- United Kingdom

- /

- Personal Products

- /

- AIM:PXS

3 UK Penny Stocks With Market Caps Over £10M To Consider

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weaker trade data from China affecting global economic sentiment. Despite such fluctuations, investors often look for opportunities in smaller or newer companies that may offer growth potential. Though the term 'penny stocks' might seem outdated, these stocks can still represent a valuable investment area when they exhibit strong financial foundations.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.70 | £174.08M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.80 | £455.09M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.905 | £468.49M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.918 | £146.62M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.185 | £812.03M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.23 | £158.38M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.31 | £81.05M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ★★★★★★ |

| QinetiQ Group (LSE:QQ.) | £3.646 | £2.03B | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.435 | £183.39M | ★★★★★☆ |

Click here to see the full list of 444 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Cavendish (AIM:CAV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cavendish Financial plc, along with its subsidiaries, functions as an investment bank in the United Kingdom and has a market cap of £30.74 million.

Operations: The company generates £61.75 million in revenue from its Corporate Advisory and Broking, M&A Advisory, and Institutional Stockbroking services.

Market Cap: £30.74M

Cavendish plc, recently rebranded from Cavendish Financial plc, operates with a market cap of £30.74 million and generates revenue of £61.75 million through its investment banking services. Despite its revenue generation, the company remains unprofitable with declining earnings over the past five years at a rate of 48.7% annually. The board and management team are relatively new, averaging 1.4 years in tenure, which may affect strategic stability. Positively, Cavendish maintains more cash than total debt and has short-term assets exceeding both short- and long-term liabilities, suggesting financial resilience amidst operational challenges.

- Navigate through the intricacies of Cavendish with our comprehensive balance sheet health report here.

- Explore historical data to track Cavendish's performance over time in our past results report.

Provexis (AIM:PXS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Provexis plc, with a market cap of £14.66 million, develops, licenses, and sells functional foods, medical foods, and dietary supplements globally.

Operations: The company's revenue is derived entirely from its Vitamins & Nutrition Products segment, totaling £1.20 million.

