- United Kingdom

- /

- Capital Markets

- /

- AIM:FEN

Frenkel Topping Group Plc's (LON:FEN) CEO Compensation Is Looking A Bit Stretched At The Moment

CEO Richard Fraser has done a decent job of delivering relatively good performance at Frenkel Topping Group Plc (LON:FEN) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 22 June 2021. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

Check out our latest analysis for Frenkel Topping Group

Comparing Frenkel Topping Group Plc's CEO Compensation With the industry

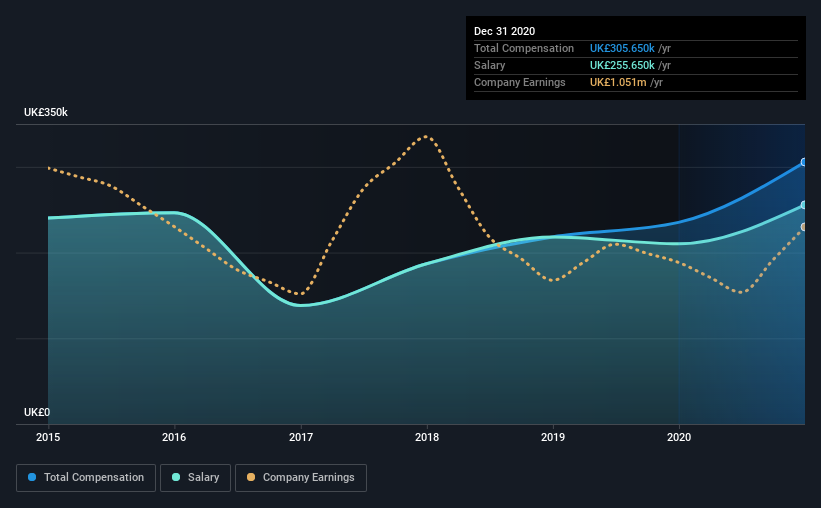

At the time of writing, our data shows that Frenkel Topping Group Plc has a market capitalization of UK£54m, and reported total annual CEO compensation of UK£306k for the year to December 2020. That's a notable increase of 30% on last year. Notably, the salary which is UK£255.7k, represents most of the total compensation being paid.

On comparing similar-sized companies in the industry with market capitalizations below UK£142m, we found that the median total CEO compensation was UK£183k. Hence, we can conclude that Richard Fraser is remunerated higher than the industry median. Furthermore, Richard Fraser directly owns UK£1.0m worth of shares in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | UK£256k | UK£210k | 84% |

| Other | UK£50k | UK£25k | 16% |

| Total Compensation | UK£306k | UK£235k | 100% |

Talking in terms of the industry, salary represented approximately 49% of total compensation out of all the companies we analyzed, while other remuneration made up 51% of the pie. Frenkel Topping Group is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Frenkel Topping Group Plc's Growth

Over the last three years, Frenkel Topping Group Plc has shrunk its earnings per share by 17% per year. Its revenue is up 19% over the last year.

Investors would be a bit wary of companies that have lower EPS But in contrast the revenue growth is strong, suggesting future potential for EPS growth. It's hard to reach a conclusion about business performance right now. This may be one to watch. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Frenkel Topping Group Plc Been A Good Investment?

Frenkel Topping Group Plc has served shareholders reasonably well, with a total return of 16% over three years. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

Some shareholders will be pleased by the relatively good results, however, the results could still be improved. We still think that some shareholders will be hesitant of increasing CEO pay until EPS growth improves, since they are already paid higher than the industry.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We did our research and identified 3 warning signs (and 1 which is concerning) in Frenkel Topping Group we think you should know about.

Important note: Frenkel Topping Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade Frenkel Topping Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:FEN

Frenkel Topping Group

Provides professional and financial services in the personal injury and clinical negligence field in the United Kingdom.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives