- United Kingdom

- /

- Diversified Financial

- /

- AIM:PCIP

PCI-PAL PLC (LON:PCIP) Looks Just Right With A 34% Price Jump

PCI-PAL PLC (LON:PCIP) shareholders would be excited to see that the share price has had a great month, posting a 34% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 56% in the last year.

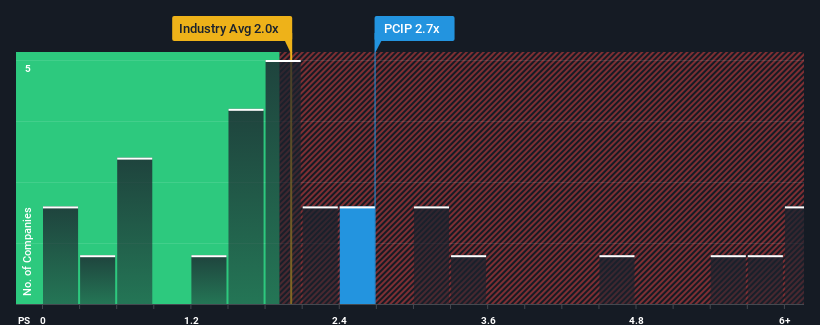

Following the firm bounce in price, when almost half of the companies in the United Kingdom's Diversified Financial industry have price-to-sales ratios (or "P/S") below 2x, you may consider PCI-PAL as a stock probably not worth researching with its 2.7x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for PCI-PAL

How PCI-PAL Has Been Performing

With revenue growth that's inferior to most other companies of late, PCI-PAL has been relatively sluggish. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

Keen to find out how analysts think PCI-PAL's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For PCI-PAL?

The only time you'd be truly comfortable seeing a P/S as high as PCI-PAL's is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company grew revenue by an impressive 20% last year. The strong recent performance means it was also able to grow revenue by 144% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should demonstrate the company's robustness, generating growth of 25% as estimated by the sole analyst watching the company. Meanwhile, the broader industry is forecast to contract by 20%, which would indicate the company is doing very well.

In light of this, it's understandable that PCI-PAL's P/S sits above the majority of other companies. At this time, shareholders aren't keen to offload something that is potentially eyeing a much more prosperous future.

What Does PCI-PAL's P/S Mean For Investors?

The large bounce in PCI-PAL's shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we anticipated, our review of PCI-PAL's analyst forecasts shows that the company's better revenue forecast compared to a turbulent industry is a significant contributor to its high price-to-sales ratio. At this stage investors feel the potential for a deterioration in revenue is remote enough to justify paying a premium in the form of a high P/S. We still remain cautious about the company's ability to keep swimming against the current of the broader industry turmoil. Although, if the company's prospects don't change they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for PCI-PAL (1 is significant) you should be aware of.

If these risks are making you reconsider your opinion on PCI-PAL, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:PCIP

PCI-PAL

Through its subsidiaries, engages in the provision of payment card industry (PCI) compliance solutions and telephony services primarily in the United Kingdom, the United States, Canada, rest of Europe, and the Asia Pacific.

Acceptable track record with mediocre balance sheet.

Market Insights

Community Narratives