Market Cap: £14.66M

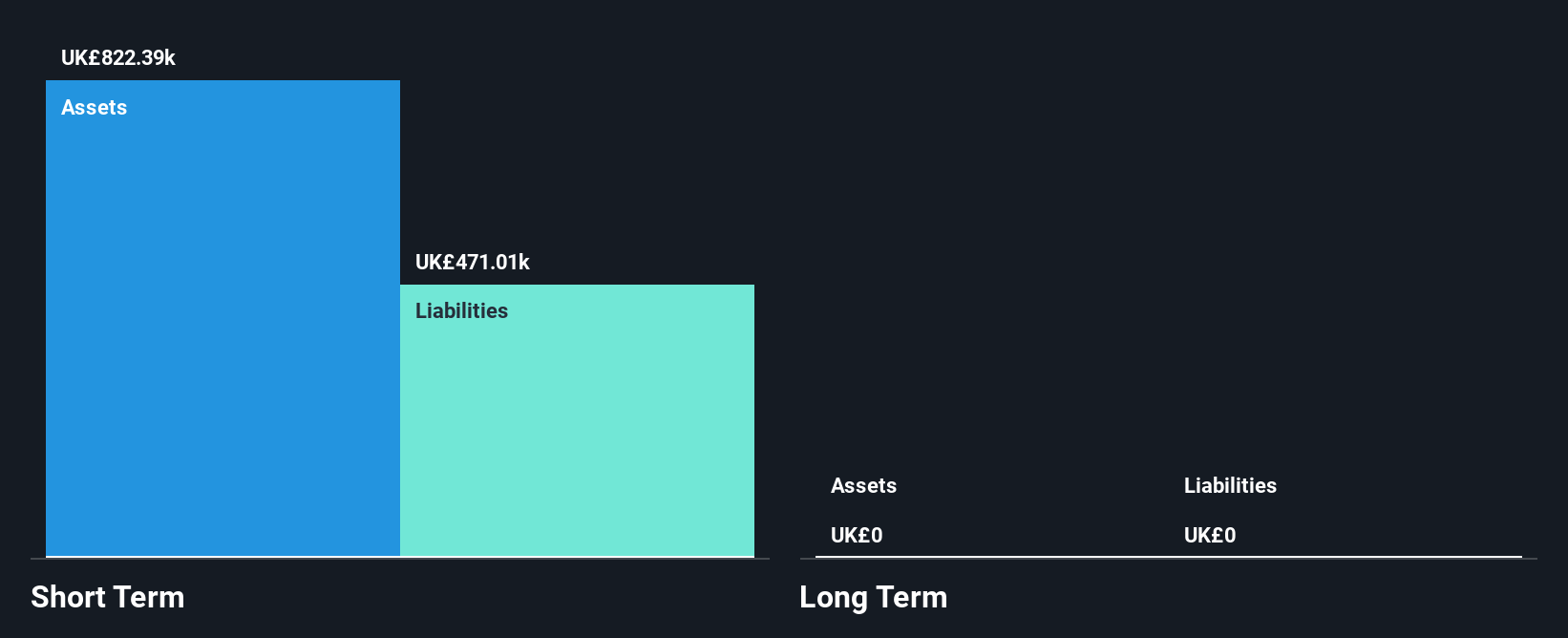

Provexis plc, with a market cap of £14.66 million, remains a pre-revenue company in the functional foods sector, reporting sales of £0.79 million for the half-year ending September 2024. Despite being unprofitable and experiencing increased losses over five years at 5.5% annually, Provexis benefits from having no debt and sufficient cash runway exceeding three years based on current free cash flow trends. The firm's short-term assets surpass its liabilities, indicating some financial stability despite high volatility in share price over recent months. The board's extensive experience may provide strategic guidance as the company navigates growth challenges.

- Jump into the full analysis health report here for a deeper understanding of Provexis.

- Gain insights into Provexis' historical outcomes by reviewing our past performance report.

Time Finance (AIM:TIME)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Time Finance plc, with a market cap of £55.23 million, provides financial products and services to consumers and businesses in the United Kingdom through its subsidiaries.

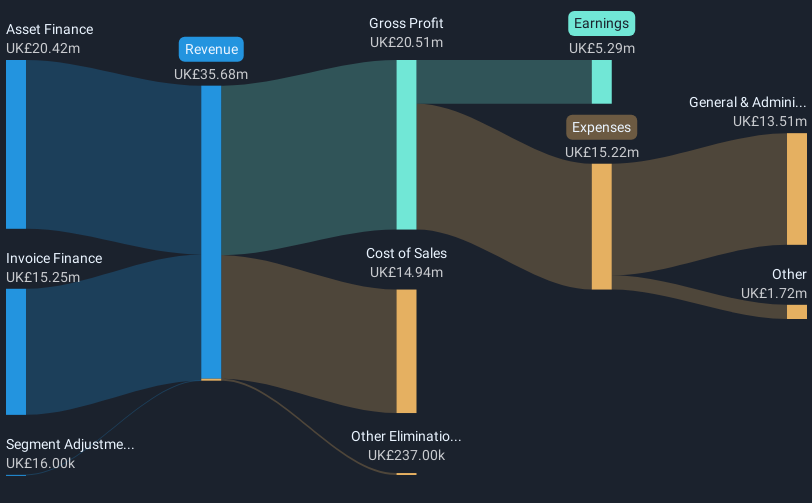

Operations: The company generates revenue through its Asset Finance segment, contributing £20.42 million, and Invoice Finance segment, adding £15.25 million.

