- United Kingdom

- /

- Consumer Finance

- /

- AIM:HAT

Reflecting on H&T Group's (LON:HAT) Share Price Returns Over The Last Year

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. That downside risk was realized by H&T Group plc (LON:HAT) shareholders over the last year, as the share price declined 38%. That's disappointing when you consider the market declined 11%. At least the damage isn't so bad if you look at the last three years, since the stock is down 27% in that time. The falls have accelerated recently, with the share price down 23% in the last three months.

See our latest analysis for H&T Group

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate twelve months during which the H&T Group share price fell, it actually saw its earnings per share (EPS) improve by 26%. It could be that the share price was previously over-hyped.

The divergence between the EPS and the share price is quite notable, during the year. But we might find some different metrics explain the share price movements better.

Revenue was fairly steady year on year, which isn't usually such a bad thing. But the share price might be lower because the market expected a meaningful improvement, and got none.

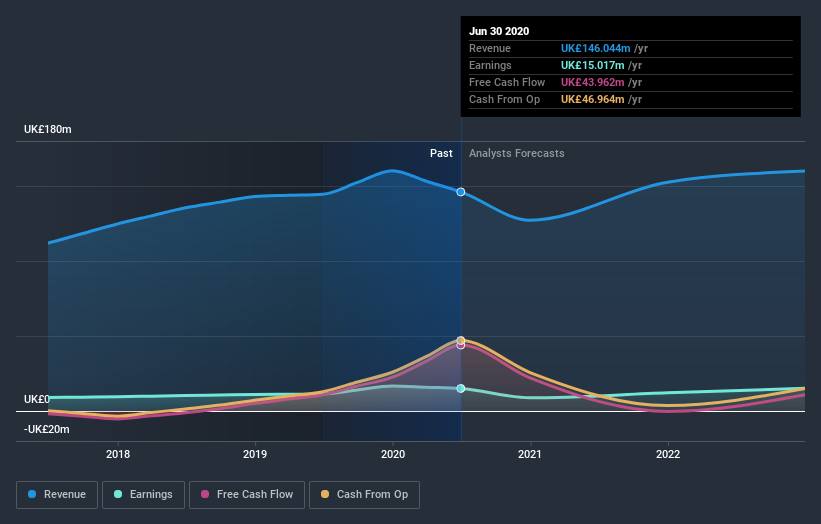

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We know that H&T Group has improved its bottom line lately, but what does the future have in store? So we recommend checking out this free report showing consensus forecasts

A Different Perspective

We regret to report that H&T Group shareholders are down 37% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 11%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 8% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand H&T Group better, we need to consider many other factors. Take risks, for example - H&T Group has 2 warning signs we think you should be aware of.

We will like H&T Group better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you decide to trade H&T Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if H&T Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About AIM:HAT

H&T Group

Primarily provides pawnbroking services in the United Kingdom and internationally.

Adequate balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)