- United Kingdom

- /

- Capital Markets

- /

- AIM:KWG

Cautious Investors Not Rewarding Kingswood Holdings Limited's (LON:KWG) Performance Completely

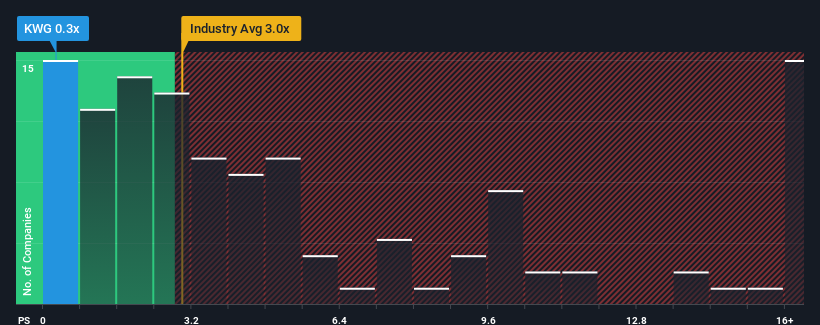

You may think that with a price-to-sales (or "P/S") ratio of 0.3x Kingswood Holdings Limited (LON:KWG) is definitely a stock worth checking out, seeing as almost half of all the Capital Markets companies in the United Kingdom have P/S ratios greater than 3x and even P/S above 10x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for Kingswood Holdings

How Kingswood Holdings Has Been Performing

Kingswood Holdings could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Kingswood Holdings.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Kingswood Holdings' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 24%. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 30% during the coming year according to the only analyst following the company. With the rest of the industry predicted to shrink by 3.7%, that would be a fantastic result.

In light of this, it's quite peculiar that Kingswood Holdings' P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Kingswood Holdings' P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Kingswood Holdings' analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't contributing to its P/S anywhere near as much as we would have predicted. We believe there could be some underlying risks that are keeping the P/S modest in the context of above-average revenue growth. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. So, the risk of a price drop looks to be subdued, but investors seem to think future revenue could see a lot of volatility.

You need to take note of risks, for example - Kingswood Holdings has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Kingswood Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:KWG

Kingswood Holdings

Operates as integrated wealth management company in the United Kingdom.

Slight and slightly overvalued.

Market Insights

Community Narratives