Market Cap: £55.23M

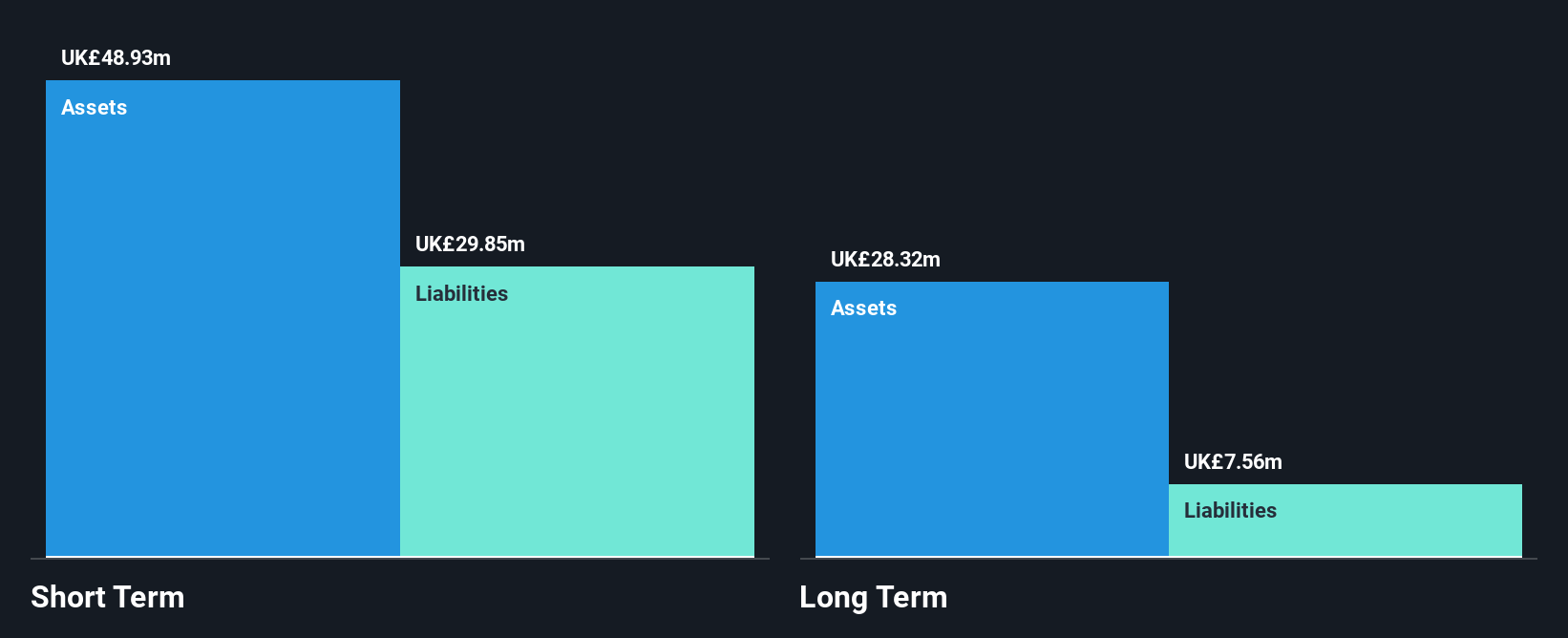

Time Finance plc, with a market cap of £55.23 million, demonstrates financial stability and growth potential within the UK market. The company's short-term assets of £190.6 million comfortably cover both its short-term (£81.2M) and long-term liabilities (£70.2M). Time Finance has achieved consistent earnings growth, with a 34.9% increase over the past year, surpassing industry averages. Despite low return on equity at 7.7%, it maintains high-quality earnings and reduced its debt-to-equity ratio significantly over five years to 1.2%. Recent reports show net income rising to £3 million for the half-year ending November 2024, reflecting ongoing profitability improvement.

- Click here to discover the nuances of Time Finance with our detailed analytical financial health report.

- Gain insights into Time Finance's outlook and expected performance with our report on the company's earnings estimates.

Turning Ideas Into Actions

- Unlock more gems! Our UK Penny Stocks screener has unearthed 441 more companies for you to explore.Click here to unveil our expertly curated list of 444 UK Penny Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:PXS

Provexis

Develops, licenses, and sells functional foods, medical foods, and dietary supplements worldwide.

Moderate with adequate balance sheet.

Market Insights

Community Narratives