- United Kingdom

- /

- Diversified Financial

- /

- AIM:EQLS

Equals Group (LON:EQLS) shareholder returns have been stellar, earning 270% in 3 years

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But in contrast you can make much more than 100% if the company does well. For instance the Equals Group plc (LON:EQLS) share price is 270% higher than it was three years ago. How nice for those who held the stock! It's even up 12% in the last week.

The past week has proven to be lucrative for Equals Group investors, so let's see if fundamentals drove the company's three-year performance.

View our latest analysis for Equals Group

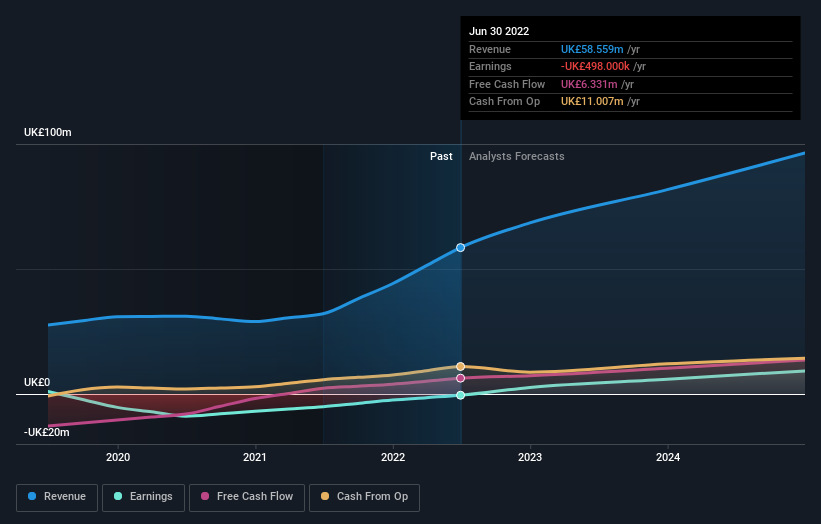

Given that Equals Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Equals Group's revenue trended up 23% each year over three years. That's much better than most loss-making companies. Along the way, the share price gained 55% per year, a solid pop by our standards. But it does seem like the market is paying attention to strong revenue growth. That's not to say we think the share price is too high. In fact, it might be worth keeping an eye on this one.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Equals Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Equals Group shareholders have received a total shareholder return of 4.5% over the last year. There's no doubt those recent returns are much better than the TSR loss of 1.9% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. Before spending more time on Equals Group it might be wise to click here to see if insiders have been buying or selling shares.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

If you're looking to trade Equals Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Equals Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:EQLS

Equals Group

Through its subsidiaries, develops and sells payment platforms to private clients and corporations through prepaid currency cards, international money transfers, and current accounts in the United Kingdom.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives