was a year ago, much better than the market decline of around 7.9% (not including dividends) in the same period. That's a solid performance by our standards! We'll need to follow AJ Bell for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

See our latest analysis for AJ Bell

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

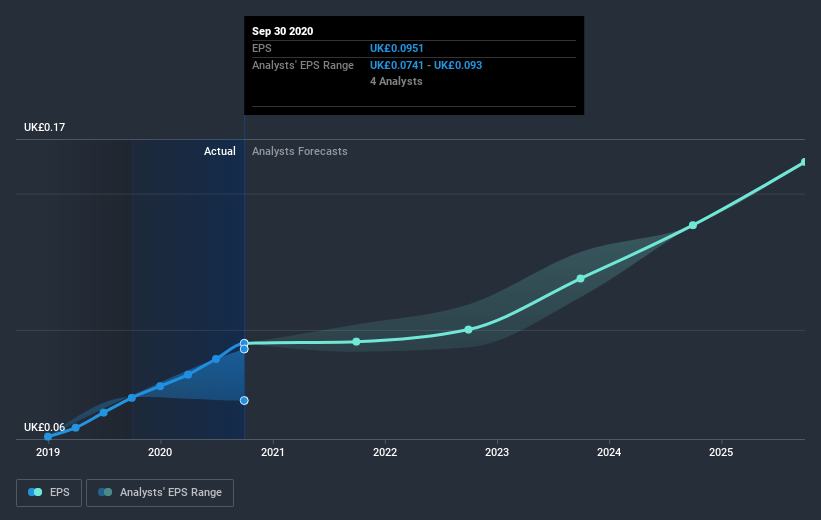

AJ Bell was able to grow EPS by 27% in the last twelve months. It's fair to say that the share price gain of 15% did not keep pace with the EPS growth. Therefore, it seems the market isn't as excited about AJ Bell as it was before. This could be an opportunity.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that AJ Bell has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

A Different Perspective

AJ Bell boasts a total shareholder return of 17% for the last year (that includes the dividends) . And the share price momentum remains respectable, with a gain of 9.3% in the last three months. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with AJ Bell , and understanding them should be part of your investment process.

We will like AJ Bell better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you decide to trade AJ Bell, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:AJB

AJ Bell

Through its subsidiaries, operates investment platforms in the United Kingdom.

Outstanding track record with flawless balance sheet.