- United Kingdom

- /

- Capital Markets

- /

- AIM:MTW

Mattioli Woods (LON:MTW) Is Paying Out A Larger Dividend Than Last Year

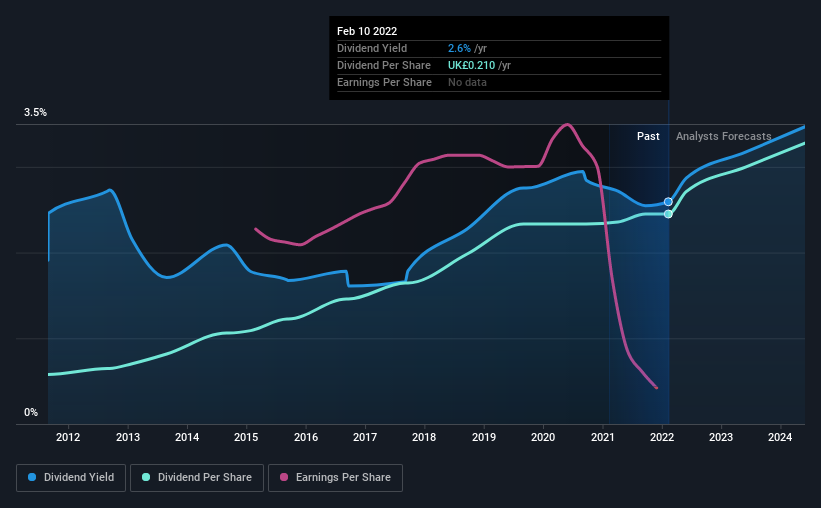

Mattioli Woods plc (LON:MTW) will increase its dividend on the 25th of March to UK£0.083, which is 11% higher than last year. Based on the announced payment, the dividend yield for the company will be 2.7%, which is fairly typical for the industry.

See our latest analysis for Mattioli Woods

Mattioli Woods' Distributions May Be Difficult To Sustain

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. While Mattioli Woods is not profitable, it is paying out less than 75% of its free cash flow, which means that there is plenty left over for reinvestment into the business. In general, cash flows are more important than the more traditional measures of profit so we feel pretty comfortable with the dividend at this level.

Recent, EPS has fallen by 13.6%, so this could continue over the next year. This means that the company will be unprofitable, but cash flows are more important when considering the dividend and as the current cash payout ratio is pretty healthy, we don't think there is too much reason to worry.

Mattioli Woods Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. Since 2012, the dividend has gone from UK£0.05 to UK£0.21. This implies that the company grew its distributions at a yearly rate of about 16% over that duration. We can see that payments have shown some very nice upward momentum without faltering, which provides some reassurance that future payments will also be reliable.

Dividend Growth Potential Is Shaky

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Unfortunately things aren't as good as they seem. Mattioli Woods' EPS has fallen by approximately 14% per year during the past five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future.

The company has also been raising capital by issuing stock equal to 81% of shares outstanding in the last 12 months. Regularly doing this can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

Our Thoughts On Mattioli Woods' Dividend

Overall, we always like to see the dividend being raised, but we don't think Mattioli Woods will make a great income stock. The company has been bring in plenty of cash to cover the dividend, but we don't necessarily think that makes it a great dividend stock. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Just as an example, we've come across 2 warning signs for Mattioli Woods you should be aware of, and 1 of them is potentially serious. We have also put together a list of global stocks with a solid dividend.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:MTW

Mattioli Woods

Provides wealth management and employee benefit services in the United Kingdom.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives