- United Kingdom

- /

- Capital Markets

- /

- AIM:FEN

Frenkel Topping Group Plc's (LON:FEN) CEO Compensation Is Looking A Bit Stretched At The Moment

Key Insights

- Frenkel Topping Group will host its Annual General Meeting on 31st of May

- Salary of UK£288.6k is part of CEO Richard Fraser's total remuneration

- Total compensation is 85% above industry average

- Frenkel Topping Group's EPS grew by 1.3% over the past three years while total shareholder return over the past three years was 5.8%

CEO Richard Fraser has done a decent job of delivering relatively good performance at Frenkel Topping Group Plc (LON:FEN) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 31st of May. However, some shareholders will still be cautious of paying the CEO excessively.

See our latest analysis for Frenkel Topping Group

How Does Total Compensation For Richard Fraser Compare With Other Companies In The Industry?

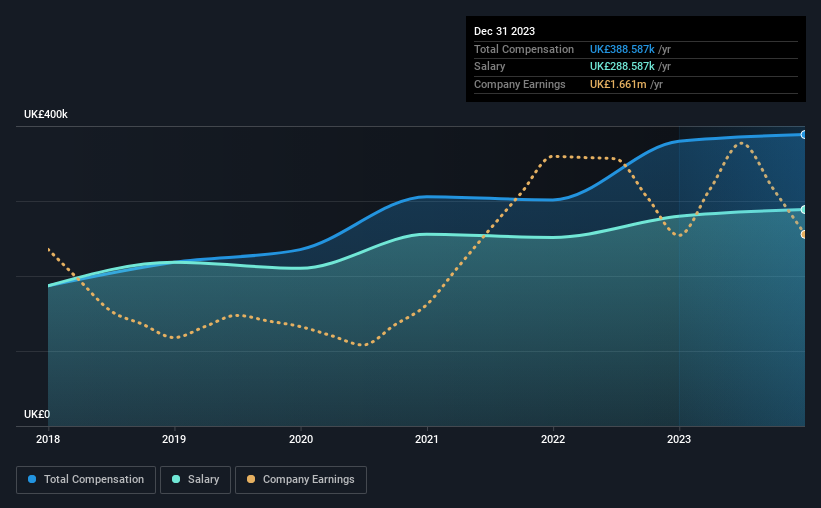

At the time of writing, our data shows that Frenkel Topping Group Plc has a market capitalization of UK£63m, and reported total annual CEO compensation of UK£389k for the year to December 2023. That's mostly flat as compared to the prior year's compensation. Notably, the salary which is UK£288.6k, represents most of the total compensation being paid.

In comparison with other companies in the British Capital Markets industry with market capitalizations under UK£157m, the reported median total CEO compensation was UK£210k. Hence, we can conclude that Richard Fraser is remunerated higher than the industry median. What's more, Richard Fraser holds UK£969k worth of shares in the company in their own name.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | UK£289k | UK£280k | 74% |

| Other | UK£100k | UK£100k | 26% |

| Total Compensation | UK£389k | UK£380k | 100% |

Talking in terms of the industry, salary represented approximately 54% of total compensation out of all the companies we analyzed, while other remuneration made up 46% of the pie. It's interesting to note that Frenkel Topping Group pays out a greater portion of remuneration through salary, compared to the industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Frenkel Topping Group Plc's Growth Numbers

Frenkel Topping Group Plc's earnings per share (EPS) grew 1.3% per year over the last three years. In the last year, its revenue is up 32%.

We like the look of the strong year-on-year improvement in revenue. With that in mind, the modestly improving EPS seems positive. We wouldn't say this is necessarily top notch growth, but it is certainly promising. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Frenkel Topping Group Plc Been A Good Investment?

Frenkel Topping Group Plc has not done too badly by shareholders, with a total return of 5.8%, over three years. It would be nice to see that metric improve in the future. In light of that, investors might probably want to see an improvement on their returns before they feel generous about increasing the CEO remuneration.

In Summary...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 3 warning signs for Frenkel Topping Group that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:FEN

Frenkel Topping Group

Provides professional and financial services in the personal injury and clinical negligence field in the United Kingdom.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success